Prime Funds

The Best Mutual Funds

To Invest In

Expert-curated list of top performing mutual funds to grow your wealth.

What are Prime Funds?

Best performing funds

Top funds for your portfolio to fit every goal you have, hand-picked from 1000s

Research picked

Combining cutting-edge automation with the wisdom of experienced researchers

Mix of strategies

Mix of strategies both in equity and debt for easy portfolio diversification

Across MF categories

Tailor your portfolio with Equity, Hybrid, Thematic, & Debt choices

For all needs

Find the perfect fit, with different risk & time-frame options

Diligent follow-up

Remove laggards and add early movers for consistent growth

Ready to achieve investment success? Start your free 14-day trial now!

No credit card or payment needed!

How you benefit from

Prime Funds

Cut through the clutter

No more poring through 1000s of fund ratings.

A compact list of recommendations across categories, that makes your choice super easy.

Stay on top of performance

Quarterly reviews that will help remove laggards and unlock new potential, to keep your investments on track.

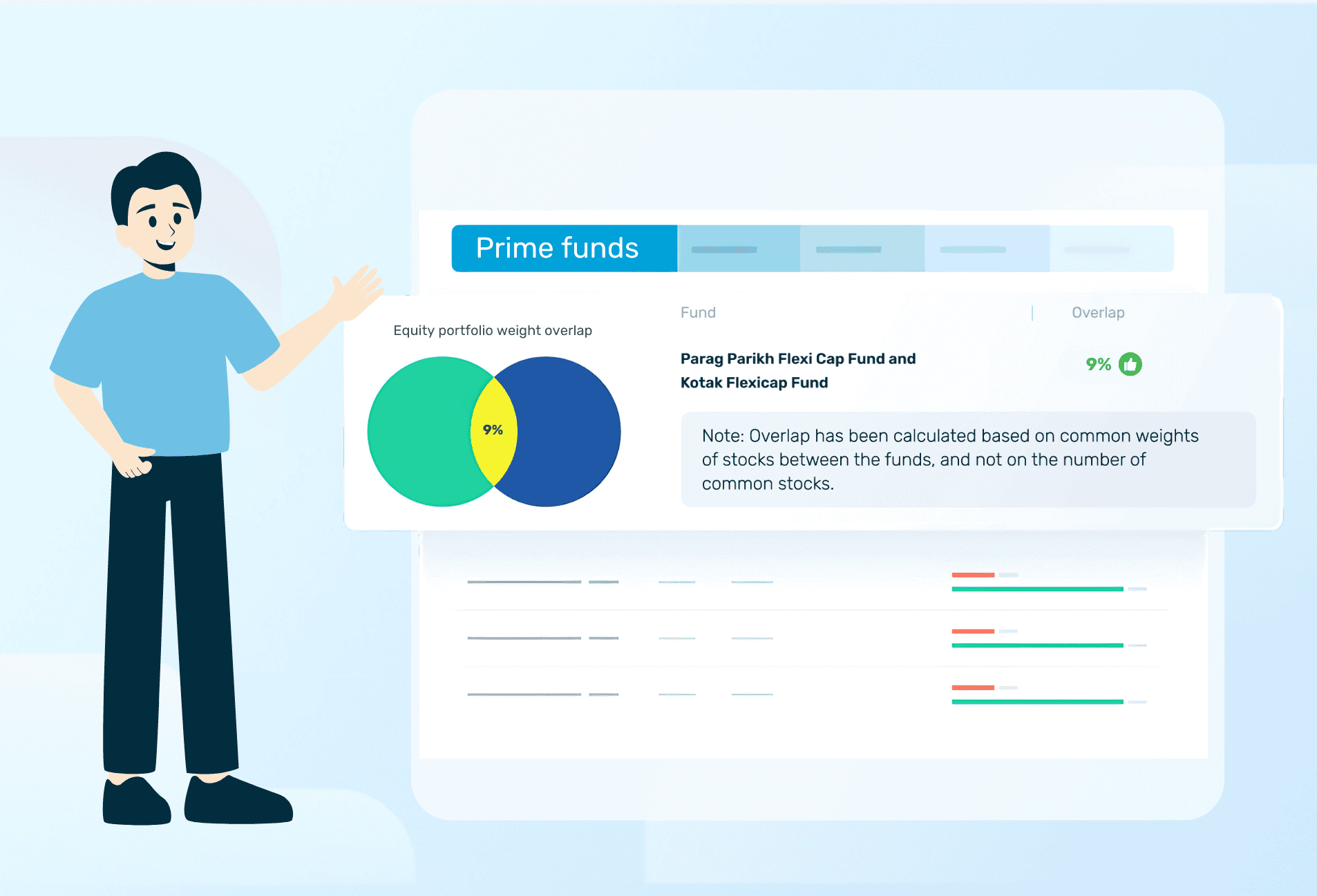

Avoid overlaps

Our choice of funds within each category ensures minimal overlaps so that you get good diversity in your portfolio.

Easy to use categories

Simplify your investing with our user-friendly time and risk based categories vs. overwhelming SEBI categories.

GopalaKrishna NarayanMoni

“PrimeInvestor is just the kind of tool/website a common man needs. The articles, tools and features cater to folks of all maturity levels, right from a novice investor to a seasoned investor. I am a big fan of the MF review tool or the nice write up on stock recommendations which is a hit almost 75-80% of the times. I extend my membership every year without blinking my eyes.

Money well spent! Please keep up this standard Srikanth and team!”

Micheal Arun

Their services are evolving every day and I am looking forward for a long association.

Prasanth Ethiraj

Their write-ups especially on Term Insurance & Mutual funds are indeed more valuable and makes our understanding much better.

Balaji V

There are many firms which gives advise, I find PrimeInvestor to be more balanced , simple and authentic. They cover a wide range of product for retail investors Stock MF Bonds etc. There many tools available which are useful to use. The filters which are available for mutual funds are very unique, wide and no other website offers such a wide range.

Ready to achieve investment success? Start your free 14-day trial now!

No credit card or payment needed!

FAQ

What are the top mutual funds in India?

There is no single best mutual fund in India. Each category of fund serves a specific purpose and role in your mutual fund portfolio. Within each category, the best mutual funds are those that are consistent, above-average performers across different market cycles or interest rate cycles. Factors such as ability to contain losses, deliver higher risk-adjusted return are additionally important. The best mutual fund for you is also specific to your own requirements – such as your risk, timeframe, and the other funds you hold in your portfolio and so on. Prime Funds combines the power of Prime Ratings along with qualitative factors such as portfolio, market scenario, trends in performance and so on to curate a list of the best mutual funds in equity, debt, and hybrid which can form a part of your mutual fund portfolio.

Why should I invest in top mutual funds?

When you invest in mutual funds, you are investing towards a particular financial goal. In order to meet this target, you need to ensure that your portfolio delivers well. When you simply pick a fund based on its recent returns, and not based on comprehensive parameters, you run the risk of your fund underperforming and not delivering as required. While you can change your poor performer to a top mutual fund, your portfolio will take time to improve performance and you may incur opportunity loss. This apart, frequent changes in your portfolio also involves unnecessary tax outgo. Therefore, by investing in the best mutual funds, you can limit your portfolio churn.

How can I select top performing mutual funds?

There are several hundreds of funds available to invest in! To filter out the top performing mutual funds among these requires you to understand mutual fund performance. Key metrics to consider when analysing, to pick the best mutual funds, are consistency against category and/or benchmark, ability to contain losses, risk-adjusted return, and volatility. You can drill further down into checking performance in different market cycles for equity and hybrid funds and across interest rate cycles for debt funds. You can use our MF Screener tool to do your number-crunching. Over and above such quantitative analysis, you can apply qualitative factors such as the strategy the fund follows, the kind of portfolio it has, how it may deliver given the market scenario and so on. Alternatively, you could just refer to Prime Funds, for the best mutual funds in equity, debt and hybrid! We do all the analysis for you, backed by our decades-long experience in markets and investments, to draw up a concise list of mutual funds to invest in at any time.

What makes Prime Funds unique?

Prime Funds is a hand-picked list of funds in equity, debt, and hybrid that goes beyond ratings and looks for clarity in fund strategy, consistency in performance across cycles, variety in investment styles to minimize duplication, along with adjusting for the current market scenario in both debt and equity. Prime Funds lets you build a diversified portfolio with ease and cut through the clutter of the dizzying number of funds there are. Prime Funds are reviewed and updated quarterly, in order to catch any new opportunity and nip any signs of underperformance.

Do I need to have market knowledge to invest in Prime Funds top performing funds?

Prime Funds is designed to be used by any investor. Equity funds in Prime Funds are bucketed based on risk involved, to make it easy for you to pick moderate-risk and high-risk funds based on your requirement. Debt funds are classified based on the minimum timeframe required, which lets you pick the funds best suited for your goal. Each Prime Fund is unique in style and portfolio overlaps are minimized, so it is easy for you to build a diversified portfolio. And if you need a little more research inputs for your portfolio, you can use our Build Your Own Portfolio tool which will help you design a portfolio using Prime Funds for yourself.

Other useful links to use

Portfolio Review Pro

Your one-stop to monitor & review performance, risk & allocation of your MF portfolio and take corrective action.

Build Your Own Portfolio

Create and customise your own portfolio with the best funds, guided by research.

SIP Value Calculator

Investing every month? Know how much you will get at the end of your investment time frame.

MF Direct/Regular Expense

Save cost. Check if you’re paying too much in a regular plan and if your fund is costlier than peers.

Recent Articles

StocksCategoriesPremium

Prime Stocks Update: Moving this healthcare stock from a BUY to a HOLD

-

Pavithra Jaivant

- No Comments

MarketsCategories

Podcast: Aarati Krishnan on SEBI’s new proposed asset class

-

PrimeInvestor Research Team

- 2 Comments