Prime Strategy: Nifty range for you to buy the market

![]() When stock markets fall the question is always about – is this a good time to buy and at what market level should I be buying?

When stock markets fall the question is always about – is this a good time to buy and at what market level should I be buying?

The answer to this is not easy but it is good for you to know some ballpark levels for you to deploy your money. Here are such levels and also and recommendations on where to invest.

The strategy

While investing a big sum at a market bottom is every long-term investor’s dream-come-true, market bottoms are often crystal clear only in hindsight. When you’re in the midst of panic and mayhem, it can be very hard to identify such lows.

While we don’t claim to know exactly where the market will bottom out, as fundamental and long-term investors, there’s one guidepost that we thought we could use – Nifty50 valuations.

Do note the following:

- This is recommended only for investors with a 5-year plus horizon.

- Do not liquidate emergency funds or money needed in the next 2-3 years or your regular investments towards specific goals, to make such one-off investments.

- The strategy is not based on technical analysis.

Estimating the Nifty levels

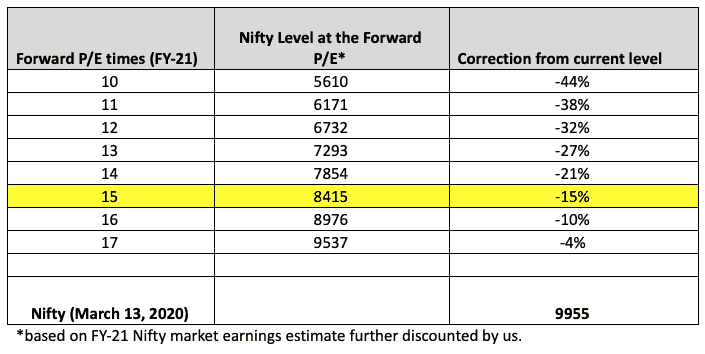

In this exercise, we use the Nifty50 earnings estimate for one-year forward (FY21) as a starting point to gauge good levels to invest.

Currently, research reports tell us that the consensus estimate for Nifty50 earnings for FY21 stands at about Rs 660. But past experience tells us that this is subject to fairly big misses. Today, the achievement of this number is highly uncertain given two key imponderables – crude oil and business disruptions from the coronavirus outbreak. Allowing suitable discounts for these, the discounted FY-21 earnings per share for the Nifty50 comes to Rs 561.

Having arrived at this EPS, the next step is to guess the likely PE at which the Nifty50 will be either at long-term averages or below them. Here, we used the history as our guide. In severe bear markets like 2008, Indian markets bottomed at forward P/Es close to 7-8 times. But the 15-year average forward P/E for the Nifty50 is about 15 times. Based on these indicators, here’s a matrix of the Nifty50 levels which may be good entry points for investing lumpsums into equities.

What the table above tells is that the Nifty 50 would need to touch around 8400 levels (please don’t measure the exact level, allow for a deviation of at least 1 percent) for you to deploy at the long-term average P/E of 15 times.

What if the correction isn’t that deep? It is okay because the markets may test recent lows multiple times over the next few months and you would anyway be investing through SIPs.

Please note the following:

- The P/Es are forward fiscal earnings estimated by analysts and further reduced by us. This earnings can well be downgraded further. This is the reason we went with lower P/E and Nifty levels.

- The Nifty levels above are NOT based on trailing P/E. So just look for the Nifty levels we have mentioned.

Where to invest?

Even if you know the right levels to invest, deciding what stock to pick up can be difficult, especially if you need to react with lightning speed.

However, there are still good alternatives to buying individual stocks at market lows. If you wish to know where to invest to make the best of the market correction, follow the link below to register. The link will open in a new tab. Once you complete registration, you can come back to this page to see our research recommendations on where to invest.

https://www.primeinvestor.in/be-prime/

Article: https://www.primeinvestor.in/prime-strategy-at-what-nifty-levels-should-you-be-investing/