If you are an investor looking to do your own stock research, then PrimeInvestor’s Stock Screener is the right tool for you. Prime Stock Screener helps sift through 1000s of stocks and eliminate the ones with poor fundamentals, using our powerful filters. Our tool is suitable irrespective of the style of investing you follow.

Prime Stock Screener is a useful tool for any investor to create a shortlist of investing ideas with just a few steps.

- Simple “click” and “select” filters to create short list

- Retrieve your “Saved” screens at anytime

- Download your screens in excel and analyse further

Just to make this easy for you, let us look at different ways in which you can use Prime Stock Screener. We will try to cover this in 2 parts.

In this first part, we will look at how you can use the Screener to:

- Pick growth stocks form the entire universe of NSE listed stocks

- How to use it to pick stocks from a sector when the prospects are turning bright

Picking Growth Stocks

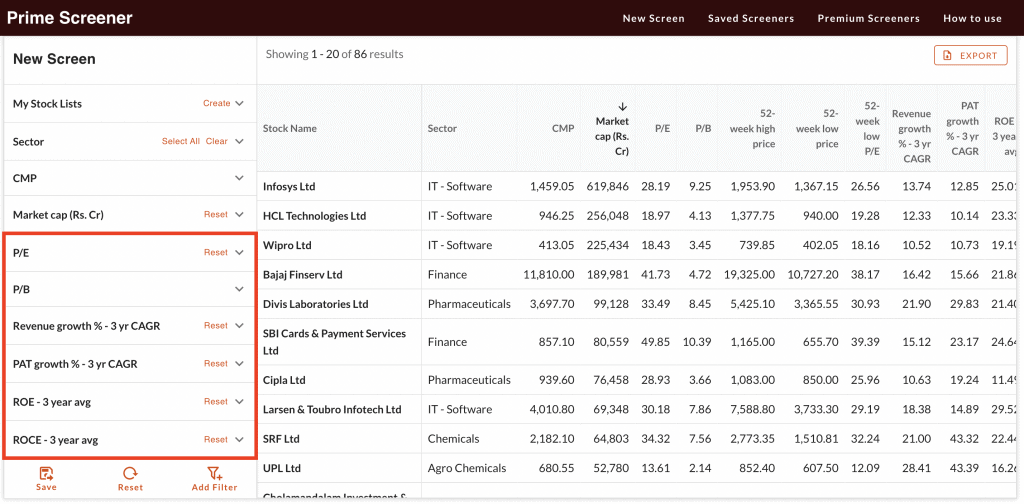

This is how the Prime Stock Screener will look like when you log in. The button called ‘Add filter’ will allow you to choose various metrics under the broad parameters of ‘growth’, ‘quality’, ‘valuation’ and ‘ownership’. Any filter that you choose under these will appear on the left side as shown in the RED box below.

In the screen below, we have used specific filters to narrow 1882 stocks listed in the NSE to just 86 growth stocks. We will now explain how you can use this yourself to pick growth stocks.

- Growth filter – Choose Revenue, EBIDTA and PAT growth filters and input the “range”. This range is dependent on whether we are in a high earnings growth phase in the market in the last few years. Since most sectors have been hit by pandemic in recent years, you may keep the lower range in single digits.

- Quality filter – Choose parameters like 3-year RoCE and RoE and also use the debt equity ratio to filter out high debt companies. You can additionally use the cash flow and cash conversion cycle filters if you want to be more stringent on quality.

- Valuation filter – Use this filter to add upper band on PE or Price to Book to choose stocks within a reasonable valuation range. Also, you can use Market Cap to sales ratio to filter out expensive stocks, say a Tata Elxsi trading at 20X market cap to sales or even a Happiest Minds at 12X market cap to sales.

- Ownership – You can use these filters to weed out stocks with low promoter holding or use the “Promoter Pledge” filter to avoid companies with higher pledging.

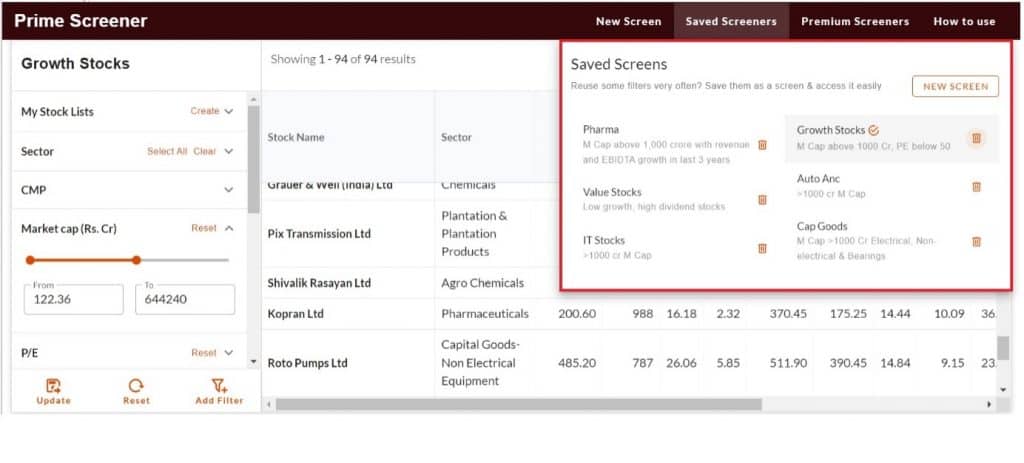

You can save your screen and that will appear under “Saved Screens” as shown in the image below.

These screens can be retrieved from your PrimeInvestor account any time. And it is not a static list. Whichever stocks meet the criteria when you open it next, will appear on the screen! So, you can be always be sure you have a current list of stocks that meet your criteria.

While it is 86 stocks that met our criteria now, it can be 89 stocks tomorrow or even 100 stocks a month later.

Here is also a link to our earlier video on how to pick growth stocks.

Riding a sector

Prime Stock Screener will be handy when you want to filter out the best quality stocks from a sector that is expected to perform in future. This approach is also referred to as top-down approach in investing.

In this case, there are two ways in which you can use our stock screener:

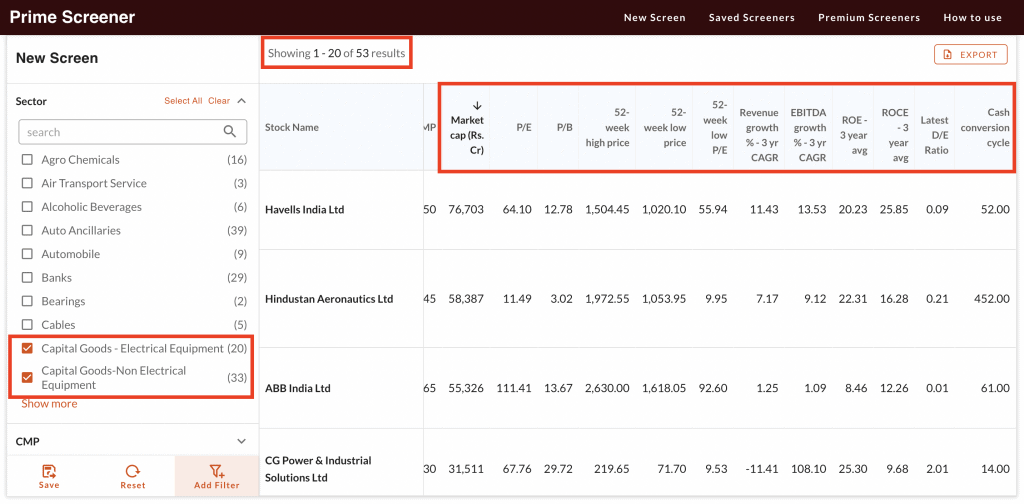

- You can simply download the entire list of stocks belonging to a sector while choosing various parameters on growth (revenue, EBIDTA, PAT), quality (RoE, RoCE, debt to equity) and valuation (PE, P/BV, M Cap to sales) with default values. This will give you the list of all stocks within that sector with all these parameters. In case you want to weed out small caps, you can do that using the market cap filter in the menu on the left side.

Below is the list of 53 stocks from capital goods space (electrical and non-electrical) with Market Cap above Rs.1,000 crore selected on the basis of various parameters as shown below. The same can be downloaded in excel and be used to prepare your watchlist.

- You can also additionally apply various filters to figure growth companies from a particular sector also by following a similar approach as explained initially for the growth stocks.

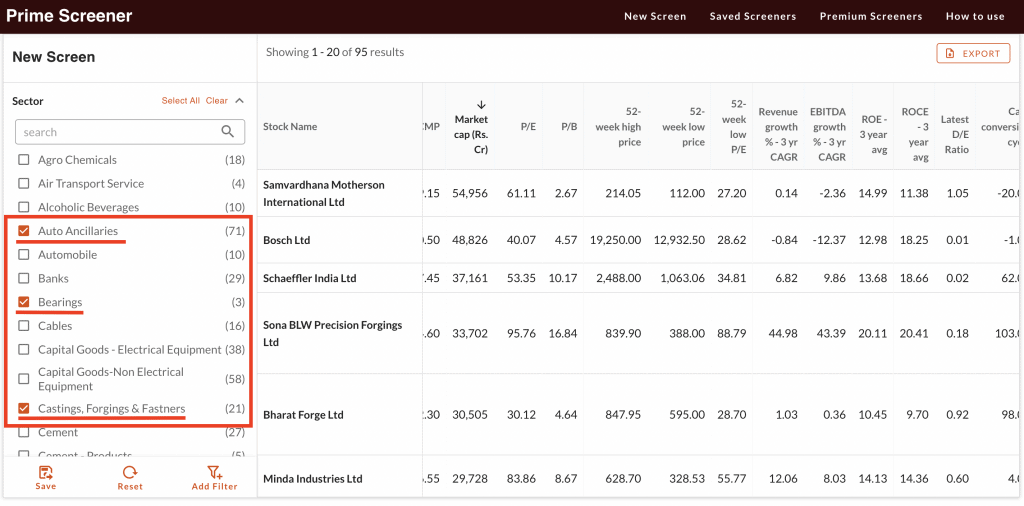

Let us take the case of auto-ancillary sector and see if we find companies that managed to do well in last 3 years despite a downturn in the industry.

While getting into segments in a sector first run through the various industries and then choose the ones that fit the sector – as you may have to choose multiple industries within a sector. For example, while selecting auto-ancillary companies, we selected ancillaries, bearings, castings and forgings, etc on the left menu. This gave us a basket of nearly 100 companies, as shown below:

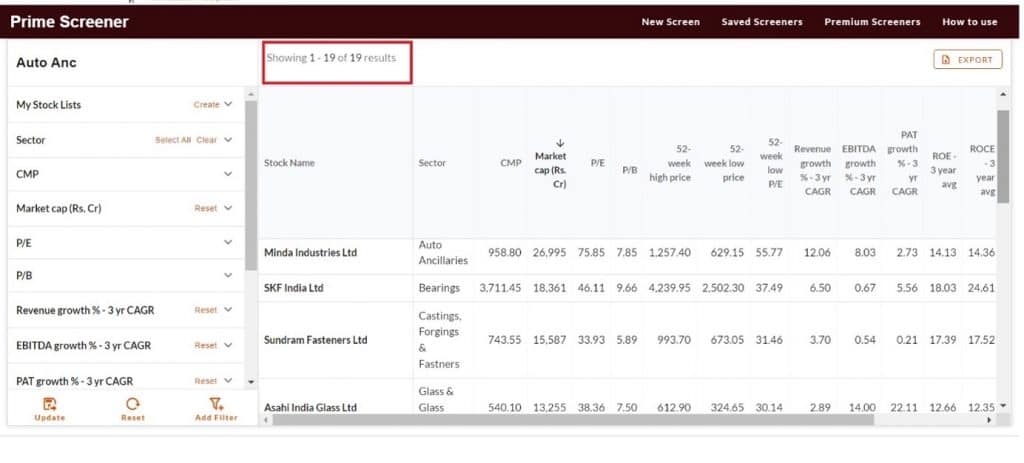

If we apply the growth and quality filters and also get more stringent on cash flow s(number of years of positive cash flow) and cash conversion cycle (working capital management), we end up with just a handful of 19 companies out of nearly 100 as shown below. You can download the same in excel as well and start doing more company-specific analysis.

Note: Here, while giving the input on growth “range” in the growth filter, we have kept the lower end of growth (Sales, EBIDTA and PAT) at -5% as the sector has gone through a slump in last 3 years due to cyclical downturn as well as Covid. But, there is no compromise on RoE, RoCE, cash flows and working capital management.

As we have explained earlier, once you save your screen, you can retrieve it at any point of time in future. At that point of time, whichever companies that meet the input criteria will appear in the screener. In the above case, as the sector prospects improve, if you run the same screener a year later, you may find 25 or 35 companies instead of 19 companies now

The same exercise can be done for any sector such as pharma or IT services or capital goods, as mentioned above.

But, be cognizant of the sector dynamics while providing the inputs. For example, in the case of sectors like capital goods or auto ancillaries that have gone through pain in the past few years, giving high growth ranges as inputs may not give right results and may also mean you are not picking the companies that may be turning around . So, provide the right inputs based on the sector dynamics. But try not to compromise on quality parameters as much as possible unless the quality is unique to a sector. For example, there may be sectors like infrastructure with inherently slightly higher debt levels or low ROE levels. So, in those cases, parameters like ROCE will matter. Hence, understanding sector becomes important when you run such sector-specific screeners.

These are just a few ways to pick growth stocks from a larger universe. In the next part, we will discuss how you can use our Premium Screeners such as Steady cash flow positive, Debt Reduction, IncreasingEBIDTA margins, Rising RoE, Steady earnings growth, etc. These premium screeners will help you narrow down your choices readily, without your needing to apply filters yourself.

Until then, try to apply these filters and let us know what you came up with and share what you did further, by commenting here and sharing with other Prime members 😊

In the video below, we discuss 2 easy ways to pick stocks using our stock screener :