Small finance banks, with their focus on small ticket loans for urban and semi-urban India, are a play on the underpenetrated market for financial products in India. Players who’ve bagged SFB licences have managed scorching loan book growth with Net Interest Margins (NIMs) and Return on Equity (ROE) far superior to traditional universal banks. Yet, after stellar performances soon after their IPOs many of these stocks have seen their valuations levelled. So, when a new candidate – Suryoday Small Finance Bank IPO (Suryoday) comes out in an overcrowded primary market, how should it be judged? Read on.

About the bank

Suryoday started operations as a micro finance player in 2009 and became an SFB in 2017. It does not have a holding company structure like some of the listed peers such as Equitas or Ujjivan, which is an advantage. The primary purpose of the IPO is to comply with RBI’s norms of listing within 3 years of incorporation of a Small Finance Bank in India. The bank has come out with an IPO of Rs 582 crore at the higher end of the price band of Rs 303-305. About 57% is an offer for sale by existing investors and 43% is fresh issue that would enhance capital adequacy. The offer closes on March 19, 2021.

At the higher end of the price band, the bank’s market cap post listing would be about Rs 3,200 crore.

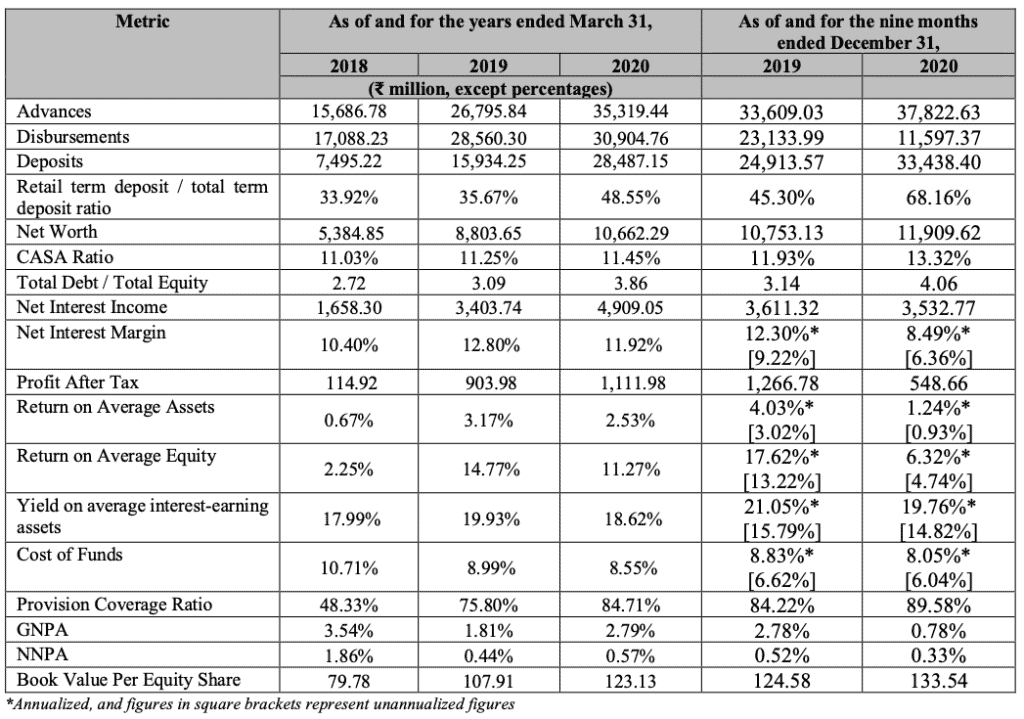

The image below will give you a summary of the bank’s key metrics, pre-issue. Date is sourced from the offer document.

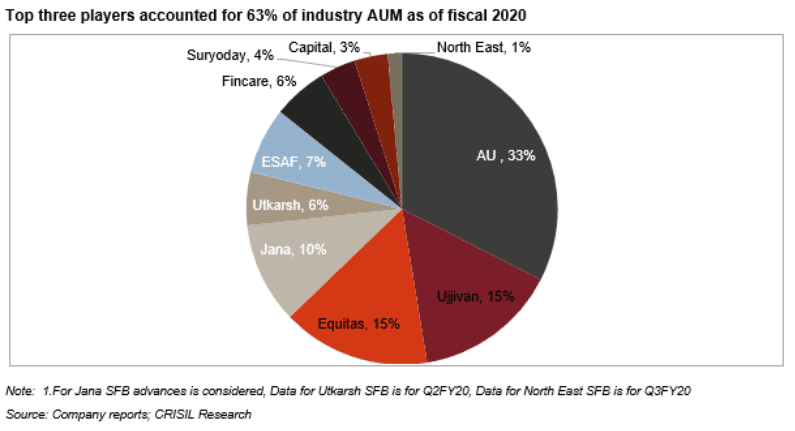

Suryoday, is clearly among the smaller players in the SFB space, in terms of assets under management. Data below will tell you that the top 3 players garner over 60% of the market share. In other words, it is not an industry leader.

Positives

#1 High growth in assets and deposits

Suryoday has had a trail blazing growth in advances at close to 50% CAGR between FY-18 to FY20 – superior to all other listed SFBs and matched only by universal bank Bandhan Bank. The bank managed to grow its advances by 7% between March 2020 to December 2020, at a time when closest peer Ujjivan saw a decline. Similarly, deposits jumped 4-fold between March 2018 and December 2020 (to Rs 3344 crore).

Two-thirds of its advances come from metropolitan and urban regions, thus significantly improving its prospects for growth. Presence in high-demand states of Tamil Nadu and Maharashtra (together accounting for 62% of advances) heightens its prospects for growth.

#2 High yields

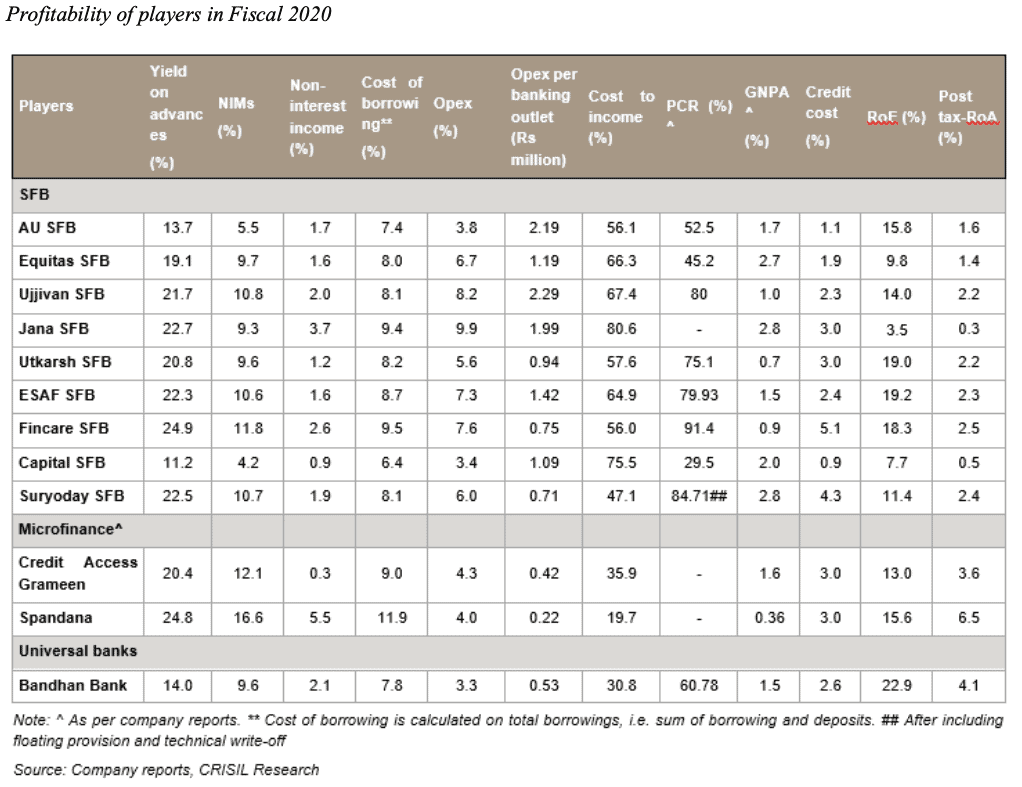

Suryoday scores across profitability metrics. The data given below (source RHP) for FY-20 will tell you that the yield on advances and net interest margin are healthy. As a result, the cost to income ratio at 47% for FY-20 is the lowest among SFBs and even lower than universal banks like Bandhan.

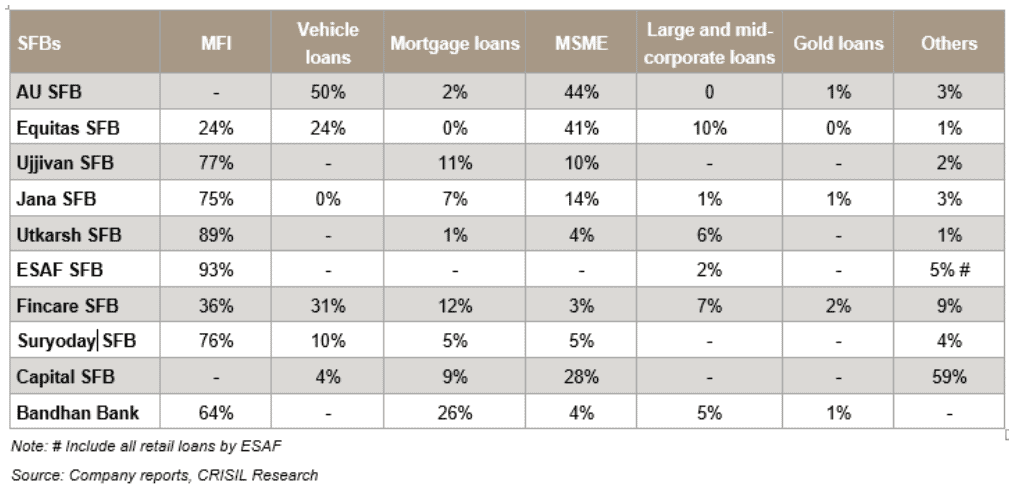

The superior profitability is a mixed blessing because it indicates a riskier loan book. The data below shows that high exposure to micro finance segment is the margin-clincher for Suryoday. Among the listed players, you will notice that Ujjivan has a similar profile with almost similar profitability metrics while leaders such as AU SFB have a higher non MFI contribution.

#3 Highly capitalized

Suryoday’s capital adequacy ratio (CAR) was at 41% (Tier I and II) as of December 2020, against the regulatory requirement of 15%. This is significantly higher than Ujjivan’s CAR of 28%.

With pre-IPO fund raising as well as post IPO this will move well above the 50% zone making it the best capitalized play among SFBs as well as universal banks like Bandhan. This provides Suryoday with extra cushion not just to pursue high loan growth, but also to absorb any loan losses from Covid related distress.

4 thoughts on “Suryoday Small Finance Bank IPO – Invest or avoid?”

Dear Vidya ji,

Well presented and with comparable SFBs. The risks are well brought out. A good , guiding article.

bala

Thank you sir. Vidya

They are still managing to give FDs at 6.75% for any amount which is more than other peers combined. How does it affect their viability?

Most SFBs do it to get CASA/deposits. It will mean high cost initially but do remember that they also lend at high rates given that their borrowers are high risk. thanks, Vidya

Comments are closed.