- A debt fund for long-term portfolios

- Maintains a steady portfolio maturity, taking neither duration risk nor credit risk

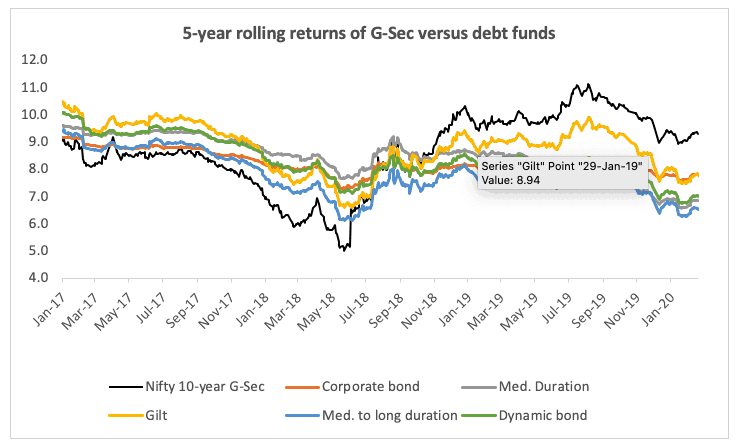

- Beats debt funds across different categories including corporate bond and medium duration.

What if you want your debt fund to have two things – safety and predictable strategy? Most funds have either of these but not both. Funds that don’t take credit risk are still open to changes in portfolio maturities and one-off events. If you want an option where you take absolutely nil credit risk, not compromise much on returns, and not be subject to surprises in strategy, then pick this one.

SBI Magnum Constant Maturity is the fund that fits these features. This fund invests only in government securities, meaning you get zero credit risk. It maintains an average portfolio maturity of around 10 years, and this address the problem of funds taking different duration calls.

SBI Magnum Constant Maturity (SBI Constant Maturity) is a good fit for portfolios with a timeframe of at least 5 years and above. It will not suit shorter timeframes as volatility in the short-term is higher owing to bond price fluctuations.

In fact, the fund is in essence a proxy to holding a 10-year government bond. With retail participation in g-secs still difficult, the fund provides an opportunity to hold a low-risk, predictable strategy.

This is the reason SBI Constant Maturity features in our recommended list and in our long-term portfolios. The role of a debt fund in 5-7+ timeframes is simply to provide safety and a hedge to equity. The limited exposure to debt in such portfolios additionally removes the need to have multiple debt fund strategies. This may seem at odds with our debt outlook for this year where we are wary of taking long duration calls. Please note that our debt outlook is geared more for those who wish to capitalise on opportunities that present themselves this year and those who have a shorter-term holding period than 7-10 years.

Steady strategy

A constant maturity fund mixes gilts of different longer-term maturities such that the average portfolio maturity stays at 10 years. This strategy has two key benefits. The first and obvious is the absence of credit risk. By investing purely in gilt securities, these funds are less risky than even high-credit-quality debt funds. For instance, an event such as the IL&FS catastrophe can hurt such high-quality debt funds, but will still leave gilt funds unharmed.

The second benefit is that there are no risks of wrong duration calls. Gilt funds, unlike constant maturity funds, will change their portfolio maturities based on the stage of the interest rate cycle. That is, they may go for short-term gilts, or medium-term or even very long-term 20+ years of gilt papers. Dynamic bond funds similarly switch between duration and accrual based on the direction of the interest rate cycle.

This introduces uncertainty in how well they can capture market opportunities. A dynamic duration strategy needs to get its calls correctly in order to book profits made from bond price rallies. Missteps here can hurt returns. Since constant maturity funds stick to a specific duration, this risk significantly reduces. The strict maturity also ensures that the fund can book and realize the gains made on price appreciation. As an investor, therefore, you get both the accumulated coupon and the capital appreciation.

Constant maturity funds have the ability to beat other debt fund categories such as corporate bond, medium duration, medium to long duration, and other gilt funds especially over a period where interest rates are overall trending lower.

Consider the 5-year rolling return for period between 2011 to date, of the Nifty 10-year Benchmark G-Sec. While most debt funds from categories such as corporate bond, dynamic bond, short duration, and medium duration beat the benchmark return, just about half were able to do so more than 60% of the time. That is, the 10-year benchmark G-Sec index was able to beat funds with a good degree of consistency.

Constant maturity funds do not have too long a history. However, their 5-year returns in the past six-year period have beaten funds across debt categories. It is noteworthy that rate cycles have not only become shorter in the past 6 years but have also turned trickier to forecast and manage. This makes constant maturity a strategy devoid of the uncertainties of all other duration categories.

Fund and performance

At present, there are 4 constant maturity funds and SBI Constant Maturity is our recommendation. The fund was earlier a short-term gilt fund that became a constant maturity fund post new SEBI categorisation in 2018. However, the fund scores better than peers.

Its average 1-year return since 2018 stands at 9.9%, second only to IDFC G-Sec Constant Maturity Plan. It has not suffered a 1-year loss in this time, unlike the funds from DSP and ICICI. On volatility too, SBI Constant Maturity manages lower volatility than peers, a factor in its favour as IDFC Constant Maturity can clock very high and very low return. SBI Constant Maturity’s lower deviation also helps it deliver higher risk-adjusted returns.

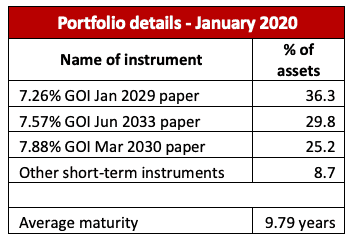

The fund additionally has a much larger asset size at Rs 508 crore; peers are all less than Rs 150 crore. It does not stick only to 10-year papers, but mixes different long-term maturities of 8-13 years such that the overall average maturity remains around 10 years.

Suitability

The fund should be used only for holding periods of 5 years and above. Shorter periods have high volatility where long-term gilt papers are concerned.

SBI Constant Maturity suits any investor. But it should be used only for holding periods of 5 years and above. Shorter periods have high volatility where long-term gilt papers are concerned. Prices of these papers react much more sharply than corporate bonds or shorter-maturity gilts to potential interest rate changes. This can cause low 1-year or 3-year returns; for example, 3-year 10-year g-sec index return has been as low as 3.8%. Holding for the long term irons out these fluctuations and you earn, at the minimum, the underlying gilt coupon.

Comments are closed.