StocksCategoriesMarketsPremium

Prime Stocks performance review 2024

A year-end review of Prime Stocks performance and how our calls have fared against the market.

-

PrimeInvestor Research Team

- No Comments

Researched list of top stocks to invest in across market caps and sectors.

Uncover fundamentally sound stocks for long-term wealth creation

Expert-driven, top-down and bottom-up analysis to picking stocks

Stocks across marketcap and mix of growth and value strategies that are risk bucketed

Followed up with timely buy/hold/sell calls to maximize

gains

No credit card or payment needed!

Our Quality, Growth and Valuation (QGV) approach ensures you maximise gains and minimise risk.

We not only give you stock recommendations but also alert you to timely accumulating opportunities.

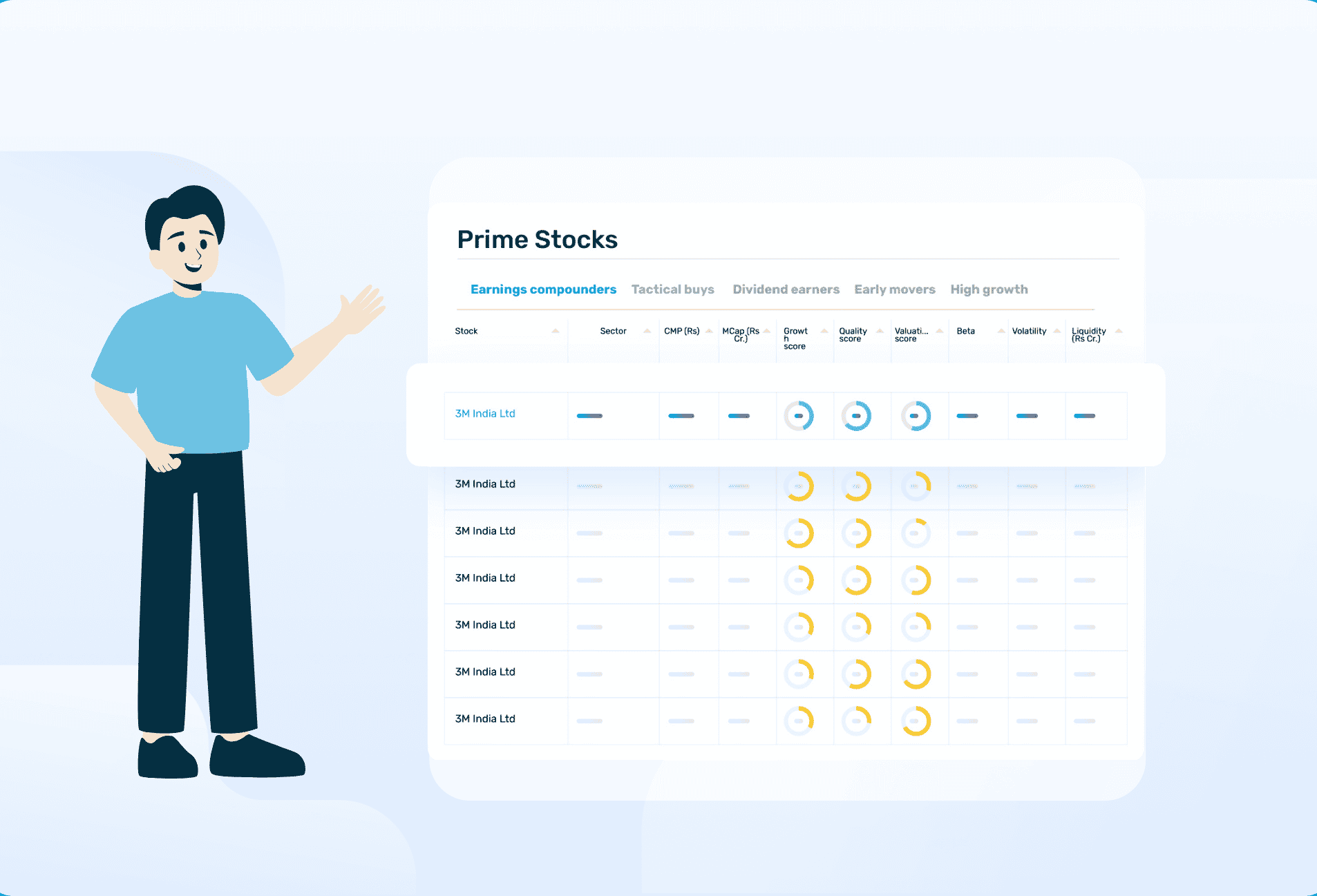

Stocks categorised as compounders, dividend earners or tactical to help choose with ease based on your goal & risk appetite.

We tell you when to hold the stocks and when to fold to lock in your profits. You get the right calls at the right time.

“PrimeInvestor is just the kind of tool/website a common man needs. The articles, tools and features cater to folks of all maturity levels, right from a novice investor to a seasoned investor. I am a big fan of the MF review tool or the nice write up on stock recommendations which is a hit almost 75-80% of the times. I extend my membership every year without blinking my eyes.

Money well spent! Please keep up this standard Srikanth and team!”

There are many firms which gives advise, I find PrimeInvestor to be more balanced , simple and authentic. They cover a wide range of product for retail investors Stock MF Bonds etc. There many tools available which are useful to use. The filters which are available for mutual funds are very unique, wide and no other website offers such a wide range.

There is no single best stock recommendations. Stocks with sound fundamentals, which have a good potential for growth, and which are trading at reasonable valuations given the growth potential will be good stocks to add to your portfolio. When you invest in stocks, you need to build a portfolio.

There are 5 steps to using best stock recommendations to build a portfolio. One, know your objectives. Two, choose your style and strategy. Three, diversify. Four, pay attention to stock weights. Five, have a cash component to take advantage of market-driven opportunities.

Our stock recommendations by experts are designed for long-term portfolios. We analyse stocks using our in-house Quality-Growth-Valuation model to bring out stocks with strong fundamentals that are available at reasonable valuations. This allows us to assess stocks across a wide spectrum of sectors and avoid being limited by only ‘tracked’ sectors.

Unlike other brokerages, our aim in our stock recommendations by experts is to help you build up a solid portfolio of quality stocks. It is not to churn your portfolio frequently by giving short-term price targets which can stymie long-term compounding that sound stocks can offer.

Our stock recommendations are categorised into useful buckets such as Earnings Compounders, Dividend Earners, Early Movers and so on, to make it easy for you to build a diversified portfolio. We additionally provide the risk level involved in each of our buy stock recommendations.

Our stock recommendations are also unique in that they are not tied to a particular date of recommendation. Since we adopt a long-term perspective, as long as valuations are conducive to investments, we retain these stocks in our Buy list. That means you can invest in our buy stock recommendations at any time if we list it in the Buy category. This opens up more buying options for you. We track our buy stock recommendations and move it to Hold/Book Profit/ Sell based on valuations and growth prospects.

To us, quality, growth and right price for the business – all matter for stock recommendations. We also believe that good businesses can spring up in any market cap segment. Therefore, we don’t have defined allocations to large-caps, mid-caps, and small-caps or defined allocations to sectors in our stock recommendations.

We consider the entire Nifty 500 basket. On this, we apply our in-house model that uses metrics to measure Quality, Growth & Valuation to shortlist stocks. This helps set a basic bar on the fundamental metrics that a company needs. From the shortlist our model generates, we dig deeper to understand more about each company, its sector, its growth and profit drivers, valuations, and more. This exercise is an entirely qualitative analysis.

With this quantitative-qualitative blend, we arrive at our Buy stock recommendations. We track these Buys to alert you on when to stop further additions (Hold), when to book profits and when to sell. Our stock recommendations are designed for long-term portfolios.

In our stock recommendations, our intention is to help you add return boosters to your investment portfolio. In Prime Stocks, our aim is to identify quality businesses where you can take focused exposures.

Investing directly in stocks gives you the ability to take focused exposures to promising businesses that will let you capitalise on wealth creators. We don’t advocate frequent buying and selling of stocks. The idea is to own businesses that can create stock price returns from earnings compounding over many years.

If you are already a mutual fund investor, investing in stock recommendations by experts such as us can help you use stocks as good additions to this long-term asset-allocated mutual fund portfolio. The fund portfolio forms the core of your investments. Adding on stocks to this will give you diversification and your returns a leg up. Using both stocks and funds in your portfolio helps you mitigate risks and limit the impact of stock calls going wrong.

Our stock recommendations in Prime Stocks are built along these lines. Essentially, we look for stocks that score on balance sheet strength and growth prospects and where valuations are reasonable.

No credit card or payment needed!

Good time to invest now? Get the answer with our Nifty Valuation & Momentum Indicator.

Your personal research assistant to filter stocks based on powerful fundamental metrics.

Know whether your stock scores better than others on growth, quality and valuation metrics.

Get the financials, prices, shareholding, corporate action, & more of any stock

The purpose of these disclosures is to provide essential information about the Research Services in a manner to assist and enable the prospective client/client in making an informed decision for engaging in Research services before onboarding. History, Present business and Background: PrimeInvestor Financial Research Private Limited is registered with SEBI as Research Analyst with registration no. INH200008653. The Research Analyst got its registration on August 19, 2021 and is engaged in offering research and recommendation services. Terms and conditions of Research Services: The Research Services will be limited to providing independent research recommendation and shall not be involved in any advisory or portfolio allocation services. The Research Analyst never guarantees the returns on the recommendation provided. Investor shall take note that Investment/trading in stocks/Index or other securities is always subject to market risk. Past performance is never a guarantee of same future results. The Research Analyst shall not be responsible for any loss to the Investors. Disciplinary history: There are no pending material litigations or legal proceedings against the Research Analyst. As on date, no penalties / directions have been issued by SEBI under the SEBI Act or Regulations made there under against the Research Analyst relating to Research Analyst services. Details of its associates: No associates. Disclosures with respect to Research and Recommendations Services: The Research Analyst or its directors or any of its officer/employee does not trade in securities which are subject matter of recommendation. There are no actual or potential conflicts of interest arising from any connection to or association with any issuer of products/ securities, including any material information or facts that might compromise its objectivity or independence in the carrying on of Research Analyst services. Such conflict of interest shall be disclosed to the client as and when they arise. Research Analyst or its directors or its employee or its associates have not received any compensation from the company which is subject matter of recommendation. Research Analyst or its directors or its employee or its associates have not managed or co-managed the public offering of any company. Research Analyst or its directors or its employee or its associates have not received any compensation for investment banking or merchant banking of brokerage services from the subject company. Research Analyst or its directors or its employee or its associates have not received any compensation for products or services other than above from the subject company. Research Analyst or its directors or its employee or its associates have not received any compensation or other benefits from the Subject Company or 3rd party in connection with the research report/ recommendation. The subject company was not a client of Research Analyst or its directors or its employee or its associates during twelve months preceding the date of recommendation services provided. Research Analysts or its directors or its employee or its associates has not served as an officer, director or employee of the subject company. Research Analysts has not been engaged in market making activity of the subject company.

Full disclosures and disclaimers

Compliance Officer Details: Name: Srikanth Meenakshi; Email: contact@primeinvestor.

Grievance Officer Details: Name: Srikanth Meenakshi; Email: contact@primeinvestor.