If you had to buy a stock in 1995, you would have to :

- Give your broker money beforehand

- Call your broker

- Tell him what stock to buy and how much

Your broker would then,

- Go to the stock exchange

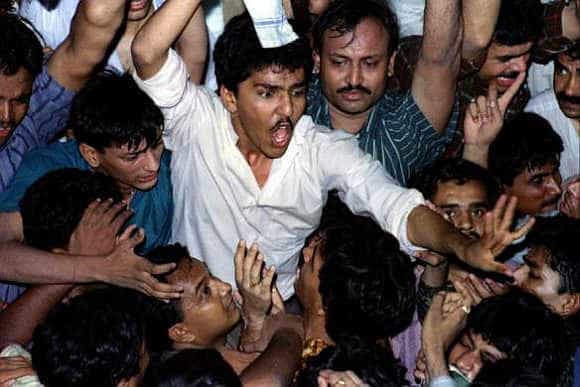

- Tell everybody that his client wants to buy a share, like this :

- Find a seller who wants to sell the same number of shares

- Agree on a price

- Get confirmation of the trade in 15 days

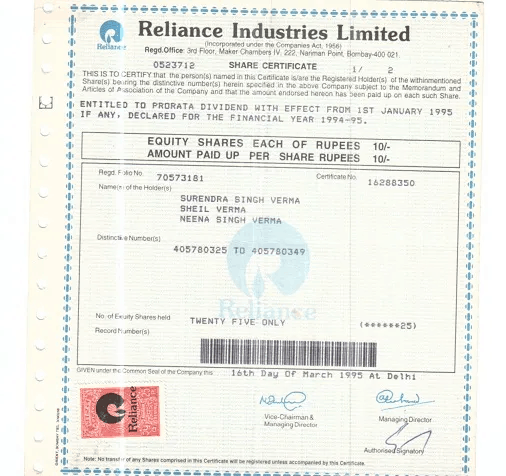

- After confirmation you would’ve received a stock certificate that looked something like this :

This is the process of one transaction. The average number of transactions at that time was approximately 50 lakh transactions.

What is demat account?

Around the mid 1990s, the Stock market authorities realised that they could not keep up with the increasing amount of paperwork involved. They then came up with the brilliant idea of converting share certificates into electronic certificates with the power of the internet and other technologies that picked up steam at that point.

This process of converting physical share certificates into electronic certificates is called Dematerialisation.

This resulted in a need for storage of these electronic or dematerialised shares.

Hence to do away with all the paperwork & store the demat shares, the exchanges (BSE & NSE) created “Depositories”. These depositories were called CDSL (Central Depository Services Ltd.) & NSDL (National Services Depositories Ltd.) respectively. You can read more about depositories here.

Both the depositories had one purpose. Hold & monitor Demat accounts.

Demat accounts are used to hold these demat shares (and other assets like ETFs, mutual funds, bonds, and government securities).

Why do I need a demat account?

SEBI has made it mandatory to allow trading only for those who have a demat account and demat holdings. This means that you cannot buy or sell shares without having a demat account.

Here’s why that’s important :

There are 3 main accounts you need for trading securities.

Your bank savings account, your trading account and your demat account.

Let’s say you want to buy a share of Infosys.

- You transfer funds from your bank account to trading account

- You place an order for 10 shares on your brokerage platform

- The funds from your trading account will be debited

- 10 shares of Infosys will be credited to your demat account

Here’s the super awesome part.

If Infosys decides to send out dividends, it will directly come into your bank account! Also, If Infosys decides to split their shares, they don’t have to courrier the extra thousands of shares to all their shareholders. They can simply add more shares to your demat account.

Types of Demat accounts

There are 3 types of demat accounts.

- Regular Demat Account

This account is suitable for people who live in India and are citizens of India.

- Repatriable Demat Account

This account is suitable for people who are NRIs because this account allows fund transfers abroad. With this account, NRIs can invest in the Indian stock market and also withdraw their profits and transfer it to their international accounts.

- Non Repatriable Demat Account

With this account, NRIs cannot transfer funds abroad but can still buy and sell equities in the Indian stock market.

Benefits of a Demat account

- Lower risks & convenience

Holding stocks in a paper format is prone to theft, fire, damages, forgery and misplacement. Stocks in demat remove all those risks and are convenient to consolidate all your financial holdings in one place.

- Easy transfer

You can easily transfer the shares you hold to any person without the need to physically deliver them.And this is not just selling in the market. You can also transfer shares to gift it specifically to another person through your demat.

- Lot sizes

In the olden days, if you held a stock certificate, you could either sell all the shares at once or not at all. With a Demat, you can buy and sell shares in whatever quantity you want.

- Reduced costs

Since Demat has almost zero paperwork involved & is mostly electronic, the costs involved in it are also much lesser.

- Reduced time for delivery

In the olden times, it would take approximately 2 months for a share certificate to be delivered to you. With a demat account, your shares are delivered to you within 2 days.

- Hold multiple instruments

You can hold stocks, ETFs, mutual funds, gold, bonds and debentures all in a single demat account. You can also apply for IPOs with your demat account.

- Freezing services

In case you decide you are not going to transact using your demat (maybe because you’re going on a holiday for an extended period of time), you have the option to freeze your account.This helps in preventing unauthorised use of your demat account. During the freeze period, corporate actions like dividends, stock splits and bonuses will come into your account as scheduled. Once frozen, you can unfreeze your account whenever you want by simply completing the KYC process again.

Difference between demat and trading account

Since most of you open a trading account online, the demat is so seamlessly opened that many of you may not know that a demat account exists.

You need to know that a demat is different from your broking/trading account. A demat is a storehouse of all your securities. But you cannot simply use it to buy or sell your securities. You need a trading account to do that. A trading account acts as the intermediary between your bank and demat account and helps you place orders in the exchange.

But remember when you buy an instrument, the credit is done through your demat and the same applies when you sell. So demat is the real ledger for the share / instrument quantity you hold.

How do I open a demat account?

Any brokerage firm, be it your bank or any financial institution or an online platform will be a depository participant (DP) as well. A DP is simply an agent between you and the depositories that we discussed earlier. Most brokerages offer a DP cum trading account so that your holdings and transactions (buy and sell) can be done with the same player. You will need to provide your Know your customer (KYC) details and sign agreements (that you must read). Most of these are online and won’t take much time. Once your application is approved, you will be given a unique ID number for demat.

How do I convert physical shares into demat?

If you have a physical share certificate, you will need to convert that share into a dematerialised share if you want to buy more shares or sell your existing shares.

To convert your physical shares into demat, you will need to do the following :

#1 – Open a Demat Account

The best way to open a demat account is to

- approach a broker or any financial institution and open an account there.

- Fill up their account opening forms

- Submit all the required documents (PAN, Proof of address, Details of Bank Account)

- Pay an account opening fee (this amount varies depending on the institution & will come under the head of DP fees)

#2 – Cancel physical shares & Credit demat account

Once your demat account has been created, the next step is to

- Go to your brokers / financial institutions website

- Search for the dematerialisation request form

- Fill in the entire form (One for each certificate unless share certificates are in a sequential order)

- Attach your original share certificates to the form

- Attach your other documents

- Send it to your broker / financial institution

- This process will be completed in 15-30 days depending on your broker / financial institution

- Once this is completed, pay the fees. This amount will be different for each broker / financial institution

- If the process has not been completed in 30 days, contact your broker / financial institution to ask them to look into it

Check out PrimeInvestor’s articles on the stock market!

Got any more doubts regarding your demat account? Write to us contact@primeinvestor.in or here.