“Can I invest in hybrid funds?” is a question that we often get. Ranging from the aggressive equity-oriented funds to arbitrage funds, the broad term is ‘hybrid’. We have already discussed some of the key categories of hybrid funds in our earlier articles.

However, this one will cover all of them in a single essay and let you know when and whether you need them.

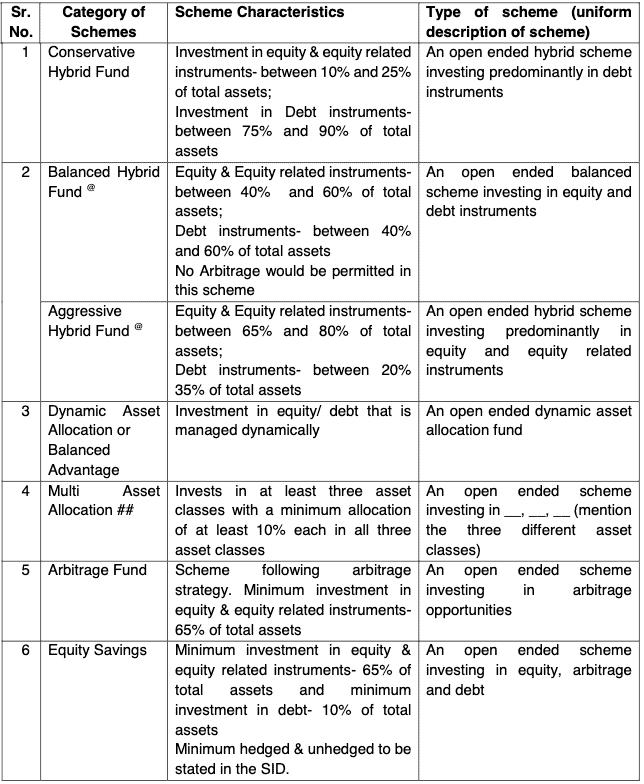

The table below will give you the list of SEBI-classified hybrid fund categories. In these, we are not going to discuss about the balanced category as there is no meaningful number of funds to discuss. Besides the balanced category’s equity-like portfolio with debt taxation does not make it worthwhile.

Before we proceed, in the order of risk profile, hybrid aggressive funds are the riskiest and arbitrage the least. The standard deviation graph below will tell you how these funds rank in terms of risk profile.

We also list below the purpose of these categories and their taxation status.

Please note that taxation of conservative hybrid funds (including any fund category with less than 35% exposure to domestic equity) has recently undergone a change. There will be no distinction between long term and short-term holding period for these funds. The gain from these funds will be added to your total income and taxed at your income tax slab rate. This new law is applicable for investments made after April 1, 2023. You can read about this in greater detail in our article ‘Tax changes in mutual funds – how to manage your investments now’.

Aggressive hybrid

Earlier called balanced funds, this category of funds has been the darling of the distribution industry. It appealed to many investors for its equity taxation, an equity-cum-debt structure, and above all, the seeming (but mis-sold) regular dividend income from some of these schemes.

With some of the quoted benefits misfiring and dividend coming under the tax fold, this category of funds is slowly losing its charm for the reasons below:

- One, it has seen a lot of shuffle in performance charts. In other words, there seem to be very few consistent funds in this category. For example, HDFC Hybrid Equity, a top-rated fund in this space as of December 2019, slipped significantly in performance chart. There are many such funds that have swung wildly in performance. What this means is that there is a high chance that the fund you choose may go down, and it needs you to always be vigilant. If you ask us why there are such swings, it is hard to answer simply because no single fund has a stated strategy. Hence, any change in tack, in terms of equity market cap segment exposure, stock picking style, or debt strategy can impact performance. There is also no single or common reason for the uneven performance. It varies across funds.

- Second, as is the case with quite a few categories, this category has been struggling to beat the index. When compared with the Nifty 50 Hybrid Composite 65:35 index, hybrid aggressive funds have outperformed the index just 25% of the times when 1-year returns were rolled daily for 3 years. Over a longer period, when 3-year returns were rolled over 5 years, this outperformance was again low at 35%. So, the very performance of this category comes into question. This is despite funds having higher equity allocations and taking more risks in terms of market cap segments.

- Third, this category, although containing declines better than pure equity, swings wildly. For example, the standard deviation of fund returns on an average (on a rolling 1-year return basis for 3 years) is 9% – not way away from the 10% deviation seen in large-cap and large-cap index funds. In other words, you cannot expect this category to contain volatility significantly better than large-cap funds. The fact that these funds take exposure to the hilt in equity rallies to generate returns, also means that volatility will be heightened.

What to do with the hybrid aggressive category

You should exercise caution when choosing funds in this category. In our list of Prime Funds, we have chosen a few. But when you have sufficient money to asset allocate (and not small sums like Rs 2000 a month of SIP), we would urge you to use asset allocation using separate equity and debt funds. Remember, if you hold even 20% in a hybrid fund, given the current allocation of these funds to debt (25%), your debt allocation will only be 5%. So do not count on these funds to help diversify your portfolio.

Also, here are things you need to do, if you are holding this category for the wrong reasons:

- This category is not meant for regular income. Exit if you hold it for this purpose, so that you do not take any shocks in a steep correction.

- Dividend option is no longer efficient. If you have held these funds for long under dividend option, exit now. In our view, you need not enter another hybrid fund. Use existing equity and debt funds to asset allocate. Check our regular income portfolio for any income need and park the rest in equity.

- Hold these funds like you would treat any other equity fund – both in terms of long-term time frame and volatility. This, after checking their quality in our MF review tool.

Conservative hybrid funds

This category is debt-oriented with equity capped at 25%. We have not been recommending this category of funds. The reason is partly the same as for hybrid aggressive – swinging performance and poor consistency. This category (average) beat the NIFTY 50 Hybrid Composite Debt 15:85 Index 56% of the times, when 1-year returns were rolled daily for 3 years. Not good enough considering the average equity holding is higher than the index presently, at 20%, for these funds. But there are also other reasons why we are not comfortable with this category:

- One, these are go-anywhere funds as far as their debt strategy goes. They can play duration and they can take credit. Many of these funds had over a fifth of their portfolios in credit during the IL&FS debacle and even as recently as March 2020. Currently while holdings below AA+ is 10% on an average, some of the funds have 20-25% exposure to this space. Some of the top names in this space from the Aditya Birla and HDFC houses have instruments downgraded to D and others such as UTI, Franklin and Nippon India have segregated portfolios arising from bad papers. This category of funds have also been hurt in earlier rate hike cycles, due to duration calls that did not work. In other words, these are funds that simply cannot be blended into a well-constructed, planned portfolio as they have no clear duration/credit strategy.

- The second and most important why we are not enthusiastic about this category is that the average expense ratio is 1.1% under the direct plan and a whopping 2% under the regular plan. For a debt-oriented fund, this cost is way above a blended approach of say an equity fund with 1% expense ratio a debt fund with 0.5%!

What to do with the conservative hybrid category

This category is one that you can conveniently skip. The desired time frame for this category is at least 2 years since the data further down will show you that even 1-year returns can languish in the negative zone.

If you already hold funds in this category when they were long ago called MIP (monthly income plan), and are using it for income, our suggestion would be that you exit them. These funds are treated like any other debt funds and you do not get any significant tax advantage.

Consider investing 20-25% in equity and the rest in simple income earning options like the RBI floating rate bonds or Senior Citizens’ Savings scheme (if you are above 60). You can also look at our regular income portfolio or our retiree portfolio, if you are a senior citizen.

Balanced advantage and dynamic asset allocation

We have covered this category in detail in the below reports:

At the cost of repeating some of what we said above, balanced advantage funds (and dynamic asset allocation) seek to shift their equity-debt allocation based on market conditions and fundamental factors. They use a dose of derivatives to contain downsides and use this as part of ‘equity’ for fulfilling their equity-tax status (mutual funds need to hold at least 65% in equities to qualify for equity capital gains).

The asset allocation metrics are unique to each firm based on their internal research methodology. Whether funds use fancied terms like ‘pro-cyclical’ or simply do nothing (like HDFC Balanced Advantage), the fact is that each of these funds remain unique. Hence it becomes important for you to know each of their strategy when you choose them. Too much work, isn’t it?

At PrimeInvestor, we view this category as a hedge, as a source to contain volatility. Our assessment metrics measure these funds based on this objective alone. They are not meant to generate high returns. We have a couple of funds and believe that these are not a ‘must have’ for all investors.

What to do with the balanced advantage category

Know that balanced advantage funds are not a panacea for market volatility. In fact, they have fallen 20% (on an average) in a single month and have sported negative returns even over a year (see data earlier in the article).

They have their specific uses. They are ideal for time frame of 2-3 years or so, where you cannot afford high equities and yet want equity’s tax efficiency. Or you may fancy this as a low-risk option in your longer-term equity portfolio. But remember that the ‘dynamism’ in these funds may not really help your portfolio ‘time’ markets’ as it is highly unlikely that you have 100% of your portfolio in this category.

Equity Savings category

This category is quite like the Balanced advantage category in terms of using equity, debt, and derivatives. Just that this category has less of unhedged equity compared with the balanced advantage segment. This makes it far less volatile. The data earlier will tell you that its standard deviation as well as worst returns is lower than the balanced advantage category. This makes it a more conservative option.

What to do with the equity savingscategory

- This category needs a 1-2 year holding at least as it has delivered negative returns even over 1-year periods (see data given earlier in this article).

- The fund’s strategy caps equity returns and is hence not suitable for those looking for high returns.

- It makes for a tax-efficient option where you want equity taxation without equity volatility.

- When debt does well, debt can outperform this category, pre-tax.

- This is not a must have unless you are very tax conscious.

Multi asset allocation category

This is a category we have received plenty of queries on. However, we have written about it at length in an earlier article. Please read it as it will tell you about performance and what to expect from this category and why you can skip it.

Just to cut out the clutter, it is a category you can avoid. You are highly unlikely to get a ‘multi-asset allocation’ using just one multi asset fund among the many funds you hold. For example: a 10% allocation to gold in a multi asset fund that accounts for even 25% of your portfolio – gives you just 2.5% allocation to gold. For many of you believing that multi asset funds can significantly contain volatility, know that they come close to balanced advantage funds in terms of downside and volatility. And over a 1-year period, balanced advantage scores better, not to mention their superior tax efficiency compared with multi-asset allocation funds.

The expense ratio of multi-asset funds vary widely – from 0.14% for the Nippon fund (direct plan), 1.26% for ICICI Pru Multi Asset and 2.4% for the Quant fund. Now that is some range of active management!

What to do with the multi asset allocation category

Hold equity, hold debt, and hold gold if you wish – separately.

Arbitrage funds

This category fully hedges the equity it has. And it needs to have at least 65% in equities. This segment has its use for HNI individuals or those in the high tax bracket given that it is treated like equity for taxation.

But you need to be aware that there is no ‘fixed return’ that you can forecast in this segment like debt. The arbitrage opportunity in the market is, well, arbitrary, and funds often have to depend on their 35% debt and cash component to deliver some additional/steady returns. Please read more about arbitrage funds and how to use them here.

What to do with the arbitrage category

Be aware that there have been times when arbitrage has given 1-month negative returns. To this extent, parking very short-term money in this space or using them for STPs is not a great idea. A minimum 3–6-month time frame is necessary.

For those of you who do not use arbitrage funds, and are not too smitten by tax savings, there is no need to seek one unless you have familiarity with the product. It is best to leave existing money in liquid funds (given their liquidity and low volatility) and have FDs for any fresh short-term parking, until the yields in liquid funds move up more.

In summary – it is our view that hybrids are complex products in terms of their ‘go anywhere strategy’/difficult-to-comprehend strategies. They mostly have high expense ratios (barring arbitrage) and do not optimally serve their stated objectives. Use them only for limited needs. Do not feel compelled to add them and do not be influenced or tempted by their ability to invest in different asset classes.