(With data and inputs from Anush Raj P)

It’s hard to write on a topic when one of two things are true – the events about that topic are fast moving, and the event itself has not reached a conclusion yet.

In the case of the story of GME stock in the US Market and the recent dramatic events surrounding it, both these are true.

As of this writing, the story is still evolving, and every market day, there is a new twist to it making it harder to predict than a spinner’s delivery on a fifth day pitch.

Nevertheless, I think it’s important to provide some context and opinion at this juncture – and I was primarily motivated to it when I saw a bunch of investors from India getting into this (mis)adventure as well.

More on that later. But first, let’s take a look at the story so far – get some background and catch-up for those who are not fully aware.

Background

So how did this 25 year old video game retail company with 5,509 Stores across 14 different countries become the headlines of business news worldwide in just a matter of days?

The stock moved up 133x times from $3.6 in February last year to $483 on 28th Jan this year. In simple math, if you invested about $7550 in GME in February last year it would have become a million dollars this year. YOLO, baby!

Now, how did this happen?

Rayan Cohen, a 35 yr old investor and businessman, was the former CEO of Chewy, an online pet food company. He starts investing big in the company and gets a seat in the board. He begins talking about his vision to turn the loss making enterprise around and “make it the amazon.com of the video game industry” (per CNBC on Nov 21 2020). By the end of 2020 he had almost about 13% of the company by buying close to 9 million shares for about 76 million dollars.

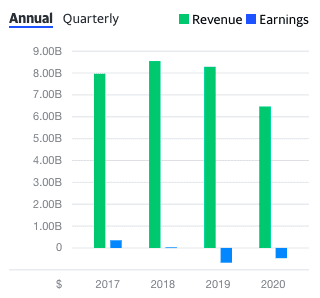

Whenever such buys happen the demand for the stock price goes up. And the stock which was trading below $5 as of Aug. 2020 started to trade at $12 -$15 later that year and closed at $18.84 on 31st Dec 2020. It was a great year for the stock as it moved up more than 10x in a few months. But was it a good year for the company? Apparently not.

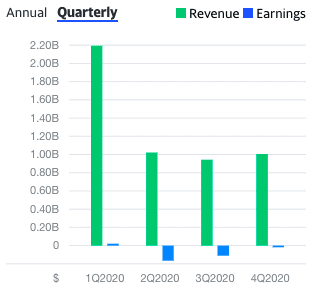

Not only did the company post losses on an annual basis for FY20 and FY19, the lock downs due to the pandemic put the already loss making Gamestop engine on a downward hyperdrive, driving down its quarterly earnings by more than half and pushing to even bigger losses.

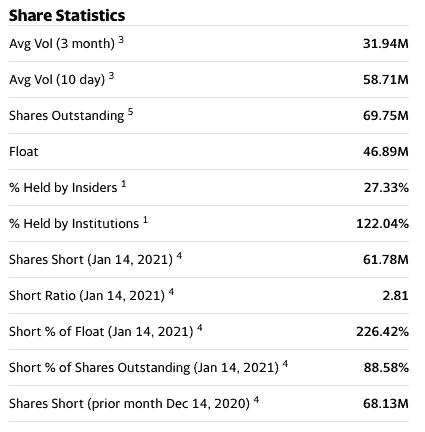

Though Rayan’s plan of restructuring and online explosion of gamestop.com was in place the market did see a valuation mismatch in the stock price and started to short the stock.

As of December last year a large amount of shorts were made by a bunch of hedge funds who felt the stock price was too high and did not match with the company’s earnings nor its future earnings potential.

Enter: a marauding Reddit group.

Now, quickly, Reddit is an online forum where people share stories, links, pictures, ideas, and what not, and comment on them endlessly. It’s a world unto itself – mostly harmless, but given its expanse, it definitely has its murky corners.

Now, the gamers on Reddit caught wind of the short positions and tried to squeeze the hedge funds out of their short positions.

They called it the gamestock rocket and even made a ton of memes calling GME ( the stocks ticker name ) as diamonds and the most famous one was the picture of GME on a rocket to the moon.

How do they do that? By coordinating buys among themselves – both shares of the stock itself as well as call options on the stock. When a group of investors – especially one that keeps growing day by day – coordinate to push a stock up and up, guess what, the stock does go up. Fundamentals? Who cares? Valuation? Please…

All this also happened under the guise of ‘teaching’ hedge fund managers a lesson and showing them the power of retail investors. And when popular folks like Mark Cuban (owner of Dallas Mavericks basketball team), Elon Musk, and Chamath Palihapitiya (a disgruntled ex-Facebook employee and, ok, a famous venture capitalist) also got in the game in support of Redditors – more people took notice, and jumped onto the bandwagon.

What is the goal? To create a situation of ‘short squeeze’ wherein the short sellers will be forced to sell their positions (by buying GME stock), driving the price still higher (“to the moon, baby!”). At which time, all the ‘diamond hands’ GME retail investors will be able to cash out and retire. I guess.

So, as the story played out, the stock went from $4 to $15 to $40 to $100 to $480 and has since reversed course. It closed at $63.77 last week, and who know where it is while you read this article (please read the opening lines of this essay).

Anyways, that’s the story so far.

Investors in India

Now, I am an old-hand at Reddit – been a member of the forum for 14 years now (since the second year of its inception). While I follow the much tamer group (sub-reddit) called /r/investing, /r/wallstreetbets (WSB) always stuck me as a group of hyperactive miracle hunters – with their coded language and their constant quest of YOLO trades (that one trade that will change your life forever).

So, when this thing erupted, I went back there and started reading the threads out of curiosity, and I was stuck by this one thread and comments therein.

An investor from India had posted that they had bought into the hype – with a bulk of their savings of about Rs 10 lakh. It looks like he or she entered the stock at $250. At the time of this writing, their notional loss is close to 74%! I sincerely hope this person cut the losses before now and moved on at a price better than it is today.

There were several replies in that thread with other investors commenting that they too are “deep in GME”.

This is scary. People could get seriously hurt.

In recent months, several outlets in India have facilitated trading in US stocks – right from the biggest brokerages to upstarts. This has made investing in the US market more than a spectator sport for Indians. While this has tremendous advantages (think of the variety of ETFs you have access to), it also has downside risks, as it is very evident now.

Groups like WSB are deafening echo chambers – voices of a bunch of co-dependent members repeat similar opinions ad nauseam. It can be disorienting and could seriously warp a reader’s sense of judgement and rational thinking. Especially, in a situation where there is a wilful suspension of logic and reason, there is a mere animalistic urge to keep buying or holding the stock to keep a balloon afloat as long as they can.

To all the investors in India considering jumping into this (“the stock is on sale”, screams WSB) at this stage, please read the next section to find out why not to.

The end game

I am not qualified to predict how this will end (or even when). But here’s what the very smart and very grounded valuation expert Aswath Damodharan has to say on this topic.

(The whole article makes a brilliant read, but here’s a snippet)

Excerpt Begins

I wonder what your end game is, and rather than pre-judge you, I will offer you the four choices:

1. GameStop is a good investment: That may be a viable path, if you bought GameStop at $40 or $50, but not if you paid $200 or $300 a share. At those prices, I don’t see how you get value for your money, but that may reflect a failure of my imagination, and I encourage you to download my spreadsheet and make your own judgments.

2. GameStop remains a good trade: You may believe that given your numbers (as individual investors), you can sell the stock to someone else at a higher price, but to whom? You may get lucky and be able to exit before everyone else tries to, but the risk that you will be caught in a stampede is high, as everyone tries to rush the exit doors at the same time. In fact, the constant repetition of the mantra that you need to hold to meet a bigger cause (teach Wall Street a lesson) should give you pause, since it is buying time for others (who may be the ones lecturing you) to exit the stock. I hope that I am wrong, but I think that the most likely end game here is that AMC, GameStop and Blackberry will give back all of the gains that they have had from your intervention and return to pre-action prices sooner rather than later.

3. Teach hedge funds and Wall Street a lesson: I won’t patronize you by telling you either that I understand your anger or that you should not be angry. That said, driving a few hedge funds out of business will do little to change the overall business, since other funds will fill the void. If this is your primary reason, though, just remember that the money you are investing in GameStop is more a donation to a cause, than an investment. If you are investing tuition money, mortgage savings or your pension fund in GameStop and AMC, you are impoverishing yourself, trying to deliver a message that may or may not register. The biggest threat to hedge funds does not come from Reddit investor groups or regulators, but from a combination of obscene fee structures and mediocre performance.

4. Play savior: It is possible that your end game was selfless, and that you were trying to save AMC and GameStop as companies, but if that was the case, how has any of what’s happened in the last two weeks help these companies? Their stock prices may have soared, but their financial positions are just as precarious as they were two weeks ago. If your response is that they can try to issue shares at the higher prices, I think of the odds of being able to do this successfully are low for two reasons. The first is that planning a new share issuance takes time, requiring SEC filings and approval. The second is that the very act of trying to issue new shares at the higher price may deflate that price. In a perverse way, you might have made it more difficult for GameStop and AMC to find a pathway to survive as parts of larger companies, by pushing up stock prices, and making them more expensive as targets.

If you are in this game, at least be clear with yourself on what your end game is and protect yourself, because no one else will. The crowds that stormed the Bastille for the French Revolution burned the prison and killed the governor, but once done, they turned on each other. Watch your enemies (and I know that you include regulators and trading platforms in here), but watch your friends even more closely!

Aswath Damodaran

Excerpt Ends

For investors in India, I don’t think either of the last two options are motivating factors – we have our own problems here, and what do we care about saving a gaming retailer in USA? It is either 1 or 2, and my guess is that it is almost exclusively the second option above.

And that is an extremely unlikely scenario to happen as well as you have probably played it out in your heads. It’s hard to time the market, it’s bloody hard to time a single stock, and it’s near impossible to to sell at a short-time price peak.

So, keep away and stay safe. There are plenty of sound investment options in India. Tech stocks at the turn of the century, Bitcoin prices 10 years ago, GME price a year ago – all these make for fantastic day-dreaming material. People who think otherwise will be up for a rude awakening.

4 thoughts on “GME and Investors in India”

Excellent article. Was trying to read up on this from multiple sources. This summarizes everything in a quick read. It is hard to believe that people end up spending their life savings just like that and end up losing it all.

Thank you! 🙂

If I remember right, Ryan Cohen did not join as the CEO of GameStop. He picked a significant stake (initially 9% and later upped to 13%) and then Gamestock gave him a board seat.

Thanks for the alert – you are right – fixed the article.

Comments are closed.