For those of you who did not follow us 2 months ago – we not only gave a timely caution but also gave exit strategies based on the exposure that you had to funds that held the Vodafone paper. You can read it here to get a background of the entire issue. We gave the call as soon as the downgrade happened, although the paper remained investment grade at that point.

In essence, we had given a ‘exit’ call on funds that had higher exposure to the Vodafone paper or if you held a higher proportion to a fund exposed to the Vodafone paper.

Now, in the current scenario, if you are still holding the funds that had exposure, what should your strategy be?

In this article – I am torn between the recent feedback received from a small but discerning number of investors, who want us to ‘substantiate’ every single thing we say (fair point, not arguing) and another larger (much larger in our collective experience) set of investors who simply tell us, ‘don’t write an essay, just tell me what I should be doing’. I have tried to satisfy both kinds and hence please bear with the word count or go to the last section directly!

Recent facts

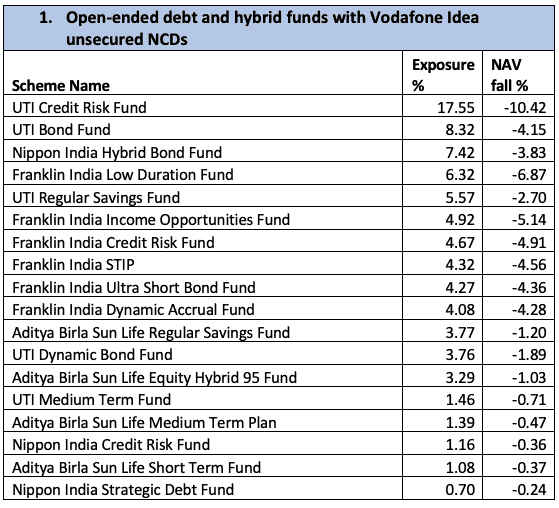

The data first. Here is the list of open-ended funds with exposure to the Vodafone Idea Limited (Vodafone) paper.

Post the Supreme Court’s dismissal of Vodafone’s petition over dues to the government, all Franklin India funds took a mark down of their remaining value in Vodafone’s debt. In other words, the paper was fully written off. All other fund houses appear to have taken a mark-to-market based on credit rating agency valuations. Hence you will see that the exposure and the NAV fall are not the same for the other funds.

Open-ended debt and hybrid funds with Vodafone Idea unsecured NCDs

NAV fall on Jan 16, 2020 for Franklin funds and Jan 17, 2020 for other funds

Multi-layered complexities in deciding

Before we get into what you can do, you need to understand the complexity of taking a decision on holding or exiting funds when the NAV is hit.

Let me list the deciding factors that is under your control (not ours):

- When you entered the fund matters. For example: If you had held Franklin India Ultra Short Bond fund for 5 years or more, your return would still be over 8% annualized (after the NAV hit!). Now, should you even bother about the fall, since this return beats any other fixed-income option? (Then why did we give a call in November then? Simply because you could have locked into higher returns at that time). For those who just entered a month or 3 months ago, the same fund is unlikely to beat FD returns if you hold it for just a year.

- Your time frame of investing decides everything: An investor had a query whether he would be able to recover his money in a year’s time as he had invested in the Franklin Ultra Short fund only last week. My answer – unlikely. My answer to the same fund, for a 2-year time frame – yes, a high probability ceteris paribus (yield, interest rate, AUM, inflows and so on remaining in similar trajectory)

- Your exit load and tax rate: The exit load you pay, and whether you have a short-term or long-term capital gain or loss if you exit now has a bearing on your net returns, and therefore on your decision. Ideally, exit loads should not stop you from getting out of a fund where your risk is greater if you continued to remain invested.

- Your exposure to the fund: You will be little hurt if your portfolio has a less than 10% exposure to a fund whose NAV is hit by 10%; as opposed to your holding 30% in a fund whose NAV fell 10%.

The above is complex and needs to be looked at as a whole – but it can be deciphered.

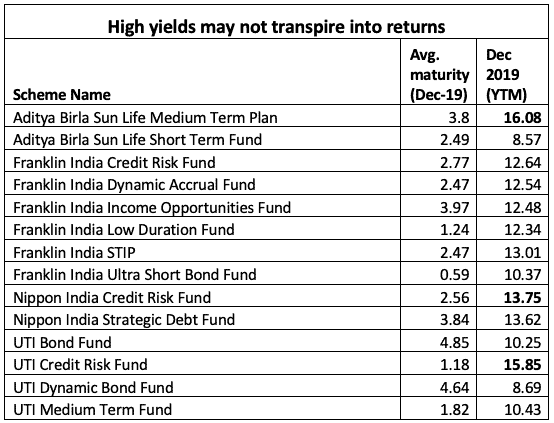

High yields may not transpire into returns

For open-ended debt funds that held Vodafone paper; not including hybrid options.

But there are lot more moving parts to giving a logical call after such events transpire. When there are fewer variables, it is possible to build a mathematical probability that will hold. But when there are way too many variables, unless most of them remain unchanged, our call can go entirely wrong. Here are just some of them.

- Redemption pressure: Often, a fund’s exposure to a bad paper may be low but panic may result in redemption pressure and lower AUM. As a result, exposure to the same paper swells. In the first table above on exposure to the Vodafone paper, you can see that in the Franklin funds, the write off is more than the exposure as of December. That means between December and now, these funds saw some erosion in their AUM. Not only that, there can be sub-optimal selling by the fund house causing rapid change in the portfolio yields.

- Yields can mislead: Sometimes, when a call to hold to a fund is taken, it is done merely by a theoretical calculation of yield over the residual duration of the portfolio less expense ratio. The yields can be inflated, either because there was a sell-off in select papers (causing yields to rise) or due to market aversion to credit risk. Unless the credit issues are resolved, such yields may not necessarily transpire into returns. (How do you identify whether the yields are misleading or really come from taking high coupon papers that may click? That is to be a separate article, some other day, for our premium investors 😊)

- Adjusting yields: As an outsider without up-to-date data on every aspect of the portfolio or the knowhow, it may be hard to adjust the yield of a bad paper. The coupon of every paper, the residual maturity and the papers’ weight must be considered to arrive at the new yields. Portfolios often have instruments like ZCBs or floating rate bonds and unless one knows the time of entry or the changing rate, it may be hard to even forecast the return from this point that an investor can expect if he/she holds the paper.

- Interest rate cycles: The yield of a portfolio may rapidly change if the interest rate cycle is turning and this may entirely turn the table on the decision to hold or sell.

- Inflows: Significant inflows in depressed NAV funds is not a rarity. When that happens, more investments at lower yields (in a falling rate scenario) or vice versa may prove a hold or sell decision wrong.

After all this….

Now, if your question is, what does this mean to me, we can guide you to make a decision. Know these first:

- All the Franklin funds have marked down fully but the others have not. So the latter can go south further in case of any adverse rating agency action or a default or in the remote event of the company going into liquidation.

- The next earliest maturity for Vodafone papers (for mutual funds) will be July 2020. All six Franklin funds hold this paper (plus papers maturing later). The other fund to hold July maturity is UTI Credit Risk. Among these, Franklin India Ultra Short Bond has only one Vodafone paper, and that matures in July 2020. Hence, if the issue resolves or the money is repaid, the earliest to recover fully would be Franklin India Ultra Short bond. Before you rejoice, please assume that you would not get back the money. This will help you assess what you should do without making assumptions on probability of repayment.

Returns of open-ended funds after the hit on Jan 16/17 2020

Here’s what action you can take, depending on your situation:

- If you who have held the funds for 3-5 years or more: You can afford to wait, except in the following funds: UTI Credit Risk, UTI Bond and Nippon India Hybrid Bond as they have high exposure to Vodafone and haven’t written it off fully. Hence, exit those. They have also taken other hits. Exit funds with a stated credit strategy as there could be more risks looming there. Use our review tool for the hybrid funds.

- If you have held these funds for 1-3 years: it is a bit tricky. You will need to hold the funds for another 2-3 years for returns to normalize (reach 7% or more). Those of you in losses, exit and consider setting it off against any profits. Others, decide whether you can hold for another 2-3 years (other than credit risk funds and the funds mentioned as exit in point 1). Else, exit and reinvest in other low risk debt funds.

- If you entered in the last 1 year and have a time frame of one year or less (especially in ultra-short or low duration funds). This situation poses problems. You may need to hold them for 1.5-2 years to ensure that you get what you initially expected. So if your holding timeframe aligns with the funds’ current maturity, then you are unlikely to beat FD returns. You may therefore need to exit and reinvest in an FD. If you have the luxury of keeping this money aside for longer, do so (again, this does not include the funds given as exit in point 1).

The guide above is given in the scenario that the money is not repaid and that the rest of the portfolio returns will make it up for you, in time.

If you knowingly invested in credit risk funds and this NAV fall has troubled you even if you have a long timeframe, credit risk funds don’t suit you. When you can, move to lower-risk accrual funds.

And finally – if Vodafone’s situation does resolve and funds receive all payments, please do not come back to us saying that you lost an opportunity or you made losses by selling the fund. The decision you make today is to cut losses, and because your situation does not allow you to take chances with your money. Never look back!! It is so for equities and doubly so for debt.

If you are looking for alternatives, look at our Prime Funds. You may be surprised by some of our choices there. Feel free to write to us then, as subscribers! Also use our review tool as a hygiene. Whether you decide to hold funds to make up losses or not, our review tool will tell you whether you are with good funds in the first place.