SBI Equity Hybrid Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 319.5901 0.0679(0.021 %) NAV as on 24 Apr 2025

Scheme Objective: To provide investors long-term capital appreciation along with the liquidity of an open-ended scheme by investing in a mix of debt and equity. The scheme will invest in a diversified portfolio of equities of high growth companies and balance the risk through investing the rest in fixed income securities.

Performance (As on 24 Apr 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 4.97 % | 14.21 % | 13.37 % | 19.48 % | 15.07 % |

| NIFTY 50 | -0.63 % | 8.23 % | 12.15 % | 21.50 % | N/A |

Portfolio

Aggressive hybrid funds invest the majority (up to 80%) of their portfolio in equities and hold the rest in debt instruments. This makes them lower risk and lower volatile than pure equity funds. On the equity side, funds invest across market capitalisations and in rising markets can hold significant mid-cap exposure. On the debt side, funds generally stick to a simple accrual strategy of investing and holding top-rated bonds.

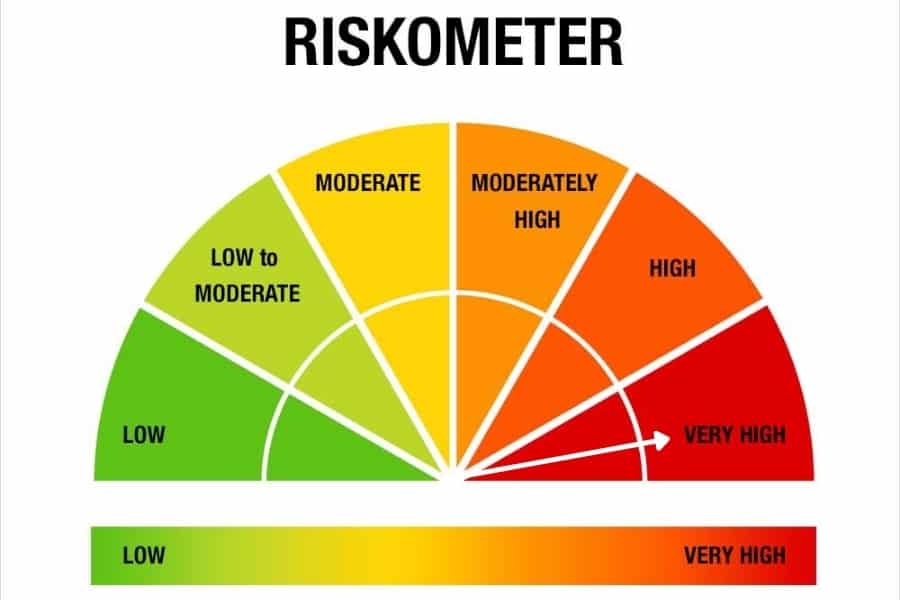

These funds suit first-time equity investors. They also suit conservative investors who want equity exposure. They can also be used to mitigate risks of high-risk investors who want to invest heavily in equity. These funds need a minimum 3 year holding period.