Recent developments in the telecom space holds the risk of pushing Vodafone’s debt instruments to junk/default status and a consequent erosion to NAVs of funds that hold the instrument. We recommend an exit on funds that have a significant holding in the instrument and suggest alternatives.

The debt instruments of India’s no.2 telecom operator Vodafone Idea (Vodafone) is under pressure after the company reported a massive loss of Rs 50,922 crore for the quarter ending September 2019. This unprecedented loss comes after the company provided for dues and penalties to be paid to the government. This provision was made to comply with a Supreme Court ruling that requires all telecom operators to include their non-core revenue (called Adjusted gross revenue) in calculating the fees due to the government.

Unless the government provides more time, telecom players must pay up the amount in another 3 months. Vodafone will have to pay Rs 28,309 crore, while Bharti Airtel will be required to cough up about Rs 21,682 crore, according to reports.

This development holds the risk of pushing Vodafone’s debt instruments to junk/default status and a consequent erosion to NAVs of funds that hold the instrument. We recommend an exit on funds that have a significant holding in the instrument and suggest alternatives.

Given below is our reasoning for the call and what action needs to be taken.

The last straw?

Since 2016, the telecom landscape in India saw a shift as Reliance Jio Infocomm disrupted the market with its free/rock-bottom tariffs. This led to smaller players exiting the market or consolidating. The 2 large players Bharti Airtel (Airtel) and Vodafone Idea came under severe financial stress as they lost market share and revenue and were forced to deal with burgeoning debt. Vodafone’s financials were more stressed than Airtel as the latter managed to raise equity and keep its debt under check.

The recent Supreme Court Verdict has only compounded the pain for these players. Vodafone’s key financial parameters have now become precarious:

- As of September 2019, Vodafone’s debt was 4.87 times its equity and its net worth eroded 65% compared with a year ago.

- The company’s profits before interest and taxes could cover its interest cost on debt a year ago. With unprecedented losses now, there is no profit to cover the interest cost.

- Rating agency Crisil downgraded the NCDs of Vodafone to BBB+ from A- and subsequently placed it on ‘rating watch with negative implication’. Other rating agencies too either downgraded the papers or placed them under watch with negative implication even before the quarterly results were out. Any rating below BBB- would be junk or below investment grade status.

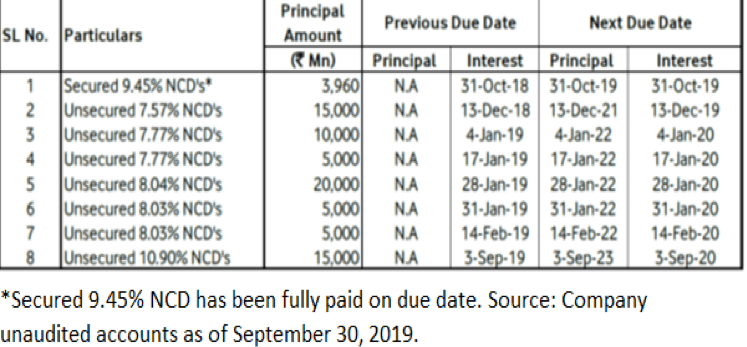

Vodafone’ borrowings through NCDs as of September 2019, were as follows:

While there is no immediate repayment of debt, Vodafone’s ability to service interest cost may come under threat if it does not receive any relief from the Department of Telecommunications (DoT) on the repayment schedule of the dues demanded. The company has stated that its ability to remain a going concern would be dependent on obtaining relief from the government.

Respite from the DoT might prevent immediate disaster. But the steady deterioration in financials on account of erosion of market share, price cuts and mounting interest cost does not augur well for the lenders of the company.

What to do with your debt holdings

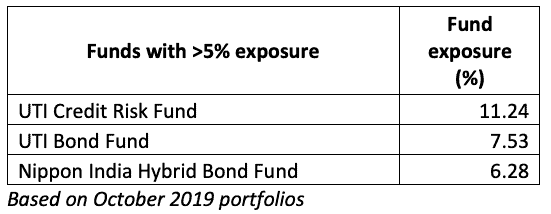

The chances of a rating downgrade therefore remains high for Vodafone’s debt papers, causing NAV decline in funds that own it. The extent of fall depends on the steepness of the downgrade and the exposure each fund has to Vodafone’s papers.

For funds that have a higher exposure, the safest option would be to exit them to mitigate your portfolio risk. Here are the funds that you can consider exiting.

Where to reinvest

- If you need the above money in less than 6 months: switch to liquid funds.

- If you have a time frame of 6 months to 1 year: in addition to liquid funds, consider stable arbitrage funds such as Edelweiss Arbitrage if you are in the 30% tax bracket. This will ensure efficient tax treatment compared with debt. Do not expect returns more than liquid funds. If you are in the tax bracket of 10-20%, then lock into post office time deposit, currently at 6.9%. This option may be better than liquid or arbitrage funds at this point for a 1-year time frame.

- If you do not need this money for more than 2 years: switch to equity savings funds (not a like-for-like alternative to short-term debt funds, but provides better tax efficiency) such as Kotak Equity Savings. Here again temper your return expectations to that of low-risk debt funds.

You can also read this article on short term funds.

Please note the following:

- These recommendations have been made with the idea of averting further erosion to your wealth (UTI funds have been hit by other defaults as well). They may not yield returns similar to long-term debt.

- Some of the funds like UTI already have segregated units (side pocketing). You will not be able to exit the segregated units as they hold bad debt from earlier papers.

- You may suffer exit load or taxes on some of these funds based on when you entered. Our call is based on the looming risk, to prevent any portfolio loss due to markdowns.

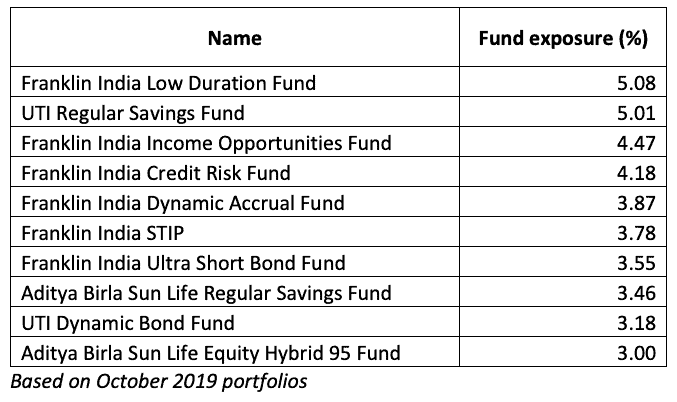

Funds with 3-5% Vodafone paper exposure

The funds below hold Vodafone instruments to the extent of 3-5%. If these funds individually or together account for over 10% of your total portfolio, then you may exit them and choose one of the options stated in the ‘Where to reinvest’ section above.

What about Airtel?

Airtel has not been spared from the Supreme Court’s verdict. The company also ended with losses of Rs 23,044 crore for the quarter ended September 2019, after providing for the DoT dues and penalties. However, the company had raised close to Rs 25,000 crore through a rights issue to reduce some of its debt earlier this year. As a result, its debt is 1.69 times its equity, far more manageable than Vodafone. The free operational cash flows have also turned positive from negative a year ago.

At least 8 debt and hybrid funds have over 3% exposure to Airtel and related group entities’ debt papers. While we do not see the need for any action at this juncture, we will keep watch for any deterioration in quality or developments that may risk downgrades.

Update: We take note of the recent development from the government, providing relief to telecom companies Bharti Airtel, Vodafone and Reliance Jiocomm, to the extent of Rs 42,000 crore. The relief will provide Vodafone a moratorium period of deferring about Rs 24,000 crore. In other words, Vodafone doe not have to worry about this cash outflow for the next 2 years. It is noteworthy that there is no reduction in the overall levies. Vodafone owes about Rs 53,000 crore overall to the government.

Our call above already factored a possible relief. The deteriorating cash flow and poor rating remain the primary reasons for our call.

Editor’s note: You will have all these alerts and action needed, in a timely manner, through your PrimeInvestor subscription, once our platform goes live. Stay tuned and until then, invest safe! 🙂