With returns failing to match risks and RBI relief measures complicating life for lenders, the next six months promise to be a minefield for debt investors. Here’s how you can navigate this.

- SFB financials may look better than mainstream banks, but their lending operations are quite risky

- We identify three of them based on financials and disclosures

- SFB deposits are good as a diversifier and not as capital protection vehicles

By winding up six of its debt schemes with credit strategies, Franklin Templeton AMC has become the first casualty of the turmoil wrought by COVID-19 on debt markets last week. But the COVID impact may have just begun. Fixed income investors may need to brace for a rocky road ahead on their debt investments in the next six months.

To navigate this rocky road, it helps to be aware of where the minefields lie, so that you can steer clear of them.

Rising default risks

The financial strain to businesses as a result of COVID is likely to be much worse than that from any previous economic slowdown, including the global financial crisis of 2008-09. While India has only witnessed a growth slowdown in the past, this lock-down has forced most businesses to make do with zero revenues for the past month. Even if the lockdown is lifted soon, the resumption of business is likely to be gradual. The April-June quarter may thus be a washout for most corporates, while July-September will remain under a cloud.

Rating agencies have therefore already begun to warn of corporate defaults shooting up in FY21. Even before this pandemic hit, CRISIL reported a sharp spike in its corporate bond downgrades relative to upgrades. In the second half of FY20, it downgraded 469 bonds while upgrading only 360, leading to a credit ratio of 0.71. The ratio hasn’t fallen below 1 in the last three years. CRISIL expects it to plummet further in FY21 as the COVID impact is felt.

While many corporate borrowers are likely to struggle to service their loans in the months ahead, retail borrowers may be no better placed with salaried folk already being warned of pay cuts and job losses, as their employers juggle cash flows.

This likely rise in defaults from both corporate and retail borrowers puts banks and NBFCs who lend to them in a tight spot. Given that banks and NBFCs run highly leveraged businesses (they give out Rs 5 to Rs 10 in loans for every Rupee of their own capital) interrupted repayments by their borrowers strain their finances.

Low rewards for risks

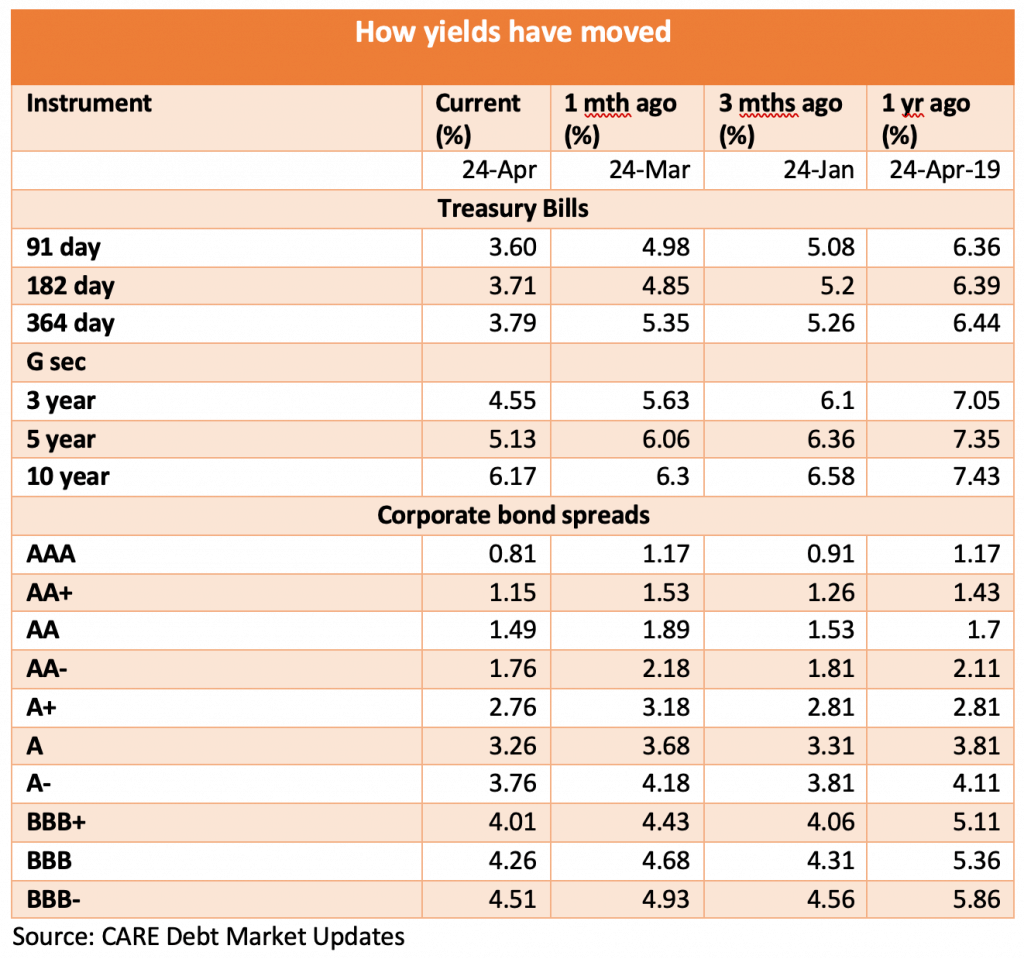

Usually, when default risks in the market rise, bond yields rise too, making it rewarding for investors to take on risks. But presently, RBI’s determined efforts to keep interest rates low, are tempering this re-adjustment. This table shows that despite credit risks rising sharply, corporate bond spreads have not expanded much over a month or a year ago. This suggests that the debt market is presently not very favourable for credit risk-takers.

Relief for borrowers, trouble for investors

Apart from rising default risk and not enough compensation for it, debt investors face another challenge over the next six months -incomplete data to figure how the crisis is hurting the entities they’ve invested in. RBI’s relief measures so far are aimed at helping borrowers, but they complicate life for debt investors. Consider this.

# 1 Loan leeway

RBI has asked all banks and non-banks to grant a 3-month loan moratorium to their term loan takers on instalments due between March 1 and May 31 2020. Effectively, for these three months, borrowers have a carte blanche to not make any repayments to banks or NBFCs they’ve borrowed from and won’t face any consequences, except paying interest for this delay. There’s also worry that this moratorium may be extended. This will mean a sharp spike in Non-Performing Assets (NPAs) for banks and NBFCs in the June and September quarters, which will require new provisions and reduce profits and capital adequacy.

# 2 Delayed recognition

RBI has also allowed banks to not ‘count’ this moratorium period in their NPA reporting for now. Earlier, banks had to disclose any loan overdue for over 90 days as NPA and disclose it in their quarterly results. Now, with defaults for 90 days from March to May not counted, the recognition can get pushed by 180 days. Suppose a bank saw a default on May 31, that would reflect as an NPA in its books only by September. If you are a depositor/investor with banks, you may not have the true picture of their NPAs for two quarters at least, until September. NBFCs under Ind AS now recognise their doubtful debts based on their projections of expected credit losses, which can go off the mark in these uncertain times too.

# 3 NBFCs sandwiched

While RBI explicitly announced a moratorium for retail/corporate borrowers, it didn’t announce one for NBFCs. This has led to a dicey situation where every NBFC is required to offer leeway to its borrowers to skip repayments, while it must continue to service its own borrowings on time. While banks have since begun offering selective moratoriums to NBFCs and RBI has extended some liquidity support, many NBFCs are still in a bind.

The extent to which individual NBFCs can weather this will depend on the type of borrowers (self-employed vs salaried, MSME vs big corporates) and loans (gold loans are 3-4 month while durable and vehicle loans take 8 months-3 years). The liquid assets held in an NBFC’s books before this crisis and its ability to raise quick money from banks, bond markets or deposits will matter a lot too. NBFC funding from bond markets has been drying up as mutual funds have faced net pull-outs. Presently, most leading NBFCs appear to hold enough liquidity to meet liabilities for the next 2-3 months. But if problems persist beyond that, things could get tricky. A CRISIL analysis estimates that, if they don’t receive a moratorium from banks, 37% of the NBFCs have a liquidity cover of over 3 times to meet their obligations until May 31 2020, while only 11% would not have even 1 time. But if repayments are delayed until June 30, nearly a quarter of the NBFCs would have a cover of less than 1 time.

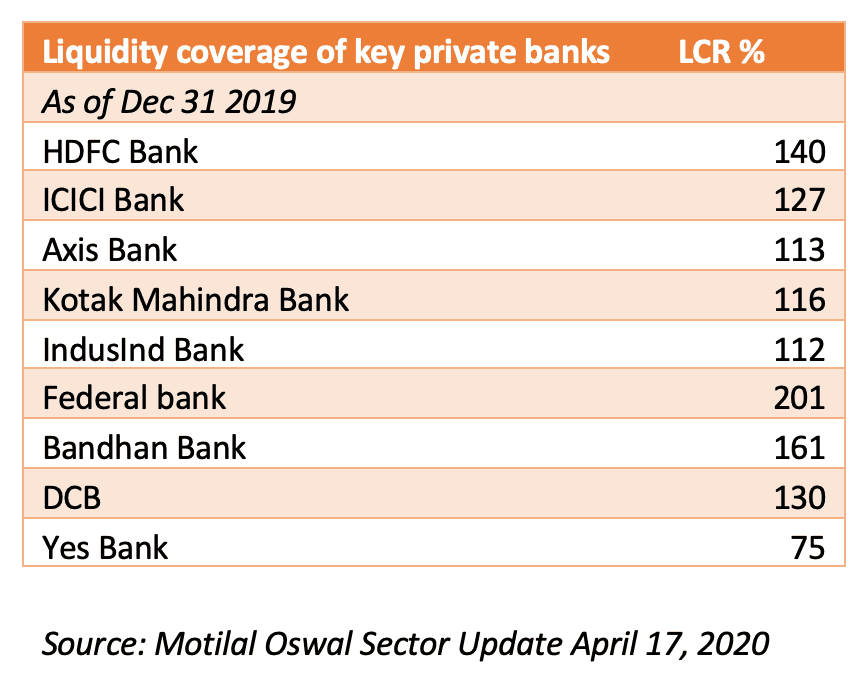

#4 Liquidity concession

To give banks an additional push to lend, RBI has relaxed the liquidity coverage ratio (LCR) from 100% to 80% until October 1 2020. The LCR is a ratio that measures how much high-quality liquid assets a bank holds, to meet its cash outflows over next 30 days. A 100% ratio means that banks needed to maintain enough liquid assets to cover their immediate liabilities fully. An 80% ratio leaves 20% of the liabilities uncovered. Thankfully though, most banks had LCRs well in excess of 100% before this crisis. In its bid to keep credit flowing, RBI has also been making ample liquidity available to banks via term repos and most banks are thus sitting on large liquidity buffers.

What’s risky and what’s safe

If you’re a conservative investor seeking capital safety, all this calls for taking a play-it-safe approach on your bond and deposit investments, even at the cost of returns, over the next few months. You can go back to risk-taking once there’s more clarity on how each entity has weathered this phase. Here are the key thumb rules to follow:

Banks better than NBFCs: Most large banks are well-placed on liquidity with RBI opening the spigots and they therefore represent a safer avenues to park your money than NBFCs. The recently enhanced deposit insurance cover of Rs 5 lakh also lends additional comfort. When choosing banks, it may be best to stick to the large ones which have a strong deposit franchise. Do take note of the following:

- Banks that have lower liquidity covers (IndusInd and Yes Bank) are avoidable.

- It is also advisable not to raise exposure to banks which are already under RBI’s Prompt Corrective Action, given that higher NPAs and provisions could pose fresh challenges to their capital adequacy. Indian Overseas Bank, Central Bank, UCO Bank, United Bank, Lakshmi Vilas Bank and IDBI Bank fall in this category.

- Small finance banks, with loans to small-ticket borrowers are vulnerable to subject to delays and defaults. However, being banks, SFBs enjoy access to funding from deposits and RBI’s repo facilities, unlike microfinance NBFCs. If you already have deposits in any of the above categories of banks, it may advisable to diversify your deposits to stronger banks so that these deposits make up no more than 10% of your portfolio.

Selective on NBFCs: As NBFCs are set to bear the brunt of the troubles that lie ahead, investing in NBFC deposits or bonds at this juncture calls for a lot of due diligence on their liquidity positions, loan books and fund base. Even so, it is hard to predict how the situation will evolve.

Here are a set of guidelines:

- Within NBFCs, those that extend asset-backed loans are better placed than those that extend unsecured loans.

- Within asset financing, home financing companies with mostly retail loans books appear the best bet, as these borrowers are least likely to default on their loans.

- Even in collateral-backed lending, segments like truck financing, vehicle financing and MSME loans are facing the heat from the lock-down.

- This makes a case for holding off fresh investments even in popular names in these segments such as Bajaj Finance, M&M Financial, Shriram Transport Finance, Shriram City Union until clarity emerges or returns improve. If you have a substantial proportion of your portfolio in these NBFCs, it would be good to limit the exposure to 10% of your portfolio on renewal and diversify to banks.

- HDFC and Sundaram Finance despite escalation in business risks remain investible, owing to their strong deposit franchise and management quality.

Stick to high ratings: All corporates/NBFCs rated AA and below are avoidable at this juncture, given that their yields do not offer enough compensation for higher risks. Government securities, especially at the short end offer very low yields.

For those seeking higher yields with matching risks, State government bonds offer a reasonable option with State governments recently issuing 10-year bonds at 7.5-8 per cent, higher than AAA rated corporates. If keen on this option, debt funds which combine State loans with PSU bonds and gilts may be your safe haven until things improve. We have written about such options earlier here: https://www.primeinvestor.in/prime-strategy-3-funds-to-beat-the-low-interest-rate-regime/

Also Read : Mutual fund holdings in bank perpetual bond