In an entrepreneur forum that I follow, someone asked a question to the group – “Which books made you the most money?”. The answers that followed ranged across topics of investing to motivational to actual business books. But one book that got the most mention was this book by M J DeMarco titled, “The Millionaire Fastlane”.

However, people who commented on this recommendation seemed quite polarized. Some of them REALLY liked the book, and other others REALLY hated it.

So, I had to buy and read it. 🙂

I just finished it, and I have to say, I hated it.

But, if you read it, you may like it. And that’s ok. While not quite liking it, I could quite see why some people will really find it inspiring or at least, alluring.

In this review, let me give you a summary of what the author says, and tell you what I thought about the ‘fastlane’ he recommends.

The Millionaire Fastlane – An overview

First things first. The author is a self-made millionaire. By his own account (which starts off the book), he was hopping across several jobs after his graduation until he had this moment of clarity. During a trip to an ice cream store one lazy afternoon, he spotted a Lamborghini car and its surprisingly young owner. He approached the owner and asked him how he could afford it at his age. The answer that he gave (I won’t spoil it for you, and it’s not really material) sets the author on a journey of self-discovery and his eventual riches. This was in the late ‘90s and not very surprisingly, the author goes on to found a dot-com company that provides a niche service (and does it well). He eventually sells it (and buys it back, and sells it again) to get to where he is today.

Based on this life journey, and his observations of fellow seekers of wealth in the road of life, DeMarco says that there are three kinds of people. The Sidewalkers, the Slowlaners, and of course, the Fastlaners.

The Sidewalkers are those that pay little to no attention to their financial life. They are innumerate (financially illiterate), live their life credit card bill to credit card bill, blame the system for their ills, and live a life of penury, or worse, a debt-laden life of faux luxury.

The Slowlaners are those that work hard, save diligently, invest in prudent instruments, and build a nest egg for their future and retirement. They are the people who seek to get rich old, and according to the author, gather wealth only to see themselves unable to spend it in their old age in things they wished for when they were young. These are the ‘acolytes’ of common groupthink, and followers of the popular wisdom of getting rich ‘slowly’.

And then, of course, there are the Fastlaners – these are those who identify opportunities to build wealth quickly and deploy their wealth in the “money machine” (of dividends and interest) and retire early in their lives. They ‘effect’ millions of lives, build assets that they can sell for ‘multiples’, make money while they are asleep, etc. Essentially, entrepreneurs who strike it rich.

The book devotes sections to cover each of these types of people in detail (LOTS of detail). The last part of the book is about how to identify your fastlane and course through it. The author recommends a formula – the CENTS formula of creating a business that will

- Let you have Control

- Have Entry barriers

- Serve a real market Need

- Can be run without utilizing your personal Time, and

- Have Scale to serve millions of people

Essentially, this part is your basic startup guidebook in a different format with aphorisms such as “focus on execution”, “choose your partners wisely”, “listen to your customers” etc.

So, in summary, the basic thesis of the book is that ‘Get rich quick’ is possible (but not ‘Get rich easy’) and that you don’t need to be condemned to a fate of poverty or slow growth if you just put your mind and some elbow-grease into it.

What the book gets right

To be fair, the book is an interesting read and it would take a dyed-in-the-wool cynic to not come out inspired and with an optimistic outlook. There are several, several anecdotes that ring true and are relatable.

Personally speaking, there are parts of the book that I could relate with.

About 15-20 years ago, there was a book that was all the rage in the self-improvement aisles. It’s still popular today, and it is the book called ‘Who moved my cheese’. It talks about how individuals should manage change in their lives, using a parable of rats (or mice?) hunting for blocks of cheese.

I hated that book.

The reason was simple: I did not want to be the person who chased after a moving block of cheese. I wanted to be the person who moved the cheese. And no book is going to tell me to just deal with the change because someone above is moving things around.

This book (TMF) strikes the same chord that I felt years ago – it urges people to take charge and not be subjects of change, but to become the changemaker themselves.

And, more importantly, the basic idea is indeed correct – even in India, and even today, we are seeing companies getting formed right, left, and center, and a flourishing startup culture emerging with stories of fast growth and faster money (at least raised, if not earned).

And, yes, there are Sidewalkers amongst us – few too many, actually – that pay scant regard to their finances and ruin their financial lives in a degrading cycle of debt and spending. And the regular folk – the so-called Slowlaners – are indeed trudging through the system with hope and discipline, but at a pace that crawls more than it runs.

So, for a young person who reads this book, it would indeed be clarifying to understand the roads ahead of him or her and make a decision as to which path they are going to take. Which path appeals to them, which ones they think they will be best served by, and if it is going to be the fastlane, what they should watch out for as they embark on it.

For these people, even the last part of the book, which I referred to rather dismissively earlier, will provide insights and guard rails that they will find useful.

So, if you are a person, or if you know a person that is unfamiliar with the mysteries of money making and want a map to tell you what the different routes are, you could do worse than reading or gifting this book.

Where the book falters, IMO

Before I get to real issues with the content of the book, here is one about its form – the book is too verbose. What can be said in 2 words, the author takes 20. The 300+ large-format pages could have been half that if it had been edited for length.

Apart from that, there are two reasons I did not quite like this book, and one is more serious than the other.

The less serious reason that turned me off this book is the rather evangelical fervour that the author shows towards his chosen path. That itself, while a bit cloying, is acceptable. But the author goes further than that to denigrate the people who do not follow his chosen path. The Slowlaners, especially, bear the brunt of needless criticism about their choices – the fact that they work Monday to Friday, await their weekends, put up with unbearable colleagues at work place, don’t understand the value of their time etc etc. The author has nothing but scorn for these people who, at the end of the day, do honest work for decent pay and go on to raise a family and live peaceful lives. With almost a hint of self-loathing, the author rails on them as if they are caricatures from an Orwellian society. I found this whole depiction rather distasteful.

The more serious reason where I disagreed with the book is the way the author presents the odds of success, which I think is dangerously and misleadingly false.

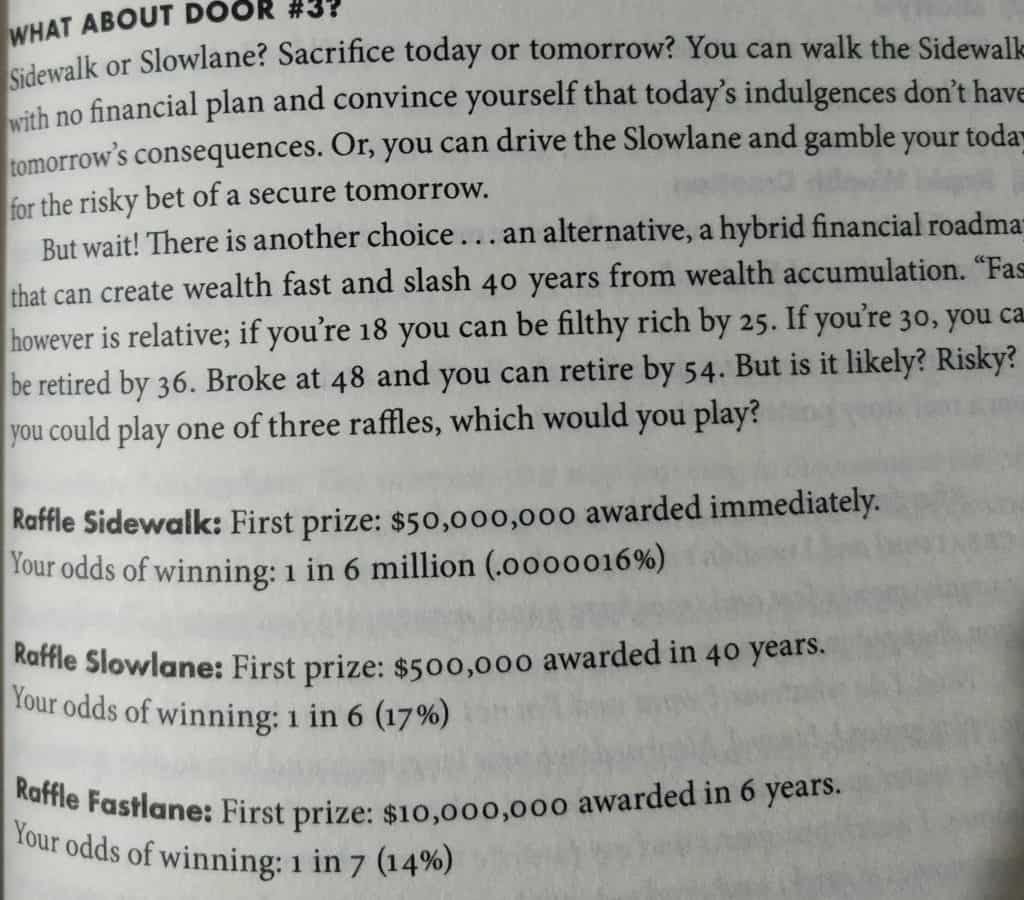

According to the author, the odds of reaching your riches for the three categories of people are as follows (page 107 in my version):

Sidewalk: Odds of winning 1 in 6 million

Slowlane: 1 in 6 (17%)

Fastlane: 1 in 7 (14%)

This is just an alarmingly false depiction of the probabilities.

Let’s ignore the Sidewalk probability – they are debt-ridden folks who will not see riches unless they inherit it from their parents or ride on their children’s successes.

To say that a saver/investor has only a 3% higher chance of gaining wealth compared to a strike-it-rich-quickly entrepreneur is just ridiculous.

According to the author, the Slowlaners have only a 17% chance of success because there are several dangers in their path: they could die before getting rich, their company could go down, the markets could tank with their investments, their real estate (home) could turn worthless, they could lose their job etc.

But, on the other hand, the Fastlaners, if they follow all the guidelines and ‘distinctions’ advocated by the author have a 1 in 7 chance of success – a fast path to millions in a short time span of 5 years after which they can retire and do as they please. Wow!

This despite statistics that 80% of startups fail in the first year and less than 1% (generously) become multi-million dollar (multi-crore rupee) successes.

Reminds me of “Hoop dreams” where inner-city kids in the US dribbling the rock in neighborhood quads with dreams of the NBA draft day. Yes, some of these kids do go on to get drafted and become millionaires. But would you go give a lecture to these kids that studying and getting a job is slowlane and they should just work out, play hard, and become NBA millionaires? The author’s presentation of these paths and their probabilities is as dangerous as that.

Finally…

I have been on both the roads – for a while I was diligently working as an employee, scrounging and saving, and investing etc. And for the past several years, I have been going down the entrepreneurial path. There are joys and difficulties in both, and when done right, there is a path to success in both. There is no need, in my opinion, to look askance at either of these roads and label them as either too lazy or too foolish. For all the adages and aphorisms thrown around in this book, there is a crucial one that is missing and that is this – ‘To each their own’.

Link to book in Amazon (not an affiliate link)

More book reviews at PrimeInvestor :

Psychology of Money by Morgan Housel

13 thoughts on ““The Millionaire Fastlane” – A review”

Great review Srikanth. As a decidedly “slowlaner” myself, I can say both the amount and the probability are way off. The author’s bias is evident for the high risk path of entrepreneurship. He forgets to mention that more than 90% of all new businesses fail within three years of founding. Even among the 10% that succeed, a large marjority provide a living wage. Only a very tiny portion lead to riches. On the “slowlane”, the figure can be 10x what the author wrote and a probability well over 50%. I am proof.

Great, congrats! 🙂

Nice review….

I have done the slowlane and became FI, quit corporate life at 41…..

When people ask me…i always say…to each their own….we are all after all unique!!

Fantastic! Congratulations!!

Srikanth Sir, Superb review and agree with you ‘To each their own’, that is the key.

The summary was awesome. The conclusion made by you was just right.

Good article, well presented!

Thank you!

Hopefully, many more to come..

Srikanth sir! It was a Crisp, Frank Opinion and Loved reading it! Keep giving us more!

Excellent detailed writing. Thank you 😊

Thanks! 🙂

Thanks for your commentary and opinion on the book. I liked your writeup that was crisp without losing the important details. I’m on your side of the view as well.

Thanks!

Comments are closed.