HDFC Hybrid Debt Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 86.9156 0.0769(0.089 %) NAV as on 29 Apr 2025

Scheme Objective: To generate income/capital appreciation by investing primarily in debt securities, money market instruments and moderate exposure to equities.There is no assurance that the investment objectiveof the Scheme will be realized.

Performance (As on 29 Apr 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 3.52 % | 9.81 % | 11.60 % | 13.36 % | 10.12 % |

Portfolio

Conservative hybrid funds invest 75-90% of their portfolio in debt instruments with the remaining in equity. These funds aim to generate returns higher than pure debt funds through the equity allocation. In their debt investments, funds can change strategies based on market movements and don't have to follow a steady strategy. They can, for instance, go in for low-rated debt to earn higher coupon.

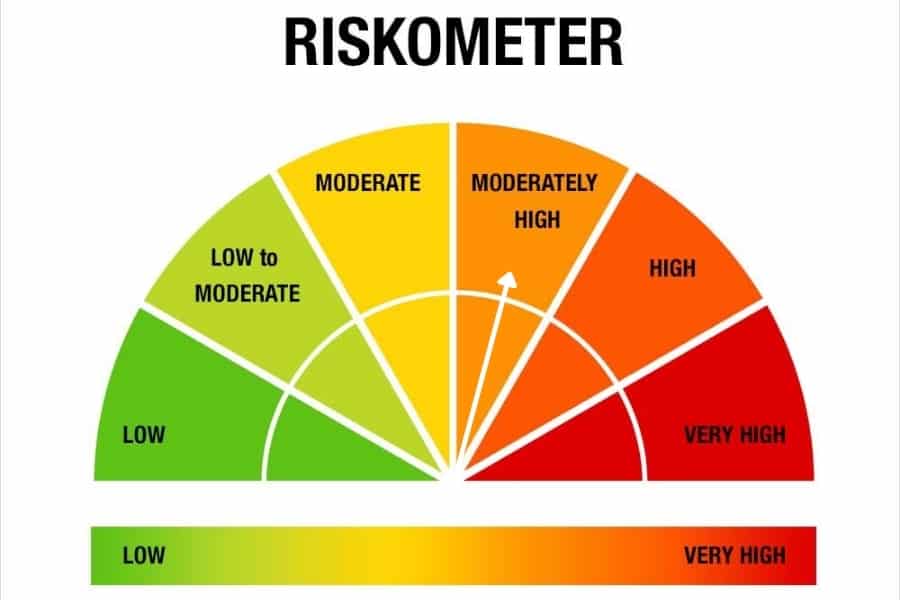

These funds suit investors who wish for debt-plus returns without taking on high equity exposure. These funds need to be held for at least 2 years.