The Tata group recently announced the investment of global PE major TPG (formerly Texas Pacific Group) in the electric vehicle (EV) arm of Tata Motors at a valuation of $9.1 billion (about Rs.68,000 crore) recently. Not surprisingly, the stock of Tata Motors soared 25% on the day of the deal announcement.

But interestingly, the news also set on fire other group stocks - Tata Power, Tata Chemicals and Tata Elxsi. Why did this happen?

It appears that these group companies will be active participants in Tata’s clean energy initiative, contributing everything from Lithium-ion (Li) battery manufacturing to the charging infrastructure required to vehicle and battery management systems.

The deal announcement even had media captions comparing this to EV major Tesla (see box below on the comparison).

In this article, let’s try and understand what the business behind this valuation is, the strategy for this business and why the market pushed the group stocks up.

Is this the Tesla of India?

In mid-2019, global EV major TESLA was valued at $45 billion – which was 5X the valuation of Tata Motors EV business today. Tesla sold just 3,67,500 cars in 2019 and its valuation was considered way too expensive in the market. But that argument did not look into the future of EV. Rather it was a comparison with the low to modest valuation of conventional auto makers such as GM, Ford and Volkswagen.

But, in the next two years, Tesla became the world’s most valued automotive company surpassing Volkswagen and Toyota in terms of market value, in 2020. Now, in 2021, Tesla’s market value is much higher than many auto majors put together.

That is the parallel that the media draws attention to now. A $9.1 billion valuation for Tata Motors EV business is nearly half of Tata Motors’ total market cap of $19 billion (on the day before deal announcement). Here again the valuation can be baffling. While Tata Motors sold over 2 lakh passenger cars in FY21, its EV division sold just 4,291 cars.

Also, the average market capitalization of Tata Motors, comprising its sizable trucks business, passenger car business and the luxury car business of Jaguar Land Rover, in the last 5 years was $12 billion. The $9.1 billion valuation for EV business is also one third of Maruti Suzuki’s market cap of $30 billion, that sells over 15 lakh cars a year. The market capitalisation numbers are in dollars for easier comparison. Tata Motors market cap of $19 billion comes to about Rs. 1,40,000 crore as at the end of 12th October 2021.

Maruti Suzuki’s market cap of $30 billion comes to about Rs.2,30,000 crore at the end of 12th October 2021. The deal value of $9.1 billion for Tata Motors EV business translates to Rs. 68,000 crore for the EV company.

Current valuation not a benchmark for EV space

While it was the Mahindra group that was an early entrant in the EV space (with acquisition of REVA Electric), it appears that Tata Motors may be the first to re-write the valuation for the EV space in India, with its recent deal.

Yes, comparison with Tesla may be an exaggeration at this point, given the Tata’s EV unit is yet to take- off in a big way and current EV sales are insignificant. But let’s dive into Tata Motors EV business presentation to understand the strategy for its EV business.

- According to the presentation, the EV subsidiary of Tata Motors will be an asset light company that will build and own future intellectual property (IP) for the EV.

- The subsidiary will invest in excess of $2 billion (Rs. 15,000 crore) over the next 5 years in products, platforms, drive trains, dedicated EV manufacturing, charging infrastructure and advanced technologies.

- The EV business plans to have a portfolio of 10 electric cars by FY-26

- The company will leverage all existing investments in technologies, brands, manufacturing capacities and sales network of Tata Motors passenger vehicle company, which will also manufacture EVs and provide services.

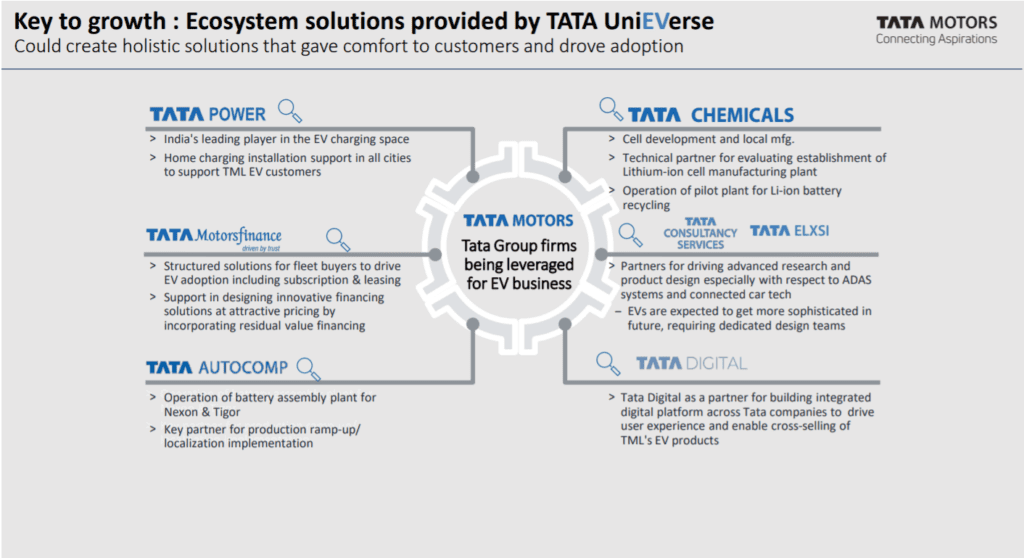

In short, Tata Motors’ EV subsidiary will allocate its resources towards R&D, product and platforms. Its group companies will take care of the asset heavy business such as manufacturing, charging infrastructure roll-out and localized battery manufacturing. The valuation for the EV business may therefore be a sum of the following: one, the primary value coming from the EV business potential, two, a premium for the asset light R&D led business model as opposed to traditional asset-heavy automotive businesses and three, a premium for higher assurance on scalability (Tata Power already has 500+ charging stations for example) powered by group companies.

There also seems to be a significant “size premium” as well for the Tata Group as the companies that are part of the ecosystem have the ability to together build scale. What is clear is that this valuation cannot therefore be a benchmark to value the EV business of every other company in the market!

The group collaboration

The image below “ecosystem solutions provided by Tata Universe” from the Tata Motors EV strategy presentation, highlights the role of group companies such as Tata Power, Tata Chemicals, TCS and Tata Elxsi.

Now, among the listed companies above, the biggest gainer in the stock market has been Tata Power followed by Tata Chemicals and Tata Elxsi. But is the EV strategy alone driving gains in these stocks or is it only an additional propeller? For this, we will look into each of these companies.

Here’s a snapshot of the present size of these businesses and their market value

#1 Tata Power

Tata Power operates India’s largest EV charging network with 543 charging stations in 102 cities. It is 70% of the total charging infrastructure available in the country. Tata Motors EV strategy presentation says Tata Power will play a key role in supporting home charging installations. It’s subsidiary Tata Power Solar (formerly Tata BP Solar) is the leader in roof-top solar installations with 372 MW of installations until June 2021 and presence in 100 cities.

The Tesla parallel: Tesla too owns a company called SolarCity (acquired in 2016) which is into rooftop solar installations. The vision, at the time of its acquisition, was to provide a complete shift to sustainable energy for those who want to go green.

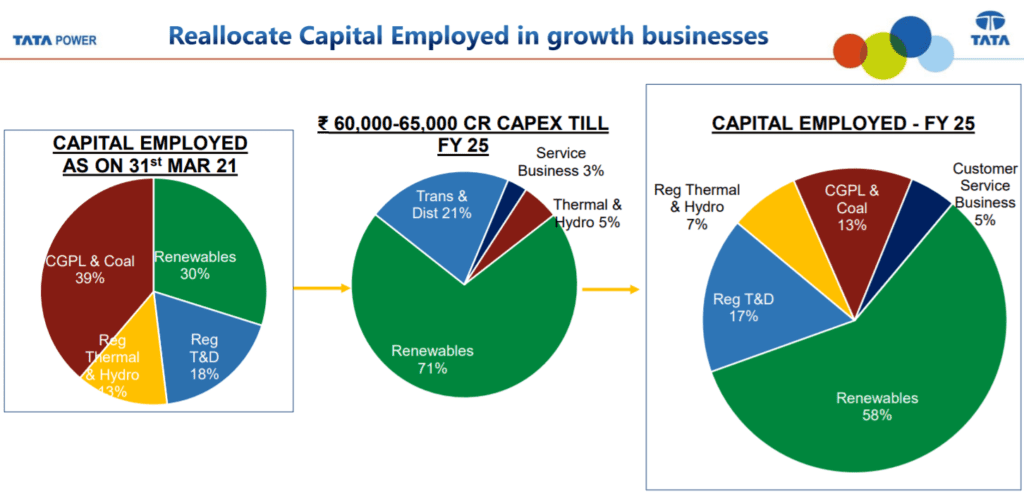

For Tata Power, the story doesn’t end here. It is making a new beginning with Strategy 2.0. Tata Power is already the third largest renewable power company by capacity at 2.7 MW (after ReNew -4.8MW and Adani Green - 3 MW) while expanding further. The market cap gains for Tata Power since the release of Tata Power 2.0 strategy on 3rd June 2021 until October 13th 2021 was Rs.28,000 Crore while the gains following announcement of Tata Motors EV strategy was Rs.22,000 crore.

These mammoth gains have come on the back of expectations of similar value unlocking exercise for the renewable energy business.

Below is an image from its Strategy 2.0 presentation :

But it is to be noted that the market has not always estimated the prospects of Tata Power well. The market echoed a similar sentiment when Tata Power bid for the 20,000 MW imported coal based ultra-mega power project in 2007. After 10 years of operations, the project had accumulated losses of Rs.9,400 crore and Tata Power has decided to merge it with itself just for the sake of tax benefits.

The stock has been lying low for 12 years since 2008 crossing its 2008 highs only in 2021. Given the Tata group’s poor record with capital allocation, one can only hope that the market is right this time with Strategy 2.0.

#2 Tata Chemicals

Tata Motors’ EV strategy presentation has assigned the role of cell manufacturing and technical partner evaluation for this company. Tata Chemicals has already made a head start with a pilot project for Lithium-ion battery recycling. It recovers valuable metals like lithium, cobalt, nickel and manganese at 99%+ purity. The operation, launched at a pilot scale, has successfully recycled Lithium-ion batteries. The company plans to scale it to recycle 500 tons of Lithium-ion batteries in the next stage.

While these are baby steps, it appears that the cell chemistry and manufacturing business of Lithium-ion batteries would vest in this company. In India, companies have already made inroads in this space. Suzuki made a head start with its Lithium-ion battery manufacturing in India (TDS Lithium-ion battery Gujarat Pvt Ltd) with Toshiba and Denso, while Mahindra & Mahindra has partnered with LG Chem.

The Tesla parallel: Tesla runs on Panasonic batteries and its $5 billion Giga Factory in the US is a JV with Panasonic. Not just technology sharing, the JV structure keeps the massive investment in a separate entity and thus ensures the automotive company is asset light. Here, Tata Chemicals playing the manufacturing role for Lithium-ion cells allows Tata Motors EV to be an asset light company.

#3 TCS and Tata Elxsi

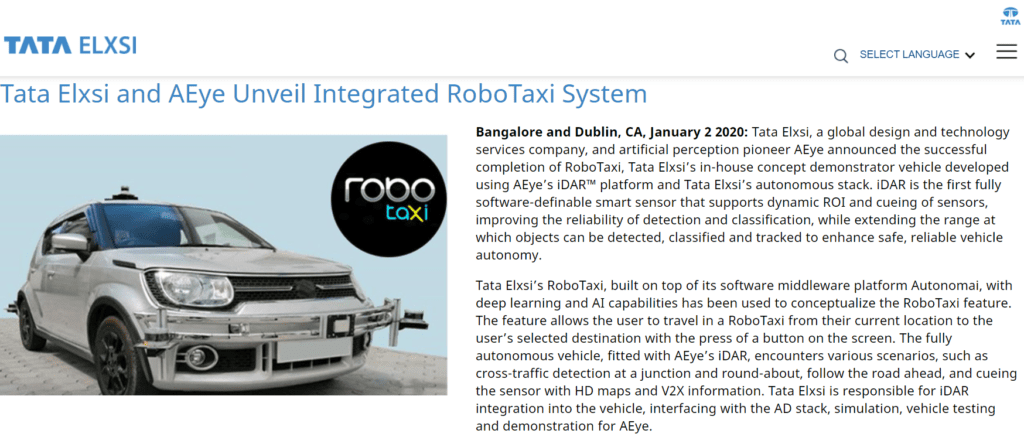

The EV news did not do much to drive the stocks of TCS. The TCS stock, in fact ended in red likely because the value addition from this deal, to its own business, may be insignificant. While TCS is a key player in ADAS (Autonomous Driver Assistance Systems), Tata Elxsi’s IoT software powers Tata Motors’ connected vehicle platform that powers its flagship EV product Nexon EV.

But the stock of Tata Elxsi has already been a stellar performer with 4X gains in the last 1 year and 12X since March 2020. Unlike TCS or other IT services companies, Tata Elxsi is an engineering & design services company. Automotive vertical contributes 45% of Tata Elxsi’s business. This press release below will talk of the progress of Tata Elxsi in the automotive space.

On EV, Tata Elxsi’s business is wide ranging – also engaging with OEMs making motors, inverters, battery, etc. So, for Tata Elxsi, EV is a larger opportunity. While the management did not give out any details on the size of existing EV business or order book, they have hinted at trebling the business from this space in the next 3 years.

Should you charge your portfolio?

If you’re wondering if you should charge your portfolio with this exciting business, be aware of this:

PE giant TPG is paying purely for what it wants – a stake in the EV business alone. But as regular investors, you don’t have that advantage. You have to buy all the parts together (the Tata Motors stock) and hope that it creates value. And it could only happen if all the parts are value accretive.

Just for the background of Tata Motors - JLR (Jaguar Land Rover) has been a big overhang on valuations (asset heavy and investment heavy businesses) while its domestic passenger car business has been a drag on profitability. Fortunately, the domestic passenger car business is turning around and may be poised now to leverage from the EV journey. But then, in the foreign market where JLR is present, the company may be forced to re-invent in the face of serious challenges from the EV segment.

P.S. : This article is NOT A RECOMMENDATION on any of the stocks mentioned. This is only an analysis of the stakes for the various Tata group companies in the EV deal.

3 thoughts on “Prime update: The Tata group’s ‘clean energy’ club”

Like other Chandrachoodamani analysis this one is quite insightful and deep. I invest only in Mutual funds but over a period of time by reading you articles I will be able to understand how to read a stock and which one to invest.

Kudos!

Thank you sir.

Excellent article that dives into a deeper analysis of the EV business and the Tata angle. It helps to evaluate these companies for long term investment

Comments are closed.