The NFO opens on April 15, 2020. Should you bite?

What’s in it?

The S&P 500 index is a free-float market cap-weighted index made up of the 500 most liquid large-cap names in the US market. The index covers 82% of US market capitalisation. Nearly $10 trillion of assets globally are benchmarked to it, with index funds valued at $3.4 trillion tracking it. Compared to the Nasdaq 100 or Dow Jones Industrial Average, the S&P 500 offers a much wider coverage of the US market, representing both industrial and technology names across eleven sectors. The index currently features 505 stocks with a total market cap of $22,569 billion.

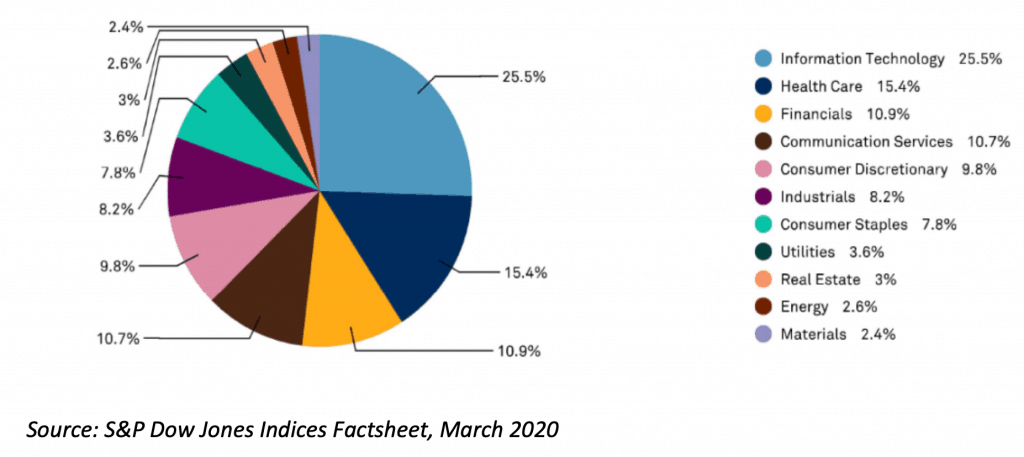

Compared to Indian indices such as the Nifty50 or even the Nifty500, the US S&P 500 is a more diversified index. Its top sector – Information Technology – is at 25.5%, followed by healthcare (15.4%), financials (11%), communication services (10.7%) and consumer discretionary (9.8%). Its top ten holdings making up a 25.4% weight. India’s Nifty500 features a bigger weight of 32% weight to its top sector financial services and top ten stocks take up a 44% weight.

Source: S&P Down Jones Indices Factsheet, March 2020

Why go overseas?

Most developed market economies are currently going through the wringer, thanks to the COVD outbreak. Even after its GDP estimates are cut sharply for 2020, India may well remain one of the faster growing large economies in a recession-hit world. So, why can’t investors just stick to Indian equities?

Well, there are three reasons for diversifying overseas.

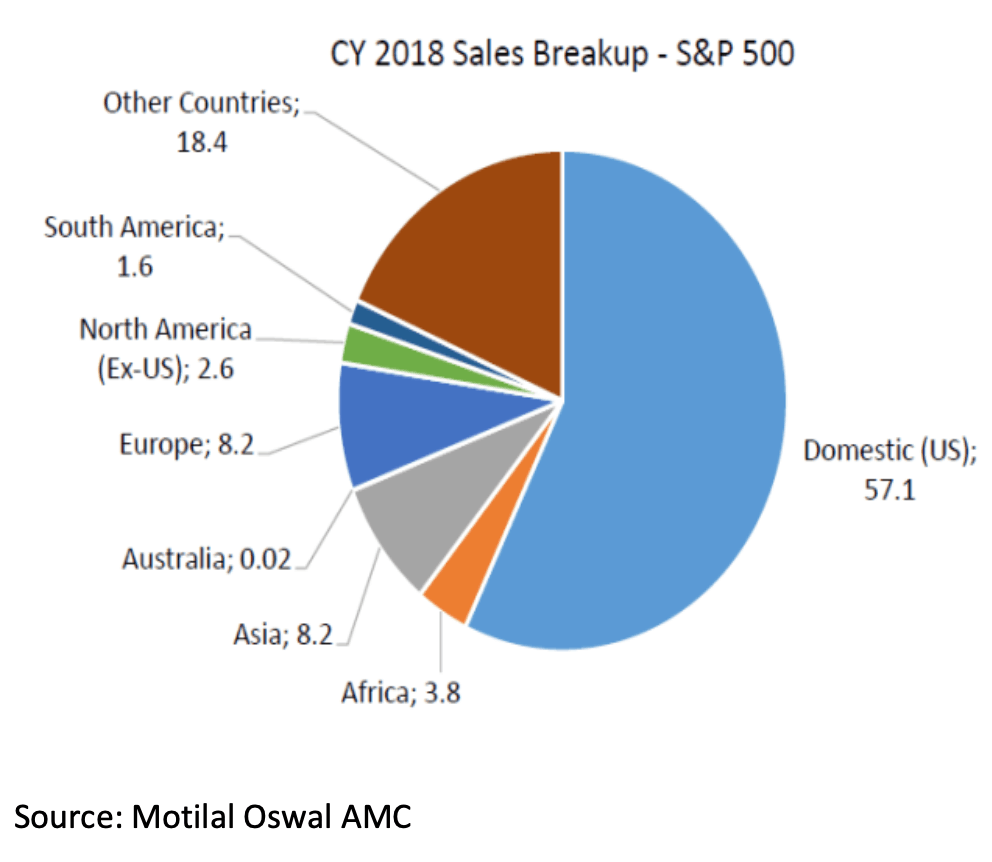

- Creating wealth from stocks is all about capitalising on lucrative business opportunities. When it comes to capturing lucrative opportunities in consumption, capex or financial services, Indian companies (for all their fast growth) account for a tiny speck on the world map. India’s GDP accounts for barely 3% of world GDP. Therefore, if you stick to stocks listed in India, you’re leaving 97% of global economic activity unexplored for wealth creation. The S&P 500 not only gives you exposure to the global economic leader, US, helps you own easily recognisable global names. It features firms with a significant global footprint, with 40% of the aggregate revenues originating outside the US.

- Despite its growth metrics, when crisis hits the Indian stock market gets lumped with all other emerging markets by global investors, who rush to pull out money. Indian market is often among the worst performers during risk-off phases in global markets, with Rupee depreciation adding to the pain. Investing in markets with more stable equities and currencies can help Indian investors cushion their equity portfolios from significant losses during such phases.

- Despite featuring 5000-odd stocks, India’s listed universe lacks the vibrancy and variety that some global markets offer. Indian benchmarks are made up mostly of old-world oil, energy, software and FMCG names, but an increasing proportion of consumer spends in India (Amazon, Swiggy, Makemytrip, Uber et al) are flowing to companies listed overseas. With growth opportunities arising from Indian consumers increasingly appropriated by global firms, it makes sense to look overseas for your stock bets too.

Finally, if you’ve got some obligations or expenses that are dollar-denominated (like a child studying abroad or preparing for a US degree), it makes sense to hedge against Rupee depreciation by holding some of your assets in dollars.

Why the US?

But if the idea behind diversifying overseas is to capture a wider canvas of opportunities, why invest in the US? Why not in international funds investing in other emerging markets, Japan, China or Europe?

Well, there are three reasons why diversifying into US equities is specially rewarding for Indian investors.

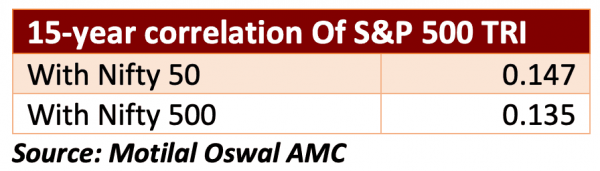

Low correlation: One, when crisis hits global markets, the one destination most global investors flock to, is US treasuries and the dollar. Most emerging market equities and currencies behave just like India during such times, offering limited diversification benefit. When you’re building a portfolio, owning un-correlated assets helps you smooth out returns during negative years. The US stock market has historically shown low correlation with the Indian stock market.

A co-relation of more than 0.5 is significant.

Currency hedge: The US dollar (apart from gold) has proved a safe haven asset during periods of global stock market turbulence. For Indians, periods of global turmoil usually see a sharply depreciating Rupee. Holding dollar-denominated US equities at such times shields your portfolio from sharp downside.

Diversifying into dollar-denominated assets also adds to your returns and helps you gain from Rupee depreciation. The Indian Rupee has depreciated steadily (losing 3-4% a year) against the US dollar for the last three decades. For example, between early March 1999 and 2020, the S&P 500 grew 4.9 times in US dollar terms but grew a whopping 8.6 times in Rupees.

Catchment for innovative companies: As the go-to market for global investors, US exchanges attract some of the most nimble and innovative companies in the world. This makes it one of the resilient markets post-crisis. Though the epicentre of the global financial crisis was in the US, the US economy (prior to the COVID outbreak) was among the first to recover from it, while Europe and Japan were still struggling.

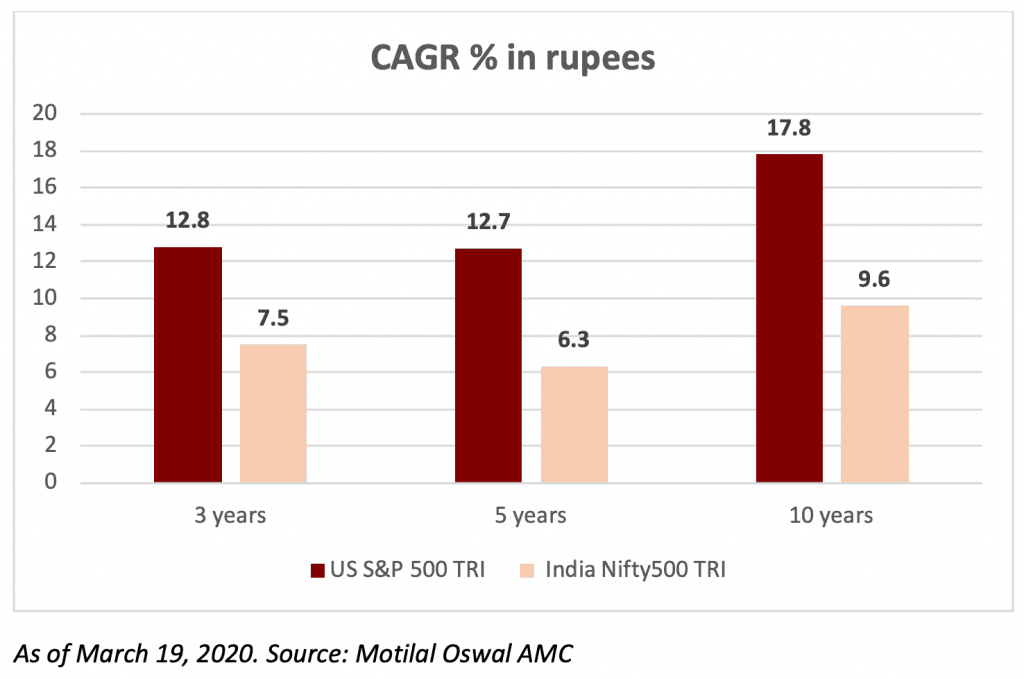

It is the combination of all these three factors that have helped the US S&P 500 deliver much better returns to Indian investors (when translated into Rupees) than the local Nifty500 over the last ten years.

The risks

While diversifying into the US markets has proved a good bet for Indian investors in the past, what could go wrong with this bet?

Well, the US market’s strong outperformance of the Indian market can reverse if US stocks enter a long bear phase, or if the dollar reverses direction after its long rally.

On the first risk, the US economy has certainly been hit harder by the COVID outbreak (going by numbers so far) compared to the Indian economy. Given that it is quite difficult to predict either the COVID trajectory or recovery from it, it is best that investors base their decisions to invest in US markets on stock valuations.

From a valuation perspective, the S&P 500 is today quite expensive relative to its historical levels. On April 13, 2020, the price-earnings ratio of the US S&P 500 based on trailing 12-month earnings was at 21.2 times. Its forward PE was 18.8 times. The latter is significantly higher than the ten-year average of 15 times. The forward PE ratio had corrected to about 14 times a few weeks ago when the S&P 500 had corrected, but the bounce-back since then has restored it to relatively expensive levels.

The valuations may be higher than those numbers indicate because earnings of S&P 500 companies, after growing at a 13% CAGR between CY15 and CY19 have flatlined in the last couple of quarters and are expected to decline by double-digits in CY20, as a result of the COVID crisis.

From a currency perspective, the US Fed after leaning towards reducing its debt pile in 2017-18, has gone back to a debt and money-printing binge in recent months to cope with the slowdown/COVID crisis. The US Fed’s new bond purchase program is expected to bloat its balance sheet to over $6 trillion and the government fiscal deficit to over $1 trillion (over 5 % of GDP) in 2020. US’ earlier debt and money-printing binge after the GFC didn’t do its economy or the dollar much harm. But there’s no assurance that this lucky state of affairs will repeat. If US stock markets correct due to expensive valuations and the dollar begins to slide against the Rupee, Indian investors could see their US equity bets weigh on their returns instead of lifting them.

Our take

We recommend the following based on the above analysis.

- Diversifying into US markets makes long-term sense for Indian investors given the attractive companies and likely Rupee depreciation.

- If you are keen to own US stocks, you have two index options in the MF space, S&P 500 and Nasdaq 100. The S&P 500 index tends to outperform most active managers and offers wider coverage than Nasdaq 100. The Nasdaq 100, on the other hand has shown superior performance but higher volatility. If you want to own a more diversified portfolio the S&P 500 is a better option. If you wish to own US for its strength in information technology then the Nasdaq 100 will be worthwhile provided you are willing to cope with its volatility.

- Use US equities purely as a diversifier, restricting your bet to 10-15% of your portfolio.

- Do not expect the Motilal Oswal S&P 500 to improve your portfolio returns over the next one or two years. It is intended to improve long-term risk-reward.

- Given immediate downside risks to US stocks, use the SIP route to invest in the Motilal Oswal S&P 500 Fund. If you are investing now, make sure you follow it up with SIPs.

62 thoughts on “Should you invest in the Motilal Oswal S&P 500 Index Fund?”

How will this be taxed as?

Hello sir,

Taxation is the same as for debt funds – capital gain on holding 3 years and above is long term, and taxed at 20% with indexation. Less than 3 years is at your slab rate.

Thanks,

Bhavana

I was thinking confused wheater to invest or not on Motilal Oswal S&P 500 Index Fund, but now I am clear what should I do

Thank you so much

Well written !!!

The risk i see with Index are, they are getting skewed to particular sector now a days. Nifty having more Banks and Financials. S&P 500 having more Internet and Tech.

Valuable insights, you would not recommend a lump sump investment now given US markets are down. My outlook is long term 10+ years.

We have mentioned valuations are not that cheap and said if you are investing lumpsum follow up with SIPs. thanks, Vidya

Yes we would not. Valuations are expensive and earnings outlook negative

Hi, great well written, researched and interesting article. The article is also thought provoking and push people to think through.

Thank you!

Tracking Error

When i look at Index Fund, the utmost important aspect which i have to look for is Tracking Error.

I have copied and pasted what they defined in their SID “The Fund Manager would not be able to invest the entire corpus exactly in the same proportion as in the underlying index due to certain factors such as the fees and expenses of the Scheme, corporate actions, cash balance and changes to the underlying index and regulatory restrictions, lack of liquidity which may result in Tracking Error. Hence it may affect AMC’s ability to achieve close correlation with the underlying index of the Scheme. The Scheme’s returns may, therefore, deviate from its underlying index. “Tracking Error” is defined as the standard deviation of the difference between daily returns of the underlying index and the NAV of the Scheme. The Fund Manager would monitor the Tracking Error of the Scheme on an ongoing basis and would seek to minimize the Tracking Error to the maximum extent possible. There can be no assurance or guarantee that the Scheme will achieve any particular level of Tracking Error relative to the performance of the Underlying Index.”

What is your view on the same.

These are standard disclaimers and could well transpire. We don’t paticularly have a view on it. thanks, Vidya

Good write-up !

1. How do we hedge against USD-INR appreciation and depreciation for this investment if i invest a lumusm amount and wait for 3 years ?

2. For NRI’s, is it good idea to invest in USD in one lumsum amount to gain thru currency appreciation of say 2-2.5% YoY ?

Thanks

The idea of the fund is to diversify to US market and long-term trend of rupee depreciation against the dollar. This fund is not a play on currency arbitrage not to hedge currency fluctuation. If so, currecy futures is the way to go. We do not have expertise on it. We also do not have expertise to state at what currency levels to invest. We have given in the article about the US market valuations (equity fundamentals) and whether it is cheap or expensive and how to invest thanks, Vidya

I have index only portfolio of Nitfy 50 and Nifty Next 50 Index funds with allocation of 80%:20% for my equity portion of the portfolio, I do have Parag parikh LT fund and waiting for the exit load to complete and move to this Index fund MO S&P 500 index fund. Can i have 15% of allocation to MO fund in this overall portfolio, Please share your views

Hello sir,

This is a specific query on our recommendation which we’d prefer to avoid answering on this forum, as it is meant more as a discussion forum. If you are a full subscriber to PrimeInvestor, please write to us with your question on our recommendations and we’ll help.

Thanks,

Bhavana

I believe the Indian Index funds are treated as Equity funds for taxation. When the same kind of index funds track US index. comprising of all equity, why it should be given debt funds tax treatment? Is there any rationale behind such taxation?

Hello sir,

That’s a question to ask the government 🙂

The taxation rule is that funds that invest 65% in domestic stocks alone get equity-type taxation. Anything else is debt taxation, which is why FOFs that invest in equity funds are taxed like debt as it is not investing in stocks. International stocks are obviously not domestic, so they don’t have equity taxation either.

Thanks,

Bhavana

Comments are closed.