Retail investors in India have a special fascination for Initial Public Offers (IPOs). When big-name IPOs make a debut, newbie investors make a beeline to brokers to open demat accounts. Folks who usually shy away from the stock markets start asking if they should ready their bank balances to apply.

IPOs evoke such interest because of the mistaken belief that IPO stocks offer a unique ticket to riches that thousands of ‘older’ stocks listed in the market don’t. But IPOs have a far worse track record than secondary market investments in long-term wealth creation.

In case you’re not convinced, we ran an analysis of IPOs in the Indian markets over the last 20 years to check for ourselves. This fundamental behaviour of IPOs also shapes our approach to analysing and making recommendations on them.

Did IPOs deliver?

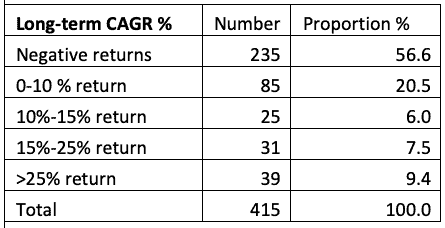

Screening for data on all IPOs that made their debut on the main stock exchanges between January 2000 and December 2019 (Source: AceEquity) threw up 415 IPOs on which complete data was available. The list consists both of IPOs that have had less than a year to deliver and those that have had ten or twenty years to perform. Here’s what the performance analysis showed.

Low returns dominate

What IPOs delivered

CAGR % on adjusted stock price from issue price to February 25 2020

For 415 IPOs for which complete details were available

When you invest in an IPO and hold long-term, the probability of making capital losses is higher than that for capital gains. Of the 415 IPOs, 235 (57%) were trading below their issue price when we ran this analysis on February 25. This is after adjusting the issue price for bonuses and splits. In addition to these, 85 IPOs (20%) managed only a single-digit annualised return. In effect, only about one in four IPOs even got their investors to a 10% CAGR if held long-term.

Yes, in the list, there were blockbuster IPOs that shot out the lights. In this period, there were 39 IPOs (9% of the total) that thrilled their investors by delivering a 25% CAGR over long holding periods. This list includes names like Avenue Supermarts, AU Small Finance Bank, Mahanagar Gas, Info Edge and Dixon Tech, to name a few.

But that’s one in ten odds of landing a multi-bagger through the IPO route.

Listing gains no guarantee

Like this analysis?

Would you like to see the investment portfolios and recommendations put together by such analyses? Research that YOU can use and gain from by top experts does not have to be out-of-reach or expensive.

A subscription to PrimeInvestor will ensure that you are always staying with good products and that you stay away from the bad. Subscribe today and get ready-to-use portfolios, access to top mutual funds, deposits, ETFs, an instant-review tool, and more!

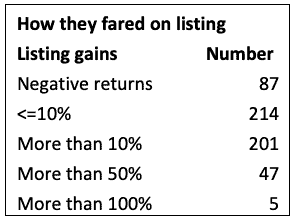

Forget long-term returns. Many investors are lured to IPOs by the prospect of listing gains that can quickly double or treble their money. But again, that’s a rarity. Of the 415 IPOs over the last 20 years, only 5 have doubled on listing (FCS Software, Indraprastha Gas, TV Today, Avenue Supermarts and IRCTC).

Listing gains on IPOs are wholly a result of market conditions and fancy for a sector at the time of listing. Betting on IPOs for listing gains is nothing short of a lottery. The much-hyped IPO of Reliance Power showed that even IPOs that trade at huge grey market premiums can turn loss-making if the market mood changes between the IPO date and the listing date. As the table shows, you had the same probability of making more than a 10% gain on listing and making less than 10%. And 20% of IPOs fell below issue price immediately on listing.

Nor does a good listing mean that the IPO investor is out of the woods. Of the 201 stocks that managed 10 % plus gains on listing, nearly 104 are today trading below their issue price.

Don’t go by subscriptions

But what if I take my cues from institutional investors? If an IPO is wildly over-subscribed, won’t it deliver returns? If you’re thinking this, be aware that institutional investors and HNIs are as susceptible to mob mentality as small investors, and often bet on the wrong horses in IPOs.

BGR Energy, Reliance Power, ARSS Infra, Inox Wind, Coal India, Quick Heal Technologies apart from the recent CSB Bank are some of the IPOs that are today in the red after boasting impressive over-subscription numbers. The availability of IPO funding that allows big investors to multiply their application amounts during the IPO can exaggerate the real demand for the shares on offer.

Why they fail

But why do IPOs as a class of equity investments fare so poorly? Well, IPOs failing to deliver the goods is not just an Indian phenomenon but a global one.

For any stock investment to create wealth in the long run, you need to get three things right:

- You need to find a business that can compound its earnings, generate matching cash flows and share them with investors over time.

- You need to invest in it at the right time (that is, before the business matures).

- You need to buy it at a reasonable price (valuation) that doesn’t factor in all of its future prospects.

All of these conditions are easier to fulfil with a secondary market stock purchase than with an IPO. On business strength, in an IPO, you essentially make your first acquaintance with the business through the prospectus and often cannot gauge its track record over an entire business or economic cycle.

On timing, IPOs are all about promoters or private equity investors in an unlisted company trying to offload their stake to the public or trying to raise new funds for expansion. That means they need to be sure of securing demand for their shares to maximise fund collection. IPOs are usually bunched up in big bull markets when a sector is wildly fancied, because that’s when they can be sure of good demand.

On valuations, given that they’re exiting from a business they built or are securing valuations for their business for the first time through new shares, promoters and/or private equity investors logically try to maximise the price and valuations at which they sell shares, leaving limited money on the table for buyers.

All this explains why, even if you manage to spot a great business at the IPO stage, there’s no guarantee that you will make money by betting on it during the offer because the pricing and timing aspects are loaded against you. The secondary market gives the freedom to time your buys to attractive valuations and wait for over-heated stocks to correct to reasonable levels. Even if you identify a great business at the IPO stage, it may make sense to wait for the subscription and listing frenzy to cool off before buying it in the secondary market. You may be surprised to know that many big wealth creators among IPOs – Bharti Airtel, Page Industries, L&T Infotech, Insecticides India, Cadila Healthcare, Aavas Financiers, Rail Vikas Nigam, Garden Reach Ship Builders, Mishra Dhatu Nigam – all listed below their issue prices before going on to deliver blockbuster gains in the long run.

But what about IRCTC, which is up six-fold from its issue price and threefold from its listing price? Well, given that no IPO stock has managed to deliver performance like it in the last twenty years, think of it as the rarest exception. Seldom will private sector promoters price their IPO at such rock-bottom valuations that public investors get to pocket gains. Even the government has probably learnt its lessons from this IPO.

Our approach

Having learnt from the above experience, we at PrimeInvestor will be taking an extremely selective approach to recommending IPOs.

One, we will not cover every IPO that comes up regardless of how fancied it is or whatever listing gains it may yield. In other words, possibility of short-term listing gains is not a criteria for our reviewing or recommending an IPO.

Two, we will review IPOs that offer an interesting business proposition. This could come from a a company’s unique business model, few competitors vying with it, a sector with attractive growth prospects or pricing that bolsters long-term return potential. Our reviews may not always translate into recommendations.

Three, we will recommend only those IPOs that meet the tests on strong business proposition, reasonable pricing and good timing.

“It’s almost a mathematical impossibility to imagine that, out of the thousands of things for sale on a given day, the most attractively priced is the one being sold by a knowledgeable seller to a less-knowledgeable buyer” – Warren Buffett on IPOs.