Prime Recommendation: A lesser-known equity fund for top returns

You don’t always need to choose the most popular funds from large AMCs. Sometimes, lesser known quality funds perform silently, waiting to be picked by those serious about building long term wealth. We are talking of one such fund – a multi-cap fund that uses a core of large-cap stocks and adds returns by selectively picking mid-cap and small-cap stocks.

The fund that we are talking of is part of our Prime Funds recommendations list. Here are four key reasons why the fund features in our list.

#1 Performance places it well above others

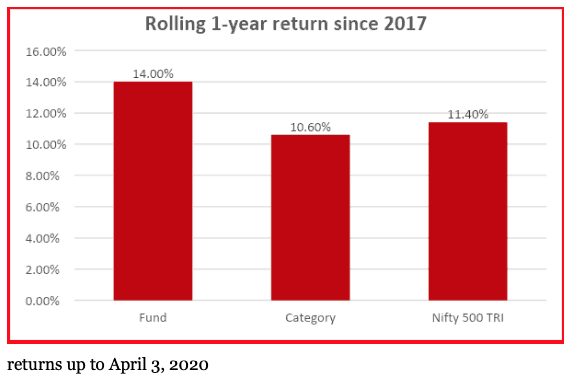

The fund has steadily ticked ahead of the broad-market Nifty 500 TRI from around mid-2017 and onwards. Against peers too, the fund has shone in the past three years. On a 1-year rolling return basis since 2017, the fund has beaten the Nifty 500 TRI 84% of the time.

On risk-adjusted returns measured by the Sharpe ratio, the fund beats almost all peers save for a few.

#2 Strategy can help it stay ahead across market cycles

The fund’s strategy involves using quality, steady, long-term growth companies as the basis of the portfolio. With most such stocks obviously not coming at low valuations, the fund is primarily growth-oriented.

However, given that opportunities do exist in value-based or cyclical plays, the fund puts around 25-35% of its portfolio in such stocks. This allocation serves to push returns as a rapid recovery in a company’s fundamentals can lead to a valuation re-rating.

A clear growth-value blend such as this can help performance stay steady across market cycles.

The other factor that can keep returns sustained is the fund’s deft profit booking. The fund makes either timely exits or pares exposure to stocks that are turnaround stories and have delivered. This helps the fund to realise profits and convert them into real gains for you!

#3 Ability to contain downsides

This strategy to pick up stable companies and to book profits or exit from time to time, allows the fund to contain downsides.

From the peak of January 2020, the Nifty 500 TRI tanked 33% till April 3, 2020 during the Covid-19 pandemic. In contrast, this fund lost only 25.3%. Containing downsides is a key positive, as such funds are quicker to recover.

#4 Provides a good blend of large-cap and mid-cap stocks

With several pure large-cap funds still struggling to beat the index, taking a moderate-risk multi-cap fund can serve better. This apart, multi-cap funds can participate in a mid-cap rally without taking the risk of a pure mid-cap fund.

The fund maintained about 65-75% of its portfolio in large-cap stocks with the rest mostly in mid-caps. It fares similarly when compared to other large-cap based funds.

Suitability

This fund suits moderate and high-risk investors with at least a 5-year investment horizon. It can be used along with a more value-based fund for a balanced portfolio.

Want to know which fund this is?

Follow the link below to register. The link will open in a new tab. Once you complete registration, you can come back to this page to see our research on this fund.

https://www.primeinvestor.in/be-prime/

Article: https://www.primeinvestor.in/a-lesser-known-equity-fund-for-uncertain-times/