Our video on this first. If you want to read the Q&A go down.

Why this sudden charge of Stamp duty?

The stamp duty charge is due to an amendment in The Indian Stamp Act,1899 by Finance Act 2019. It requires collection of stamp duty on all securities market instruments, including mutual funds. It was originally effective from 9-Jan-20, but government later postponed it to be effective from 1-Jul-20.

Is this applicable for all MFs?

- Yes, it is applicable for all MFs (including ETFs).

- Applicable whether held in Physical or Demat form.

- Applicable on all purchase transactions includinng SIPs, lumpsums, dividends reinvested and switch-ins.

- Transfer of units from one demat to another demat account including market / off-market transfers will also attract stamp duty.

- Transfer from broker to investor account will not suffer stamp duty as the stamp duty is already deducted on the units at the time of unit issuance.

- Not applicable for redemption/sale of units. Hence not applicable for redemptions or SWPs or on switch outs.

Is this applicable for SIPs?

Yes, it will be applicable for all SIPs, including those registered earlier. Every instalment will have this flat rate of duty.

How about dividend options?

Dividend Reinvestments and switch-ins will attract stamp duty. For dividend reinvestment the calculation of stamp duty will be on the dividend declared less the TDS if any.

What is the rate and how is it calculated?

It will be 0.005% for purchase and switch-ins as well as dividends reinvested. For transfers between demat accounts it will be 0.015%. The duty will be calculated on the investment amount less any transaction charge.

How will the units be allotted to me?

The units will be allotted only after deducting stamp duty. For eg you will suffer Rs 5 for every Rs 1 lakh. So, for an investment of Rs 1 lakh, your units will be allotted on Rs 99,995.

Does this have any impact on me?

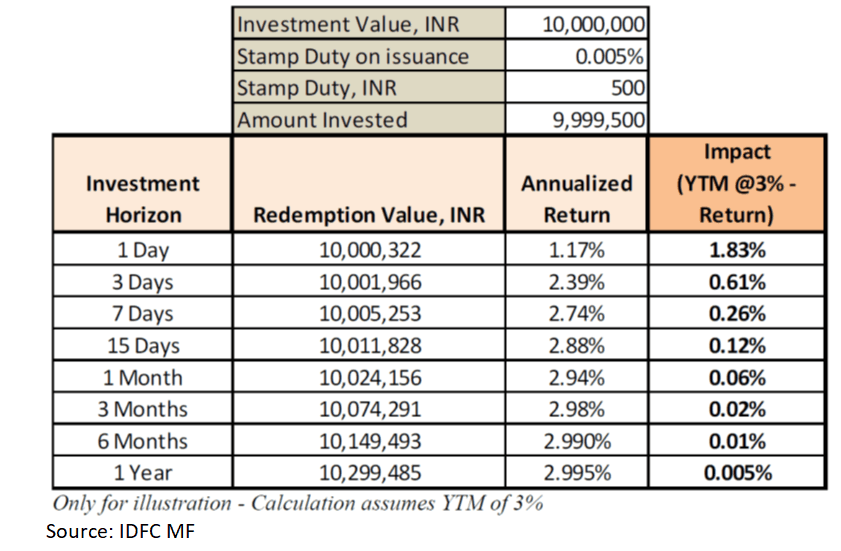

It doesn’t really, unless you invest several crores for less than 3 months. The illustration below will tell you that the returns are closer to normal for over 90 days.

For corporate/treasury money, it does impact their returns. For retail investors, it is just an operational issue and not a big deal!

Only thing: your units will no longer be allotted on the amount you invest. So the calculation takes you back to something that existed during the times of entry load!

Looking for good schemes to invest in? Check out our Prime funds!

2 thoughts on “Stamp duty on your mutual fund purchases: does it impact you?”

Exactly what I was looking for

Appreciate your guidance in the finance space. Articles have all been very informative.

Keep going..

RAGHAVAN

Comments are closed.