- A debt fund for long-term portfolios

- Maintains a steady portfolio maturity, taking neither duration risk nor credit risk

- Beats debt funds across different categories including corporate bond and medium duration.

What if you want your debt fund to have two things – safety and predictable strategy? Most funds have either of these but not both. Funds that don’t take credit risk are still open to changes in portfolio maturities and one-off events. If you want an option where you take absolutely nil credit risk, not compromise much on returns, and not be subject to surprises in strategy, then pick this one.

SBI Magnum Constant Maturity is the fund that fits these features. This fund invests only in government securities, meaning you get zero credit risk. It maintains an average portfolio maturity of around 10 years, and this address the problem of funds taking different duration calls.

SBI Magnum Constant Maturity (SBI Constant Maturity) is a good fit for portfolios with a timeframe of at least 5 years and above. It will not suit shorter timeframes as volatility in the short-term is higher owing to bond price fluctuations.

In fact, the fund is in essence a proxy to holding a 10-year government bond. With retail participation in g-secs still difficult, the fund provides an opportunity to hold a low-risk, predictable strategy.

This is the reason SBI Constant Maturity features in our recommended list and in our long-term portfolios. The role of a debt fund in 5-7+ timeframes is simply to provide safety and a hedge to equity. The limited exposure to debt in such portfolios additionally removes the need to have multiple debt fund strategies. This may seem at odds with our debt outlook for this year where we are wary of taking long duration calls. Please note that our debt outlook is geared more for those who wish to capitalise on opportunities that present themselves this year and those who have a shorter-term holding period than 7-10 years.

Steady strategy

A constant maturity fund mixes gilts of different longer-term maturities such that the average portfolio maturity stays at 10 years. This strategy has two key benefits. The first and obvious is the absence of credit risk. By investing purely in gilt securities, these funds are less risky than even high-credit-quality debt funds. For instance, an event such as the IL&FS catastrophe can hurt such high-quality debt funds, but will still leave gilt funds unharmed.

The second benefit is that there are no risks of wrong duration calls. Gilt funds, unlike constant maturity funds, will change their portfolio maturities based on the stage of the interest rate cycle. That is, they may go for short-term gilts, or medium-term or even very long-term 20+ years of gilt papers. Dynamic bond funds similarly switch between duration and accrual based on the direction of the interest rate cycle.

This introduces uncertainty in how well they can capture market opportunities. A dynamic duration strategy needs to get its calls correctly in order to book profits made from bond price rallies. Missteps here can hurt returns. Since constant maturity funds stick to a specific duration, this risk significantly reduces. The strict maturity also ensures that the fund can book and realize the gains made on price appreciation. As an investor, therefore, you get both the accumulated coupon and the capital appreciation.

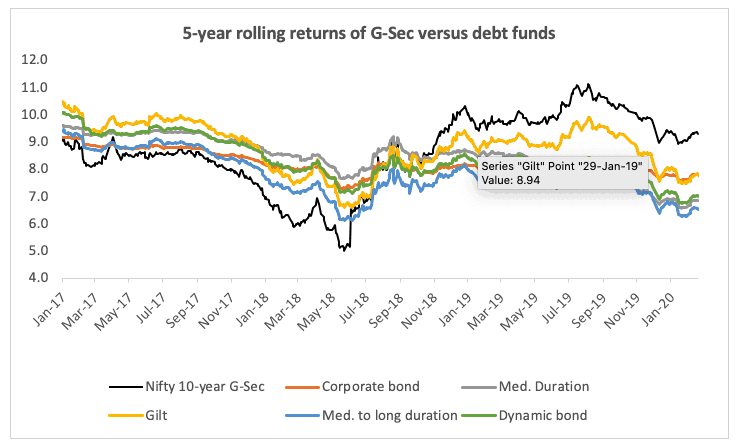

Constant maturity funds have the ability to beat other debt fund categories such as corporate bond, medium duration, medium to long duration, and other gilt funds especially over a period where interest rates are overall trending lower.

Consider the 5-year rolling return for period between 2011 to date, of the Nifty 10-year Benchmark G-Sec. While most debt funds from categories such as corporate bond, dynamic bond, short duration, and medium duration beat the benchmark return, just about half were able to do so more than 60% of the time. That is, the 10-year benchmark G-Sec index was able to beat funds with a good degree of consistency.

Constant maturity funds do not have too long a history. However, their 5-year returns in the past six-year period have beaten funds across debt categories. It is noteworthy that rate cycles have not only become shorter in the past 6 years but have also turned trickier to forecast and manage. This makes constant maturity a strategy devoid of the uncertainties of all other duration categories.

Fund and performance

At present, there are 4 constant maturity funds and SBI Constant Maturity is our recommendation. The fund was earlier a short-term gilt fund that became a constant maturity fund post new SEBI categorisation in 2018. However, the fund scores better than peers.

Its average 1-year return since 2018 stands at 9.9%, second only to IDFC G-Sec Constant Maturity Plan. It has not suffered a 1-year loss in this time, unlike the funds from DSP and ICICI. On volatility too, SBI Constant Maturity manages lower volatility than peers, a factor in its favour as IDFC Constant Maturity can clock very high and very low return. SBI Constant Maturity’s lower deviation also helps it deliver higher risk-adjusted returns.

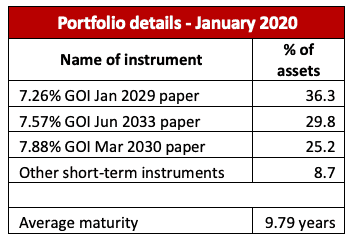

The fund additionally has a much larger asset size at Rs 508 crore; peers are all less than Rs 150 crore. It does not stick only to 10-year papers, but mixes different long-term maturities of 8-13 years such that the overall average maturity remains around 10 years.

Suitability

The fund should be used only for holding periods of 5 years and above. Shorter periods have high volatility where long-term gilt papers are concerned.

SBI Constant Maturity suits any investor. But it should be used only for holding periods of 5 years and above. Shorter periods have high volatility where long-term gilt papers are concerned. Prices of these papers react much more sharply than corporate bonds or shorter-maturity gilts to potential interest rate changes. This can cause low 1-year or 3-year returns; for example, 3-year 10-year g-sec index return has been as low as 3.8%. Holding for the long term irons out these fluctuations and you earn, at the minimum, the underlying gilt coupon.

46 thoughts on “Prime Recommendation: A debt fund with no credit risk and yet beats all others”

This one features in your 7yrs+ portfolio.

Can you comment on what’s likely to be the performance of this fund, in a rising interest rate scenario?

I’m a little suprised to see this comment:

“In fact, the fund is in essence a proxy to holding a 10-year government bond. ”

If buy a bond at an yield of say 6.5%, 10 years hence if the interest rates are at say 8%, I still make the stated yield as I hold for the long term. Doing the same thing with this fund – will likely result in a loss of principal itself right? In a rising interest rate scenario, each time the fund manager sells existing bonds to buy new ones to hold the duration constant – he makes a loss every such rebalance.

While we say, the fund eleminates both credit risk and interest rate risk – i.e., as opposed to gilt funds which may take calls on interest rate moves, here it is mechanical. But doesn’t that mean, we are making an interest rate call here ourselves – That in the long term the interest rates are headed down.

Do I take it that this one being in the 7yrs+ prime portfolio and being the only debt fund – Prime investor is quite confident that in the long term interest rates are headed down.

The fund can have losses up to even 1 year in a rising rate scenario. If held for 5 years plus this risk is eliminated. We cannot of course give any future returns. Past returns will tell you it comfortably beats FD returns.

Sir – We ARE NOT taking a call on falling interest rate 🙂 We are taking a call that over 7 years several cycles will play out and normalise returns. Please don’t forget that returns come from coupon too – apart from capital appreciation. That is more than enough to deliver over a 7-year period. thanks, Vidya

Thanks you very much for the reply and clarification.

One plea: Will be great if you can write an article – simulating a linear increase in interest rates say the next 5/10yrs and play out the 6 month rebalance of this fund (or constant maturity funds in general). A lot of us don’t understand this very well.

Thank you for your time.

Hello Sir, If I knew how interest rates would move, I could 🙂 Interest rates don’t move in a linear fashion over 5-10 years sir. In fact the last 2 decades have shown declining trend. As an economy matures, growth reduces, inflation reduces and interest rate reduces. The short to medium term spikes can’t be predicted. We will probably see one now, if the geopolitical tension currently eases soon. thanks, Vidya

This fund was recommended about 2 year back. Is this recommendation still valid for 5+ year holding?

Please see Prime Funds for our latest fund recommendations. This fund remains part of our recommendations in long-term debt; if you wish to, you can run SIPs in the fund now to take advantage of the period of volatility that can come now as the rate cycle shifts upward. – thanks, Bhavana

Can this fund be used for 15-20 years retirement goal along with equity with periodic rebalancing with 50% allocation rach?

Yes, this fund can comfortably be used for a goal 15 years away. If you mean 50% allocation to debt itself, it is fine. But if you mean 50% allocation to only this fund, it is avoidable even if it is a gilt fund. Use this fund along with other accrual-based funds. Please refer to the Medium and Long Term sections in Prime Funds, and read the Why this fund to know what strategy it follows. – thanks, Bhavana

Hi,

Can you suggest as NRI which debt fund is good for lump sump investment of 10 years. OR NRE FD is better.

Manoj

For NRIs, FDs are typically better because they are not subject to tax here. In debt funds, you will have tax deducted on capital gains when you redeem…if your income here is below taxable limit, you will have to file returns to claim reimbursement of the TDS.

Thanks,

Bhavana

Can one invest in this fund in lumpsum? Or given the volatility involved, SIP would be a preferred method?

Please refer to this one – https://www.primeinvestor.in/should-you-run-an-sip-in-debt-funds-or-in-lumpsum/

Hi Mam,

While comparing on this category “IDFC Government Securities Fund – Constant Maturity Plan – Direct Plan” seems better than “SBI Magnum Constant Maturity Fund – Direct Plan” on 1 yr , 3 yr and 5 yr returns. Am I reading right or missing something ?

Both are neck to neck on multiple returns metrics. Which is why they are both a buy in our tool 🙂 SBI has a superior risk-adjusted return driven by lower volatility (dtandard deviation). It also has a marginally lower exp ratio in direct. Reason why we picked it over IDFC in our prime list. thanks, Vidya

Thanks Vidya!!!

1) The fund “SBI Magnum Constant Maturity Fund ” should always be invested through SIP as it has high volatility or we can invest in Lumpsum ?

2) For exiting this fund while nearing the Goal what is the best strategy ?

3) For long term goals -should we diversify the debt portfolio with PSU/Corporate bond Funds along with this SBI Fund ?

Thanks,

Satyajit

Sir, kindly ask your queries through contact us if you are a subscriber. It will help us keep better track. Blog is more a commenting channel. thanks Vidya

Hello Bhavana, With interest rates slated to go up in next year or so, whats your outlook on fixed maturity gilt funds.? A 100 bps increase in interest rate means an almost 500-800 bps loss in value

Hello sir,

If you’re looking at it from a 2 year perspective, yes, you wouldn’t go for a 10-year gilt fund. But as explained in the post, the idea behind a constant maturity fund and a 7 year horizon is precisely to step around such timing issues, to ignore worrying about what the rate cycle will do and what sort of maturity or strategy to follow, and to allow the dips and rises to even out. So if you’re holding for years, a dip in returns from time to time due to rate cycles will happen. Going by normal gilt funds (which do not fix maturity) returns as well, which themselves go through loss-making periods, 5-year returns are reasonable. If you’ve already invested in gilt funds and are near your goal, we have mentioned that a gradual pull out can be done in this article.

Thanks,

Bhavana

Hello,

With a horizon of at least 7 years and with the objective to hedge the equity risk on portfolio, what kind of volatility should an investor expect on this constant duration maturity fund? There is no roll down strategy on this fund. Once rates begin to rise (eventually they will) after a few quarters, would it be wise to invest lump sum at this date? Or is an SIP better?

Hello sir,

You can invest through either. With that kind of a horizon, the volatility and the very high returns will normalise. It is hard to peg a volatility number to it, but the fund is just more volatile than other debt funds. It’s nowhere close to equity volatility.

Thanks,

Bhavana

I would like to know that considering Covid situation, the interest rates are likely to be low for another 1-2 yrs after which they are expected to again start rising slowly. In such a scenario, is it possible that for the next 4-5 yrs, this fund is likely to underperform as the rates continue to increase? Also, even if I am holding for 7-10 yrs, wouldn’t the under-performance of 4-5 yrs hurt the eventual return after 7-10 yrs?

No it won’t. The double digit returns of short periods of 1-2 years will normalise to regular debt returns. That is the nature of ay gilt fund. Vidya

Hi,

How does it compare to Quantum Dynamic Bond Fund which invests in the same GoI bonds except that it dynamically manages them . Wouldn’t this be better strategy for long term debt than the SBI Fund?

Thanks

Hello sir,

Dynamic bond funds do not only invest in gilt. They switch portfolios based on interest rate. Because rates are in a downward cycle now, dynamic bond funds hold high gilts. This can change to corporate bonds if the rate cycle turns. As explained in the post, the risk is that the dynamic bond fund takes a wrong call on the rate cycle. Constant maturity offers predictability to strategy, reduces risks that calls go wrong (even gilt funds change maturities based on rate cycle), and is low credit risk. And therefore, it suits investors who just want a long-term low risk debt component to their portfolio.

Thanks,

Bhavana

Comments are closed.