ICICI Pru Savings Fund(G)

View the direct plan of this scheme

Rs 536.2129 0.2256(0.042 %) NAV as on 17 Apr 2025

Scheme Objective: To generate income through investments in a range of debt and money market instruments while maintaining the optimum balance of yield, safety and liquidity.

Performance (As on 17 Apr 2025)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | 0.26 % | 2.39 % | 4.14 % | 8.21 % | 7.33 % | 6.70 % | 7.72 % | >

Portfolio

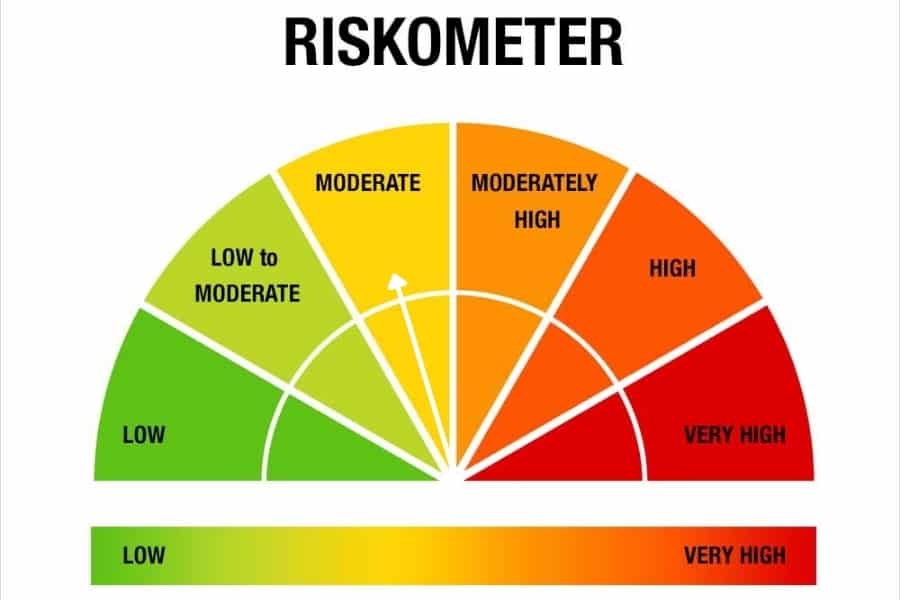

Low duration debt funds invest in debt instruments such as commercial paper, certificate of deposits, treasury bills and other money market instruments. They maintain an average portfolio maturity of around 1 year. These funds may deliver losses on a day-to-day basis but are generally low volatile. While most funds pick instruments that have a high credit rating, some can go into papers with lower credit ratings in order to deliver higher return.

These funds suit any investor with investment horizons of 6 months to a year. Ensure that funds do not have a high share of low-rated debt. These funds can also be used to maintain emergency money as well.