A company’s Annual Report is a statutory document that contains material facts and information about the company. This makes it among the most reliable sources for information on a company. In this article, we will try to give examples of where in an annual report you can find information that is useful for your understanding of business and financials. This is an illustrative article and not an exhaustive one.

Key sections of an Annual Report

- Chairman’s statement

- 10 Year financial highlights

- Management Discussion & Analysis

- Board’s report

- Corporate governance report

- Auditor’s Report

- Financial Statements

The first five sections will give qualitative information such as on people helming the company, business structure, growth, outlook and governance. The last two will provide quantitative information on the financial performance and position of the company.

Let’s take the qualitative aspect first and then the quantitative.

#1 Chairman’s Statement

This section gives quick insights on the company’s business and its future. In large business groups, this can be an excellent read.

#2 Board of Directors

Know the people behind a company when you are first looking up a company in an emerging growth sector. Understanding the people behind may be valuable to boost confidence while investing in emerging growth companies. There will be nominee directors represented by large private equity investors as well. This may open an additional avenue to track performance of companies they have invested in the past. Information such as this can also give some comfort on the kind of leadership and experience a company has access to.

Nominee directorship of major PE investors and Independent Directors with high reputation are important information to watch out for in case of emerging growth companies

To highlight a few examples, there is Renuka Ramnath of Multiples PE on the Board of PVR. Sumeet Nagar of Malabar Investments is on the board of Safari Industries. Pulak Prasad of Nalanda Capital is on the Board of companies such as Vaibhav Global and Just Dial.

Independent Directors, fast growing electronics manufacturing company Dixon Technologies has appointed former RBI Deputy Governor Dr Rakesh Mohan as an independent director. Former NASSCOM President Som Mittal is part of Sheela Foam’s board. Former Hyundai India President BVR Subbu is the Chairman of EV subsidiary of Greaves Cotton.

#3 Management Discussion and Analysis

This section contains a good amount of data and reasoning behind a company’s performance for the year, what the company plans to do, industry, and so on. Based on the depth of the explanations provided in this section, it’s a great trove of information that helps assess a company’s performance and prospects. Typically, this section covers the following areas;

- CEO comments/ Q&A on the year gone by. For example, Tata Consumer has undergone significant business transformation in FY20. There is a lot to understand on strategy, impact of reorganization, impact on market valuations, and so on. The company gave a detailed Q&A section with the newly appointed CEO in its FY-20 annual report and continued it in FY21, with updates on integration milestones and merger synergies.

For mid-sized FMCG player Jyothi Labs, FY21 is a year of transformation as the founder-Chairman stepped down and passed on the reins to his two daughters in the roles of Managing Director and Whole-time Director, while Independent Director R Lakshminarayanan has taken over as Chairman.

- Structure of industry in terms of the opportunity size, factors leading/ailing growth, competitive intensity, structural changes that have taken place and so on. This will give you the basics about the industry the company operates in, upon which you can build further through other sources. It makes it easier to understand the company’s performance as well.

The annual report of HDFC AMC is rich in macro-economic data, both domestic and global, that have a bearing on equity market performance. It contains data on Govt debt and spending, GDP growth, fiscal deficit, currency movements, capital flows, corporate profitability, stock market performance and valuations. For any investor looking for a consolidated set of factors affecting equity market performance, this is a good read. The report has even more data on mutual fund industry, growth, AUM composition, recent developments, and outlook.

- Business growth and factors that have led to growth, or reasons for slack in performance. This is specific to the company itself. It tells you what steps the company took to drive growth which gives you an idea about sustainability of that growth. It explains the key events that led to that year’s performance.

For example, in its annual report, Infosys detailed major deals it won during FY21 as it was a record year for it. It followed this up with insights on industry, its strategy, digital transformation business, strengths & capabilities, and competition.

For Federal Bank, a mid-sized private bank, its annual report explains progress achieved on the digital front including AI based initiatives, milestones on e-commerce transactions, and API banking to emerge as a strong player in this space.

- Segment-wise information, where companies have varied product/service basket. This helps understand which segment contributes more to growth and profitability and the focus areas for the company.

Consider Tata Elxsi, a mid-sized differentiated IT company. Autonomous driving & OTT platforms related areas contribute to 41% and 44% of revenue, respectively. In its annual report, it provided detailed insights on how technology and internet revolution including 5G are re-shaping the prospects of these key industries and how the company is placed to capture that opportunity.

- Capital expenditure plans that provide visibility on whether a company is investing for growth or not.

- Acquisitions or other business transformation initiatives such as mergers, de-mergers, CEO change, and so on. Sometimes, it will be important to read the annual reports for at least 3 years where companies have undergone a significant business transformation, to capture the change.

For instance, ABB India has gone through significant business realignment in its January-December 2020 fiscal year. Having demerged and sold its working capital intensive, but sizable power grids business, it is focusing on emerging areas such as electrification, industrial automation & robotics, though orders are still slow.

FY21 was a big year for Hindustan Unilever as it acquired GSK’s consumer business for about Rs. 40,000 crore, bringing brands such as Boost & Horlicks into its fold. A mammoth acquisition, HUL paid through shares rather than cash. Apart from business insights, there is a lot more on the accounting side as well related to this acquisition (brand value, goodwill, IPR accounting). If you’re keen on knowing how to look at business transformations, give this analysis on Tata Steel Long Products a read.

- SWOT analysis

It is important to take everything you read here with a pinch of salt. Remember that companies will tend to showcase their best performance and plans. Read Annual Reports for at least 3 years to see if the company has been delivering on what it has planned.

#4 Board’s Report

This statutory report provides information on areas including financial performance of subsidiary companies. There are two areas of interest here.

- Management Remuneration: This is important in case of family-owned companies where the Board will comprise mainly family members. A check on this section becomes necessary where the promoter stake as well as dividend payout are low. Such issues are less likely in larger companies due to shareholder activism, the rise of proxy advisory firms and tighter regulations recently.

For example, shareholders of Apollo Tyres rejected the re-appointment of Mr. Neeraj Kanwar as Managing Director of the company in its 2018 AGM on the issue of high managerial remuneration. Consequent to that, the promoters have taken a cut of 30% of their remuneration

- Related party transactions: This vouches for transparency of transactions between group companies. Related party transactions are not bad on their own, as companies with subsidiaries and associates often engage in several such transactions. But the nature of transactions and the amounts involved matters and where they are not transparent nor with good reason will help flag governance issues.

Britannia Industries, though a well-run business, has been in news multiple times in the last 3 years over inter-corporate deposits with group companies. Even recently, the issue popped up after it issued inter-corporate deposits worth Rs. 320 crore. ICRA has highlighted this in its September 2020 rating report as a key monitorable. Even in good companies, investors should look out for such transactions if they are part of diversified business groups.

Vedanta Group companies have faced issues with related party transactions when cash-rich companies used to give out loans to cash-strapped companies.

CG Power (Formerly Crompton Greaves), Eveready Industries (now major stake by Dabur group), Zee Entertainment, Sintex Industries and Café Coffee Day are some prominent companies that bent under unrelated diversification and related party transactions issues.

Now, let’s take the more quantitative sections in the annual report – primarily, the financial statements.

#5 Auditors’ Report

Auditors’ opinion on financial statements is expressed in this section. There will be separate audit reports on standalone and consolidated financial statements. If a company has material subsidiaries which contribute significantly to cashflows, check the opinion of the statutory auditor with respect to disclosure of information on such subsidiaries.

If there are any “qualifications” – i.e., areas of concern regarding the company’s accounts or practices – it should necessarily be looked into. For instance, auditors expressed qualified opinion on financial statements of Va Tech Wabag in FY20 that its Austria subsidiary had not been audited, a material subsidiary.

#6 Financial Statements

There will be both Standalone and Consolidated statements comprising Balance Sheet, Profit & Loss Account and Cash Flow Statement. While the Balance Sheet and P&L will give a summary of financial information, detailed information will be available in the Notes to Accounts or Schedules. This is the meat of the financial statements and offers insight into the company’s financials that you will not be able to get from the main P&L or balance sheet.

Below are a few examples of what you can look for in the Notes to Accounts:

- Notes to Investments – Non-Current will detail investments in shares of companies including associates or JVs, or other interest/ return generating long term investments

Info edge, the company that owns Naukri.com is also a significant shareholder in new age technology unicorns like Zomato and policybazaar.com. Here is an extract of its investments in FY20. The company’s market value will be the sum of its own business value plus true market value of investments. It is only in an annual report that you can get detailed disclosure of such information.

Likewise, Trent classified its investment in fashion retailer Inditex (ZARA) and Massimo Dutti as financial investments. Inditex reported Rs. 1,570 crore in revenue and Rs.104 crore in profit in FY20. For Eicher Motors, its JV with Volvo is accounted for as investment in Joint Venture under non-current assets. You won’t be able to correctly judge the contribution of these businesses to a company’s market value from the P&L and balance sheet alone.

- In the case of acquisitions or mergers, companies will give details on the merger accounting as notes to the Schedules.

HUL, for example, acquired GSK Consumer Healthcare in FY21 in a transaction worth Rs. 40,000 crore. The big change you can notice in financials is that the shareholders’ equity expanded from Rs 7,815 crore in FY2020 to Rs 47,199 crore in FY21 due to acquisition accounting. So, do not be surprised to see RoE falling sharply.

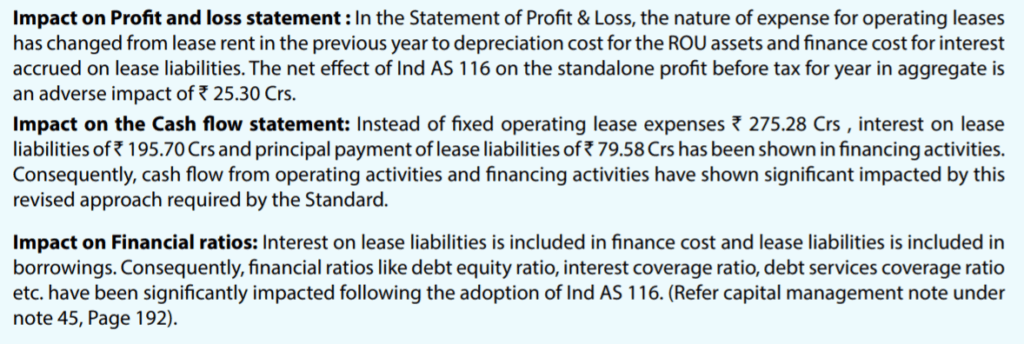

- Change in accounting policy and its impact: When Ind As 116 came into effect from FY20, it changed the EBIDTA profile of companies in sectors such as retail, quick service restaurants, hotels, cinema halls, logistics, due to changes in the way expenses such as lease rent and depreciation were accounted for. Below is an extract from Trent’s (owner of chains such as Westside, Landmark, and Star Bazaar) FY-20 annual report.

Source : Trent Ltd FY2020 Annual Report

So, for such companies, it would be necessary to read previous years’ annual reports as well.

- Expense break-ups and other details: The notes also provide granular details of operating and other expenses, where the P&L would provide only the broad top-level expense outgo. Similarly, details on aspects such as receivables, loans and advances, liabilities can be found in the notes. For example, in receivables, you can find a break-up of receivables over 6 months old - if this is persistent, then you need to dig deeper.

For example, going through the balance sheet of a PSU recently, the total inventory was more than previous year sales, while receivables are half of sales. But, fortunately for this company, the government is the buyer and the high receivables appears to be a matter of delays and approvals alone.

On the other hand, VA-Tech Wabag has receivables as high as 78% of FY20 sales, for a business with single digit EBIDTA margins.

Be cautious about companies growing fast using high working capital. Corrective phases can be painful. Such issues are common in order-book driven sectors such as construction, infrastructure, or capital goods, as well as those entering long-term contracts

What to watch in FY2021 annual reports for key sectors

Because we had an unusual FY21, every company’s annual report will have important insights. In some of the key sectors, here’s what you can look out for in their annual reports:

- Financials – How they weathered the COVID crisis and what they foresee on asset quality, collection efficiency, and recapitalization.

- IT – Outlook on global IT spends and business growth, talent hiring in new areas, capabilities in emerging business areas.

- Metals – Latest production capacity, product profile, outlook on metal prices and sustainability

- Consumption sectors - Urban consumption, which is the hardest hit, encompassing fashion retail, QSR, hotels, malls, or multiplexes. Watch for balance sheet quality, equity dilution, debt increase. In FMCG and other sectors that derive growth from the rural sector, the impact of the wider Covid spread in the second wave.

- Auto ancillaries – Ancillary companies are more asset, labor and working capital heavy. So, they are harder hit than automobile companies in bad times and vice versa. Look for how they were able to manage their finances and how they are positioned to deal with disruptions.

In this article, we have tried to give you what you can understand from each section in the annual report. Putting these together will help you understand the company. Of course, do note that while we have done our best to give you as diverse a set of pointers to look for, it is not exhaustive.