- Aggressive mid-cap fund, taking above-average exposure to small-caps

- Low portfolio churn with a buy-and-hold strategy that allows it to accumulate stocks and realise potential

- Ability to contain downsides during corrections and beat the index on upsides

- Superior risk-adjusted return compared to peers

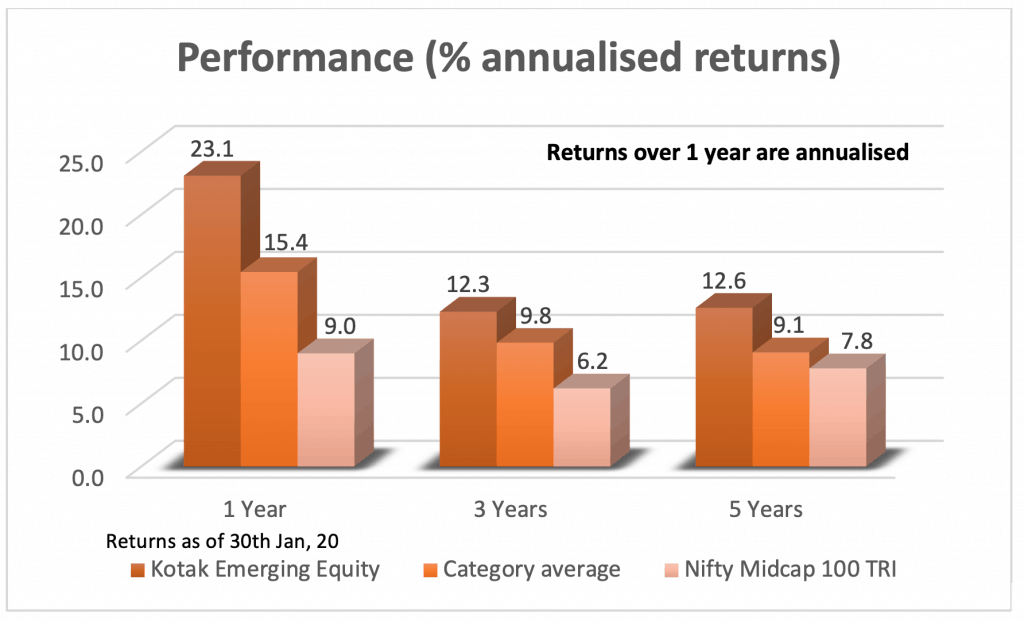

- Consistency in beating benchmark across timeframes

Over the past two weeks, we have been writing on the promise in the mid-cap and small-cap segment of the market and how the rally is starting to move beyond a handful of large stocks. While a quick recovery may be some way off, the steep 2-year correction in the mid-cap space offers good opportunities to begin accumulating mid-caps from a long-term perspective.

Kotak Emerging Equity features in our researched list of recommended funds – Prime Funds – and is among the funds we listed in our 2020 equity strategy. Please read our equity outlook on why mid & small cap funds are good segments to enter now.

The fund is among the more aggressive in the mid-cap category, dipping into small-cap stocks more than peers. It, however, still keeps volatility and downsides in check. The fund’s returns are well above that of peers and its size, at Rs 5, 718 crore is still manageable to bag opportunities in small and mid-caps. Kotak Emerging is managed by Pankaj Tibrewal.

Suitability

Before getting into strategy and performance details, know that Kotak Emerging Equity (Kotak Emerging) is for the high risk-takers only. Conservative investors can stick to less aggressive options such as Franklin Prima or opt for more dynamic large-and-midcap funds instead.

Kotak Emerging fits 5-7 year and longer portfolios. It can be used as the only mid-cap exposure, or along with another mid-cap fund or an aggressive large-and-midcap fund depending on your investment amount. Cap overall mid-cap exposure to 30% of your portfolio, no matter how high a risk-taker you are.

Stands out among peers

Kotak Emerging’s average 3-year return over a 6-year period comes in 18.2%. The mid-cap category clocked an average 14.1% in the same period. Barring L&T Mid-cap, the fund beat every other mid-cap fund. The fund is a consistent performer too. It beat the category average all the time when rolling 3-year returns over a 6-year period and the Nifty Midcap 100 TRI 85% of the time. These figures are among the best in category.

Part of the driving force behind these higher returns is the fund’s small-cap exposure, which is usually higher than peers. In the past year, for instance, small-caps accounted for about 19% of Kotak Emerging’s portfolio. Peers such as Franklin India Prima, HDFC Mid-cap Opportunities, DSP Midcap, and Axis Midcap have far lower small-cap exposures of 3%-14%. Kotak Emerging additionally picks stocks from the lower end of the mid-cap spectrum; its portfolio for December 2019, for example, has about 38% in stocks with market capitalisations of less than Rs 15,000 crore.

This ups its risk profile. When we talk of risk, we mean the risk stemming from holding a relatively higher small-cap allocation. But as far as performance goes, Kotak Emerging has managed to keep in line with peers as far as volatility and downside protection goes. On the volatility front, it is only slightly more volatile than the category average, thanks in part to its low portfolio churn and buy-and-hold strategy. On downside, Kotak Emerging loses much lesser than the Nifty Midcap 150 TRI across different timeframes over the past five years, using downside capture ratio as a metric.

Typically, funds that do great on containing losses use this ability to maintain better returns and don’t always capture upsides well. Funds scoring during bull rides tend to drop faster. Kotak Emerging, though, has the rare combination of containing downsides and participating in upsides. Going by the upside capture ratio across timeframes, the fund gains more than the Nifty Midcap 150 in rising markets.

Buy and hold stock-picking

As with most mid-cap funds, Kotak Emerging keeps individual stock allocations limited and holds a large portfolio, in light of liquidity risks. It adopts a bottom-up approach to stock selection.

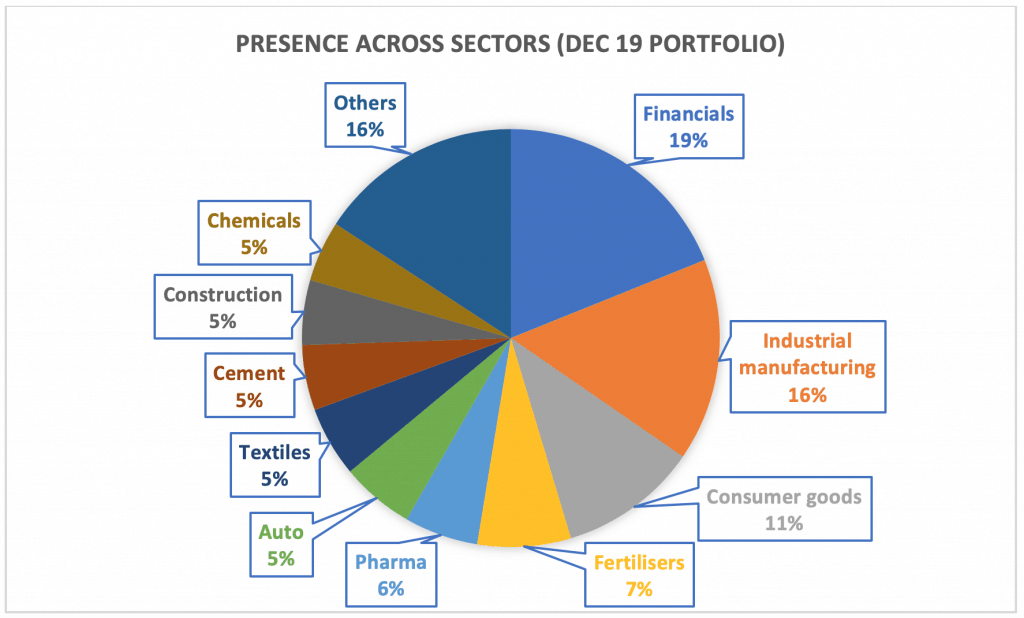

That said, its sector spread is wide, encompassing financials, consumer, industrials, metals, fertilisers, and chemicals. This wide spectrum and its ability to pick lesser-known names can keep it in good stead, especially when market recovery gets more broad-based and reacts to economic recovery. For instance, stocks such as Ratnamani Metals & Tubes, APL Apollo Tubes, Oberoi Realty, and Lux Industries don’t feature in a lot of fund portfolios. These have rallied sharply.

Kotak Emerging does not churn portfolio much; its portfolio turnover ratio is among the lowest in category. Kotak Emerging’s portfolio liquidity is reasonable as well; the average time to liquidate the entire portfolio has averaged less than 30 days. It both accumulates and exits stocks gradually over a period of months so as to keep impact costs low.

For instance, the fund added to M&M Financial Services over the course of nearly 3 years using both dips and rallies to adjust holdings, as it has with Amara Raja Batteries, Alkem Labs, SRF, PI Industries, Solar Industries, Ramco Cement, Jindal Steel, and so on. Many of these stocks have been strong gainers in the recent pick-up.

The fund’s long-term buy and hold approach, its presence across niche stocks and sectors, and its ability to consistently deliver above-average returns make it a good choice for long-term portfolios.

Here’s a list of the top mid cap mutual funds.

Relevant Article : A Nifty MidCap Index Fund that challenges other midcap funds.